Greenie

Raises Rates, and All Is Well

By Duru

December

15, 2004

Is anyone else

amazed by the absolute contrary movements in the markets in response to the

steady hike in short-term rates? Back in November

of 2003, I suspected that just as the market did not move according to

historical patterns when the Fed first began lowering rates, the market would

behave differently from history as the Fed began to hike rates. But the current

contrary moves are getting out of hand…aren't they? As expected, the Fed raised

short-term rates another quarter point at yesterday's meeting. There was also

no material change in the economic outlook. But after the dust settled on the

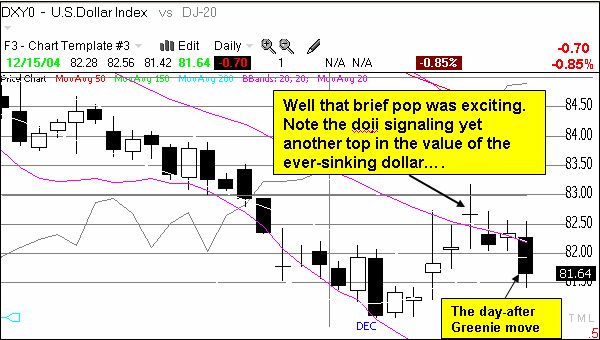

day after, we find ourselves with a weaker dollar, a strong housing index, and lower

long-term interest rates! I have posted the charts of this amazing

combo below.

What gives?

Well, I know a series of homebuilders, like HOV and LEN, have reported excellent earnings and even

better guidance. Analysts have also been singing lovely songs about the sector. That news alone is enough to get the

housing bears growling and re-inflate the supposed housing bubble. The dollar

is under-going a secular decline, so any decrease in the dollar is consistent

with the prevailing trend. No surprise there. The recent brief pop in the

dollar was certainly a reaction bounce in anticipation of the well-anticipated

Fed move. But I am truly confounded by the decrease in long-term rates. I

suppose the bond market is waiting for the Fed to declare a robust recovery has

finally begun and inflation must be battled now. Without such language, I

suppose the bond players remain skeptical about the long-term health of this

economic recovery. These lower long-term rates of course continue to help buoy

the housing markets.

And the sum of

all this seems to be that the market continues to remain comfortable with its

current lofty levels. The NASDAQ finally made some new 52-week highs and is now

poised for another quick spurt to either end this year or begin the new year. I

will not show charts here, but all other indices seem poised for greatness. It

is collectively an incredible sight.

I will close

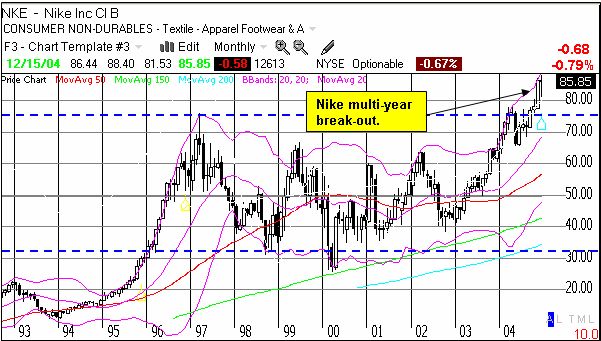

with two charts. If you are still one of the doubters that are hating on the

American consumer, the important stock charts of Nike (NKE) and Best Buy (BBY)

demonstrate that the market, at least, is quite confident in the general health

of the American consumer. Nike has finally

broken free from an EIGHT year

trading range. This trading range was certainly wide, but a range nonetheless.

The current break-out speaks volumes about the market's expectations. Best Buy

is

*Note well that Nike will be

announcing earnings on Dec 16th!

All in all, it

seems to still be all systems go for the market. I will continue to look to the

Presidential Inauguration as the next real pivot point for the markets.

In the

meantime, be careful out there!