The T2108 Resource Page ARCHIVE

See "How to Trade Extremes In Market Breadth (Above the 50)" for the latest trading rules.

By Dr. Duru created for One-Twenty Two

DEFINITIONS

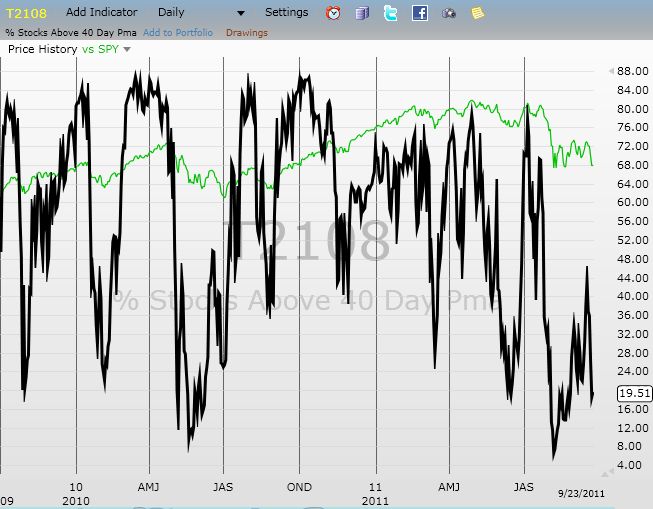

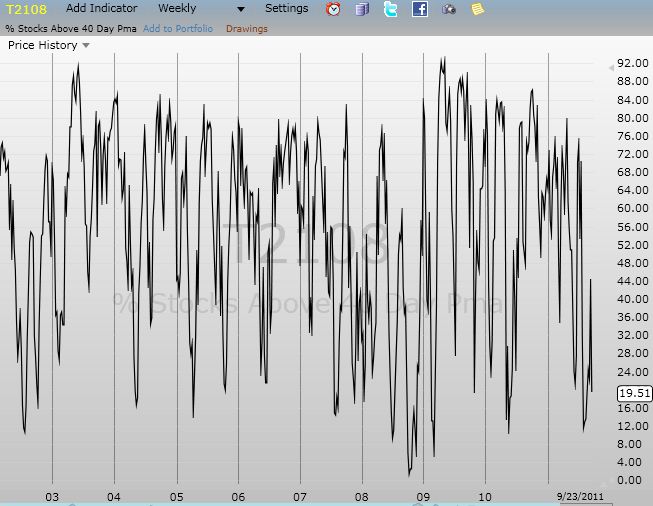

T2108 is a daily, technical indicator provided by TeleChart 2007, a charting program from Worden Brothers, Inc. The indicator quantifies the percentage of stocks trading above their respective 40-day moving averages (DMAs). I use it to flag overbought and oversold conditions in the stock market. When T2108 trades at or above 70%, I consider the stock market overbought. When T2108 is trading at or below 20%, I consider the stock market oversold. (Click here for a definition of the "T2" series of Worden’s Market Indicators)

When the stock market is overbought, a trader typically avoids initiating new long positions, starts closing out existing longs, and considers opportunities to go short. When the stock market is oversold, a trader typically avoids new short positions, starts closing out existing shorts, and considers opportunities to go long.

No hard and fast, scientific rules exist for the exact timing of trades using this indicator. However, starting in April, 2013, I began a complete overhaul of my usage of T2108 for trading that I now call the T2108 Trading Model (TTM). I produced a major update of the historical data and edits of the presentation of the model on December 29, 2014. It takes advantage of data mining and machine learning techniques to expand beyond single trading thresholds for oversold and overbought. For example, I discovered a condition I call "quasi-oversold" which occurs after T2108 drops for two consecutive days. The steeper the drop, the more reliable the prediction for the S&P 500 the following day (especially for a prediction of an up day). I also now look at the entire range of T2108 values and consider how the distribution of potential outcomes changes with the duration since T2108 last crossed a given threshold. I continue to search for a very specific, quantified definition of oversold and overbought.

