Where there

is smoke, there is fire: DAGM

By Duru

January 8,

2005

(Click here

for disclaimer that applies to this market analysis)

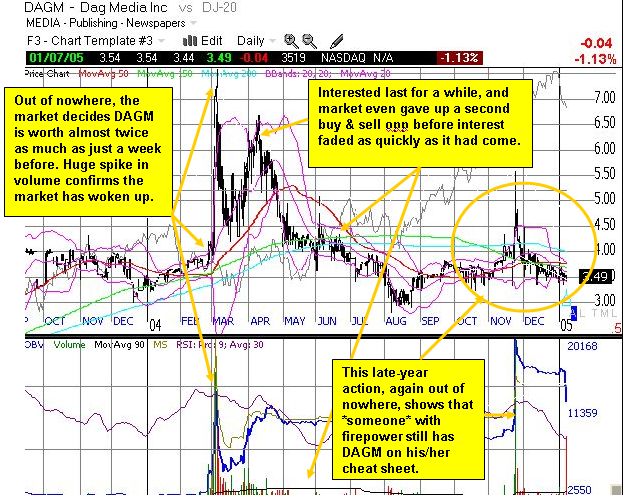

DAGM

I stumbled

upon DAGM sometime last year while looking over small cap stocks that had

recently gotten a lot of action (spring of 2004). I was amazed to find a stock

that seemed to have good financials, generated lots of cash, paid a

great dividend, and, best of all, was selling for what appeared to me to be a

bargain basement price. Unfortunately, when stocks with small floats garner

lots of attention, every good and bad character jumps on the opportunity. In

this case, the bad characters eventually won out and soon enough DAGM became

just another deflated, over-hyped, hedge fund plaything. And once the buying

interest faded away, DAGM slowly and surely punched out new 52-week lows. I

actually managed to get out with the rest of the short-term folks in order to

wait for another golden buying opportunity.

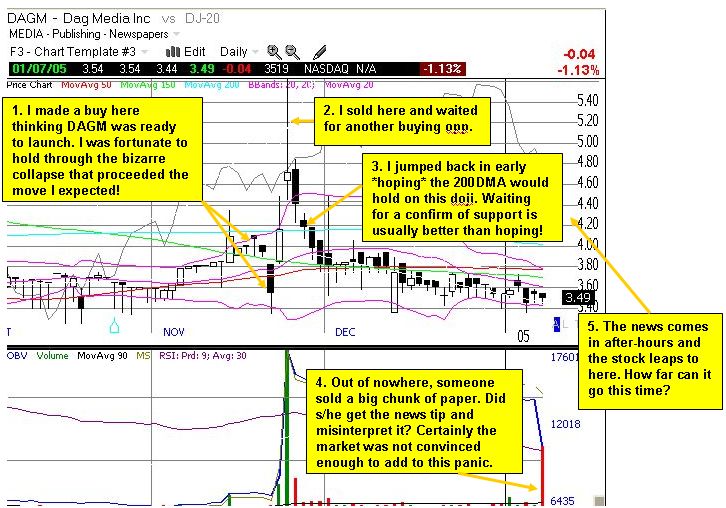

While DAGM did

not begin to recover until August, I did not get interested again until

November as the stock peaked above the 50DMA again. It turned out to be very

timely as out of nowhere the vapors of the market decided to reflate DAGM. Needless to say I sold into the frenzy and

looked for a new entry. I jumped right back in this time after the excitement

had died out but support looked likely to hold up. I also planned this time to

just hold on, so I only bought a small basket of paper to start. Sure enough,

after a bit of chop, the stock began to falter and slide and ended December on

another low note. But given my new conviction on the stock's longer-term

prospects, I prepared to buy my second basket of paper, and looked forward to

some popcorn "January-effect" action.

I got my first

jump in volume on the first trading day in January. Yet, I hesitated. Don't ask

why, I just did! I got distracted by some other opportunities. Just as quickly

the stock returned to the lows of December, and I revved up the engines again.

This time, the continued malaise and selling in the general market made me

hesitate one more time. The market gave me one chance, a second chance, but not

a third. I was quite shocked to see that volume has spiked on Friday, but the

stock did not go anywhere. After the market closed, DAGM announced it will be

selling some unprofitable businesses, will increase its dividend, and look to

use the rest of its cash to buy some other business. The whole thing is

promising but a bit vague. No matter. The stock popped in after-hours back to

my original buying point.

Assuming the

post-market action holds, *poof* went my second buying opportunity. Yet, a very

curious situation has been set up. Many folks who also bought around my first

levels will be looking to get out now. I am inclined to look for one last,

albeit more expensive, buying opportunity and then hang on as much as the

market allows. For now, I am assuming that this company's proper valuation

belongs somewhere around the highs it hit earlier in 2004…or even higher.

I present two

charts below to summarize the madness.

The madness

continues, so be careful out there!