Traders should use T2108 as a strong complement to the tools you already use. For example, if the market is oversold, a trader might wait for a climactic sell-off, like a "hammer" candlestick, before making bullish trades. When the market is overbought, a trader might wait for a "blow-off top" before going short.

I have produced several studies that can serve as your guide for thinking about how to use T2108. I have included the blog post that kicked off the T2108 overhaul that I now call TTM:

- List of articles using T2108 on One-Twenty Two for assessing market technicals

- A New Beginnnig for T2108 (April 4, 2013)

- Trading Strategies for an Overbought S&P 500 Using the Percentage of Stocks Trading Above Their 40DMAs (T2108) - an update to a similar analysis January, 2009, see below (November 6, 2011)

- Trade the Oversold Bounce (PDF file) – written for SFO (Stocks, Futures and Options) Magazine as a follow-up to my 2008 article discussing trading strategies using oversold indicators from T2108 and the VIX. (July, 2010)

- Using the Percentage of Stocks Trading Above Their 40DMAs (T2108) to Identify Overbought Conditions on the S&P 500 (January 4, 2009)

- Does the VIX Need to Spike at A Climactic Low? - Using T2108 and the VIX (July 7, 2008)

I provide my general assessment of T2108 and its trading implications on my main blog (click here for the latest commentary on T2108. Some archived commentary also listed below).

PURPOSE

I use this page as my central resource page when discussing the T2108 indicator on my main financial blog "One-Twenty Two" to avoid redefining T2108 each time I write about it.

In my "T2108 Updates", I include guidance for short-term, especiall swing, traders as a "General Trading Call." However, long-term investors can consider these signals for timing planned buys and sells as well, especially buys during the oversold conditions of strong corrections and sell-offs. The guidance is path dependent - meaning that my assessment of going long and/or short depends on where the market was before T2108 hit its current levels. When relevant, I will include such caveats and context in the commentary.

As of May 10, 2011, please go to One-Twenty Two's T2108 Commentary (and/or search for "T2108 Update") for my latest observations and interpretations for T2108.

See below for the latest charts. Below these charts, I post archived commentary from the previous T2108 reporting formats...

Black line: T2108 (measured on the right); Red line: S&P 500 (for comparative purposes)

As I always say, be careful out there!

ARCHIVED RUNNING COMMENTARY

May 6, 2011

T2108 now hovers at 61%. Yesterday, I speculated that any rally would act like a relief rally, providing a fade (short) opportunity. The market rallied on Friday's jobs number and faded, presumably, on rumors Greece was considering exiting the euro zone. Going forward from here, the trading call remains a neutral. The market sits on top of the first support level after closing at fresh multi-year highs a week ago. Stochastics are approaching oversold, so the window for short-term negative bets is closing. The market's bias will likely return upward by early next week, but unless T2108 drops much further, I will not issue a "buy" trading signal. As always, the situation for a given individual stocks may differ from overall market conditions.

May 5, 2011

T2108 dropped with the market to 59%, continuing the swift drop from overbought highs earlier this week. The S&P500 marginally broke the first presumed support level at 1336. A late buying effort took the index right back to the 20DMA at 1335. Volume on the selling increased again. The trading call for hold assumes shorts are in the portfolio. If not, some shorts should be initiated, preferrably at a key resistance level. Note well that the 4-day streak of selling is the longest such streak since early April and only the second since the November swoon. In other words, odds favor some (relief) buying on Friday that could set-up better shorts.

May 4, 2011

The surprise is complete. T2108 dropped out of overbought territory to 65%. Given the heavy volume of selling on the S&P 500 the past 3 days, this latest development leaves me tempted to call a short-term top. But I will refrain from such whiplash. No key support level has broken yet, so I am also refraining from flashing all green to go short (a drop below 1336 or so will raise the red flag). The current short-term trading call is to hold and hopefully traders were selling longs while T2108 was overbought, freeing up some cash for the next moves.

May 3, 2011

Surprisingly, T2108 dropped from 79% and almost out of over-bought territory in one day. T2108 was 69% at one point tat I checked during the day. This does not change my recent assessment of the technicals, and the trading call remains the same. The small bounce at the close confirms that the bias remains to buy. Also, no key support has broken to trigger any aggressive shorts. The previous 52-week high of 1343 can be used as a trigger with the latest 52-week high of 1371 serving as a potential stop.

April 29, 2011

T2108 hit another 2011 high at 79%. It is on track for hitting a rare 90%. Again, while previous overbought episodes in 2011 were very short and preceded strong pullbacks, I am expecting this overbought period to persist. (I wrote a general stock market summary on the main site. Click here for it).

April 27, 2011

T2108 is back to its highs for 2011 on the heels of another accomodative statement on moentary policy from the Federal Reserve. The S&P 500 had strong follow-through to yesterday's rally, so it is hard to imagine right now that we will see again the year's pattern of the market selling off when T2108 hits these levels. Instead, with the Fed making it clear it will remain accomodative and with the dollar heading for a test of multi-decade lows, the stock market has an upward bias. Again, shorts should only get aggressive on breaks of support. Currently, there is no near-term upper ceiling to this rally, and I suspect that the market could stay overbought for at least a week or so. Recall that the market was able to stay overbought for long stretches of time in 2009 and 2010.

April 26, 2011

T2108 is overbought at 73%, and the S&P 500 broke through the presumed double-top to make fresh multi-year highs. It should come as no surprise then that the dollar also lost further ground (and now sits at 3-year lows). It is all about the dollar for now, so while the technical signal is giving the clear go-ahead for shorts, I prefer to get aggressive only at a break of some key support, like the lows of today's breakout day (around 1336). With the Federal Reserve announcing monetary policy tomorrow, there is a high likelihood that further "easy money talk" from the Fed will encourage buyers to ramp stocks further and sell the dollar to deeper lows. And there will be no clear ceiling under those conditions in the short-term.

April 21, 2011

T2108 hit 70% today on a small follow-through to yesterday's rally. The S&P 500 is now right back at the highs for April and a stone's throw away from new multi-year highs. The market is now overbought, and it has paid to start shorting at these levels. The proximity of resistance makes the risk/reward for aggressive shorts more attractive given the ability to place tight stops. Again, watch the currency markets. Further dollar weakness seems to be a sure recipe for a break to new highs. Given expectations that the market "should be" weak in the shadow of the end of QE2 (and the "sell in May" mantra), a breakout could create a strong follow-through rally as late buyers rush in. In other words, short now, but be prepared for deft risk management. (Note, I will NOT be a buyer on a breakout and instead will look to release my remaining trading longs, and then wait for the market to cool off and prove it can hold some support before considering fresh longs. As I mentioned before, I find commodities, including gold and silver, the Australian dollar, and the Australian stock market more attractive alternatives for going long).

April 20, 2011

T2108 soared on today's rally. At 67%, it is once again near overbought territory. Today's surge in the S&P 500 that gapped and hurdled right over the 50DMA is essentially a mirror image of Monday's plunge below the 50DMA. I thought Monday's move confirmed the market's bias toward weakness, but I did not take into consideration the machinations of the U.S. dollar. The dollar was beaten senseless by almost every major currency (except the yen of coruse) on Wednesday as the index tested the 2009 lows. The stock market likely benefited from fund flows similar to carry trade action. While the correlation between dollar weakness and stock market strength is not 100% consistent, when it works, it can be VERY powerful. I believe this correlation was in full effect today. It is clearly time for me to update my chart of the S&P 500 priced in gold because that chart should show the S&P 500 selling off. (I think priced in silver, the S&P 500 is approaching March lows...or worse).

Anyway, while earnings season always provides plenty of wildcards, the currency market is a bigger and more important wildcard to these technical assessments. As long as the U.S. dollar continues to sell off, bearish bets against the stock market may be better applied toward buying commodities, other currencies against the dollar, and/or stock in the stock markets of countries with strong economies (Australia, for example, provides a wonderful combination of all these qualities in one bite). In the meantime, I will presume the double-top in the S&P 500 will hold in the near-term and that the tendency of the market to sell-off once T2108 gets overbought will continue. If (once?) the double-top breaks, all bets are off, and we should probably brace ourselves for another rocket upward (and a dollar sinking further ever faster).

April 18, 2011

T2108 plunged 13 percentage points to 47%, all but confirming that the stock market's bias points to weakness over strength for the near-term. The S&P 500 gapped down, breaking back below the 50DMA. Not even the standard gap buying could recover much of the day's losses. Given the S&P 500's steady (but slow) breakdown, I am keeping the trading call on an overweight to the short side. If T2108 goes below 35% or so, it will be time to start closing out a few shorts (recall that the market's two-year rally has rarely featured trips to official oversold territory - at or below 20%). The closer T2108 gets to overbought levels (70% and higher), the more aggressive shorts can become - of course, as always, with one eye trained on key technical levels on the index. Until proven otherwise, I am assuming the index has printed a (near-term?) double-top.

April 15, 2011

T2108 made a surprising pop to 60% given the small upward move in the S&P 500. The rally was small and not enough to execute the aggressive shorting strategy I mentioned yesterday. However, follow-through buying on Monday could set up some ripe fades that get all the riper the closer T2108 moves back toward overbought territory (or beyond). For the next two weeks, earnings season provides the largest wildcard and caveat, but post-earnings selling in JP Morgan, Bank of America, Fastenal Company, and Google have so far validated my earlier opinion that negative earnings reactions will dominate the headlines.

April 14, 2011

T2108 has meandered the past 3 days above 50%. The S&P500 is now oversold on stochastics and today's strong buying into the close formed a "hammer" pattern right under the 50DMA. With tomorrow being options expiration, fireworks could happen (we also have U.S. CPI numbers coming). The overall set-up puts the odds in favor of a nice bounce for Friday, likely in the form of a gap up right over the 50DMA. If the bounce does not materialize, a fade erases most of the gap up, and/or the hammer gets violated with a close below Thursday's lows, the bears get an impressive victory. Trading call remains a hold since T2108 itself is not oversold or overbought. Aggressive shorts should definitely look to fade any strong gaps up as the 50DMA could continue to act like a magnet for the index.

April 12, 2011

T2108 dropped over 10 percentage points to 52% as the S&P 500 dropped as much as 1% on the day. Once again, the trading cycle featured a sell signal once T2108 hit overbought territory. The index punctured critical support at the 50DMA on slightly higher volume, so I got a little more aggressive with shorts. The S&P 500 is increasingly looking like it is printing out a double-top. Fresh 52-week highs become a clear stop for shorts. During earnings season, it makes sense to assume negative reactions will dominate positive ones.

April 11, 2011

T2108 has dropped from 2011 highs and an overboguht reading to 63% today (68% on Friday). The selling on the index has been extremely mild. The primary uptrend is now broken but no other important support levels have broken. Aggressive traders might go all short here with tight stops at new 52-week highs. Otherwise, slightly overweight shorts with a plan to get more aggressive if support breaks. For example, the 50DMA at 1314 or 1300 which was the approximate support for the Feb/March congestion level. As a reminder, in 2011, overbought readings have immediately preceded sell-offs, but these past two days of selling have been some of the mildest yet. So, stay wary.

April 7, 2011

The trading call has remained the same for a week now as the stock market remains aloft at overbought levels. Today, T2108 dropped to 73%, a marginal decline from yesterday's 2011 high of 75%. While the primary uptrend on the S&P500 has finally broken, the bulls still retain the upperhand until a convincing break of support occurs, perhaps a close at a one-week low or another break below the 50DMA.

April 1, 2011

T2108 is now overbought again at 73%, near the highs for the year. Given I did not think the stock market would attain these levels anytime soon, I am inclined to believe the market will not remain here for long. However, the BIG difference between this overbought condition and the last set of overbought conditions is that the current market is still trending strongly upward. As long as this trend stays intact, "pre-emptive" shorts are risky and should be hedged. However, this is a great spot for unloading trading longs and freeing up cash for future shorts (or future dip-buying). So, given this assessment, I am not changing the cautionary trading call much expect to finalize the list of shorting candidates ("Sell more longs; finalize list of short candidates, and short on breaches of support and/or trend."). Note well, that the strong sell-off in the last 90 minutes or so of trading was ominous. Brakdowns in big-cap tech stocks like Apple (AAPL) and Intel (INTC) also appear to be early warning signs. I hope to write more detail with charts on the main site, One-Twenty Two, over the weekend.

March 31, 2011

T2108 is 69% and "essentially" overbought. The advice from yesterday still applies. See below. I will re-emphasize that it is still not a time to get aggressive with shorts because the current short-term trend has been stubbornly and persistently up. This behavior could indicate the market is ready to regain its ability to remain overbought for long stretches of time.

March 30, 2011

T2108 is now up to 67% and almost overbought. The S&P 500 is stubbornly pushing forward and closed at the top of the congestion from February that forms presumed resistance. Even though volume picked up a little today, it is still on the light side. However, given the steady progress and uptrend from the March lows, the presumption must be that a retest of the 52-week highs will come just as T2108 swings to overbought levels (note I have claimed that such a scenario was not likely to come anytime soon!). While it is tempting to start adding to short positions now, the market's persistence means that it will be best to wait for some kind of breakdown, whether that is a break below the 50DMA, a close below the previous week's low, and/or a break of the current short-term uptrend.

March 25, 2011

T2108 moved up to 61% as the S&P 500 managed to follow-through on the previous day's close above the 50DMA. With stochastics overbought, the index is quite vulnerable to selling. Even with the 50DMA flipping from resistance to potential support, a short below today's low could be a relatively low risk trade. Many other individual stocks have also reached overbought levels and are shortable under these conditions. With the S&P 500 essentially erasing all its post-Japan earthquake losses, the bulls retake the psychological, if not also the technical, advantage. Thus shorts must have tight leashes.

March 24, 2011

T2108 jumped to 57%, its highest level in 2 weeks. The S&P 500 managed to punch through the 50DMA with no direct catalyst serving as a ready explanation/excuse. While the move is highly suspect given the low volume, the pressure still switches from the bulls to the bears. If the sellers cannot turn back the tide here, the S&P 500 will likely punch through fresh 52-week highs in short order. Remember, the market has returned to lofty levels despite a barrage of bad news and tragic headlines. Imagine what can happen next with good news. The trading call assumes a trader unloaded some shorts and nibbled some longs when T2108 was below 30%. If a trader finds himself or herself holding relatively few longs, some buy candidates should be identified along with shorts. A pullback from the 50DMA resistance could be quite shallow. Thus, until T2108 gets closer to overbought levels, do not chase sell-offs as times to increase short exposure and instead consider increasing long exposure.

March 21, 2011

If you have followed this page throughout the crisis and tragedy in Japan, you might marvel at the ability of the technicals to present a good story about the market's likely short-term direction. In fact, you could have turned off the confusion of news, analysis, and counter-analysis and traded just as well, if not better. It just seems that when the market is running on strong, emotional responses, technicals provide the best canvass for separating noise from signal.

The S&P 500 had a strong rally of 1.5% but made little progress for most of the intra-day action. Volume was poor and the index now rests directly under the 50DMA. If T2108 were above the overbought threshold, I would make a strong case for shorting. Instead, the trading call is "hold," but the onus is on the bulls to prove themselves innocent here. A CLOSE above the 50DMA resistance, with T2108 not overbought, will flash a strong buying signal with a stop below the 50DMA.

I hope to write more on the main blog about my overall assessment and lessons learned from the past 10 or so days. The market is making downside protection cheap again, so there are some clear strategies available for staying long and well-hedged if that is your strategic preference.

March 16, 2011

The S&P 500 erased all of its post gap gains from yesterday. Essentially, everyone who bought for a trade yesterday has exited (the rest are extremely stubborn!). Now, the rubber really hits the road for our technical discipline. T2108 closed at 28%, right around where I *think* the intraday low was the previous day. As a reminder, these levels have been "good enough" for flagging a bottom since the March, 2009 lows except for last summer's swoon. Given we cannot predict the outcome for the global turmoil that is mainly responsible for roiling the markets, all standard cautions apply to any trade. However, my starting assumption is that in a bull market, oversold conditions increase the likelihood that the market has started to discount whatever ails it. These considerations explain the more complex trading call for today: "Nibble on some longs, identify others, close some shorts, create plan for closing out most remaining shorts." The market is not yet technically oversold, but traders need to be perpared for the typical wash-out type of action that occurs during oversold conditions. Sell-offs are usually exhaust themselves faster than rallies, so a trader must be prepared with a plan and not over-rely on his/her ability to think on the fly under such chaotic conditions. Pick out select out of the money puts to help you "sleep at night" if you are swing trading and holding long positions overnight. Similarly, out-of-the-money calls are appropriate for hedging shorts (or speculating) given at anytime, the chaos can resolve its overnight to the market's satisfaction...creating an up gap too large and too strong for the remaining bears to fade.

March 15, 2011

The pattern of selling/fading rallies continues along with the tendency of buyers to lift the index of intraday bottoms. T2108 closed at 34%, but it was as low as 27% at one point (Worden telechart does not provide intraday ranges on T2108, but sometimes I check on the latest levels during the day). Since the rally off the March, 2009 lows, getting "close" to the 20% oversold threshold (on a closing basis) has been sufficient for launching a reversal. Thus, the case for buying for a quick trade can be made. Given the trading action on Tuesday played out exactly as expected, traders should already be in position to take advantage of buying opportunites with some shorts closed out at the open. Note well, overhead resistance looms directly overhead at 1303, so the window for longs could be quite short, and the next opportunity for shorts could be right around the corner.

March 14, 2011

T2108 dropped to fresh 3 1/2 month lows. The S&P 500 bounced from these levels in November and August, so it is not a time to aggressively short...EVEN WITH THE BEARISH NEWS FLOW. The Bank of Japan is furiously printing money to buttress its financial system. The Federal Reserve meets on Tuesday, and it is sure to produce a statement supportive of the BoJ's efforts and supportive of market liquidity. The current action is also a great time for market makers to force out weak hands at the open with a gap down, only to buy everything back. And if that was not enough to convince you of the risks of getting too aggressive with shorts, Monday featured a hammer pattern where buyers brought the stock market to a strong close. This is NOT to say go aggressively long either. T2108 is not yet oversold. Instead, practice a measured approach and keep an eye on BOTH positive and negative catalysts that are acting and counter-acting in rapid fashion.

March 10, 2011

This was a BIG day. T2108 plunged 22 percentage points, or 32%, to close at 46%. The last time T2108 lost this many percentage points was October 28, 2009. The indicator bounced back the next day and never quite reached official oversold levels. The last time T2108 lost this much on a percentage basis was June 29, 2010 when it dropped 36%. T2108 sailed past the previous lows of 2011 to levels not seen since the end of November when the market last "wobbled" as it is doing now. Such a dramatic move typically causes technical damage, and the carnage is easy to find. The S&P 500 had its first true breakdown since late August. The index broke below the recent trading range and cracked the 50DMA. The bias in the market is now bearish. I will cover the technicals in more detail on the S&P 500, the VIX, and even the NASDAQ on the main blog.

A big lesson during this breakdown from the trading range is that having a basket of longs and shorts can pay off very well, especially when positions are trimmed and restored according to T2108's proximity to critical thresholds. With the bias nowbearish, my trading calls will be more aggressive on the short side until bulls re-establish control by, for example, breaking the previous trading range to the upside. This bias means I will be more interested in fading bounces than buying dips except for special circumstances (like commodity and solar stocks). For now, traders should cover some shorts and keep cash/margin ready to fade any bounce from current levels. Longs should also be sold into any such bounce.

March 7, 2011

See "Stock Market Wobbles But Remains Unbroken" for detailed commentary.

March 4, 2011

It is too bad T2108 does not come with intraday measures. While T2108 remained overbought today, it dropped below the 70% threshold at the peak of today's sell-off in the S&P500. A rush of buyers in the last 30 minutes "saved the day." Over the last 9 trading days, the stock market has experienced a lot of churn. The last time we saw anything similar was last November. Given oil prices are steadily climbing, it is truly remarkable that the stock market has held steady. I am not sure whether this means that market participants are seeing better days over the horizon, anticipating QE3 in response to an oil-spike driven recession, or just plain do not care enough. Whatever the reason, the advantage still rests with the bulls. Imagine where the market could be if oil were NOT creeping higher? Interestingly enough, each trip into overbought territory this year has turned out to be an ideal time to open new shorts although profits were not lasting. I cannot imagine this pattern sustaining itself for much longer, but for those who wish to play it and can daytrade, the S&P500 has provided two key levels of resistance for setting up stops and/or entry points for new shorts: 1332 - where the market has hit 4 times without breaking over these past 9 days; and 1344 - the 52-week high.

March 3, 2011

Today was a vivid reminder why a trader must get confirmation before aggressively betting against a trend. In my last note, I acknowledged that T2108 could not provide a definitive clue about the market's next direction, but I "warned" that the advantage remained with the bulls despite Tuesday's ugly one-day drop out of overbought conditions. Now, the stock market is right back to overbought conditions with T2108 = 74%, and the S&P500 essentially recovered all of Tuesday's losses. I did not think T2108 would return to overbougt conditions this soon, so I am once again being cautious on the bearish trading call by advising that traders identify new shorts. The S&P500 closed at the last real resistance before testing 52-week highs. I would not initiate any new shorts until we see how the market behaves around these levels. A more aggressive bearish stance may also make more sense once/if T2108 hits 80%.

March 1, 2011

Yesterday, I noted that I was not expecting the market to close near its highs if it gapped up. Today's gap up was small but the distance from the highs to the close was large! I was clearly far too conservative in my doubts that the bulls could sustain their advantage. T2108 fell all the way back to 61%, and the S&P 500 had an ominous-looking drop of 1.6%. However, again, until the market closes below a critical support line (the 50DMA is a little over 1% away), the upward trend remains intact, and I must assume the bulls retain the overall advantage. So, the trading call goes to neutral with T2108 no longer providing a definitive clue about the market's next direction. Given the bulls retain the advantage, it does make sense to lock in the profits on some shorts here.

February 28, 2011

The S&P 500 opened up, wavered to flatline and had a strong close. In other words, buyers were as stubborn as ever. This action put T2108 right at the 70% threshold for overbought. This makes things "interesting" for the market's tendency to rally on the first of the month as fresh money rolls in. As I have argued on the main site, I think this next trip into overbought territory will be the last for a while...assuming events in the Middle East continue to churn and boil. However, the bias and the edge remain with the bulls until some non-confirming event, like a failure to print new 52-week highs and/or a close below the 50DMA (and last week's sell-off lows). For tomorrow, given overbought conditions, I am going to assume that a strong gap up will get faded. That is, I do not expect the market to close at its highs.

February 25, 2011

The bulls closed the day in victorious fashion. The S&P 500 jumped 1%, and T2108 jumped 10 percentage points to 65.5%. This was the larrgest one-day jump for T2108 since, you guessed it, February 1st when the S&P 500 surged 1.7%. Another fun coincidence is that Friday's launching pad was the high from February 1st. Most importantly, the S&P 500 confirmed a bullish retest of its 50DMA. The current uptrend remains firmly intact. Days like these are strong reminders why following technical indicators like T2108 require discipline - like locking in some profits on shorts as T2108 drops sharply from overbought territory without violating key support. Traders who remained overweighted short should have been reducing shorts in preparation for new opportunities when (if?) T2108 returns to overbought territory. At the current pace, T2108 should return to overbought territory next week. Traders who were underweighted longs should have added more longs on a day like this. If they are lucky, the market will pull back a little on Monday for some fresh buying opportunities before the market pushes higher. A stop below Thursday's low (and below the 50DMA) is an even more clear limit for holding longs. (See "Setting Up for Another First of Month Pop…or A Bull Trap?" for earlier commentary on the technical setup).

February 23, 2011

At 54%, T2108 matches its low for the year. The S&P 500 dropped less than 1% as it went back to its usual behvaior of closing well off its lows of the day. Selling volume was strong again, but it seems the buyers may be returning. If you shorted, as recommended, when T2108 made 3-month highs, you are currently sitting on some good profits. (Hopefully you took some today as well). T2108 goes back to neutral now. The two days of selling has been enough to encourage "bargain hunters" as well as give shorts the scent of blood. As usual tests and breaks of the previous day's lows and high will be critical in determining the direction of the next short-term trades. I would also look to the S&P 500 testing the 50DMA at 1286, 1.6% away to the downside.

February 22, 2011

T2108 dropped 15 percentage points, its largest one-day plunge mid-November, as the S&P 500 dropped 2%. Both drops were slightly larger than the one-day correction on January 28, 2011. This is a tough spot for making a generic trading call because buyers stepped in the very next day after that last correction and never looked back. In a bull market, a sharp sell-off can attract "bargain hunters." So, the most prudent strategy is to take some shorts off the table, preferrably the most speculative ones and to stand ready to respond quickly once/if the upward bias returns. New shorts and longs must have tight stops. A break below Tuesday's low will provide more technical latitude for shorts to hold and even add to positions.

February 17, 2011

T2108 is finally at its highest point of the year. The last time T2108 was this high was in mid-November when the S&P500 was on its way down into a very mild correction. Given today's move, I can finally be a bit more definitive about positioning for a sell-off.

February 16, 2011

You guessed it. The market has stumbled across the overbought threshold yet again. I am assuming now that these trips back and forth are not significant until some other technical signal suggests a change in market behavior. In the meantime, it still makes sense to keep paring back on long exposure, especially in speculative stocks, and to make sure to maintain a small number of shorts.

February 11, 2011

For the fifth day in seven, the S&P500 opened down and/or went negative before ending the day in positive territory. This behavior shows a strong tendency of traders to treat any and all dips as buying opportunities, thus supporting a strong uptrend. In this environment, the bias is to hold longs, maintain a very small set of shorts, and buy out-of-the-money puts when the market goes into overbought territory as a hedge against a rude disruption in the general bullishness/complacency in the market.

February 9, 2011

The market gapped down, sold further, and then almost recovered to flat. But this was apparently enough to drop T2108 out of overbought territory. This drop means that T2108 is basically continuing the same behavior from the past six weeks of lingering around or near the overbought threshold. This behavior also means that traders should not overly committ to short or long positions.

February 8, 2011

Day #2 of overbought conditions. S&P 500 volume is trailing off but the price action has closed ABOVE the upper-Bollinger band for the sixth day in a row (all of February). With stochastics also overbought, the stock market is extremely stretched at this point! However, the recent recent history of this rally warns us that this market can stay overbought much longer than one would expect.

February 6, 2011

I launch the T2108 service with the indicator in an unusual (and historic?) pattern where it has largely stayed out of overbought territory, even as the stock market continues to creep upward.

Full disclosure: At anytime, I may have long or short positions on any publicly traded stock on U.S. and global exchanges.