The Madness

of Markets

By Duru

December 5,

2004

I have wanted

to write a piece like this for quite some time. I find investigating and

analyzing the market's madness both entertaining and educational (and even occasionally

profitable - imagine that!). I am always reminded of how inefficient the market can

be at pricing equities as it lurches and spikes in bursts of emotion focused on

short-term events. Like a kid seeking instant gratification, the market often

loses sight of longer-term trends and developments that are much more important

than the day's latest drama.

The charts

(from TC2000) below are all recent examples of stocks that first reacted poorly

to earnings events only to recover those losses in the following hours, days,

or weeks. Use these examples of reminders of why it is important to develop

your own convictions about your trades and investments before the market forces

you to react in the same trigger-happy way it is acting. Of course, certain

trading strategies require you to respond immediately. But just as you should

move with the dominant trends when trading on technical grounds, you should at

least give longer term fundamentals a moment's consideration before following

the previous hour's consensus. If you are looking over the horizon and toward

the greener grasses, then these charts should resonate with your sense of

indignation at the churn caused by instant gratification.

Certainly,

this presentation is hindered by selection bias. I could just as easily throw

up four charts where the market's instant reaction stamped a long-lasting

impression in the foreheads of any suckers who chose to continue the fight. So,

please treat this as an educational tool and not as a proof of any particular

market theory! Even more importantly, nothing in these charts should be

construed as advice to buy or sell any stock. Final disclosure: I hold a hedged

position in OVTI and have held positions in all of the other stocks excluding

MCHP at various times this year.

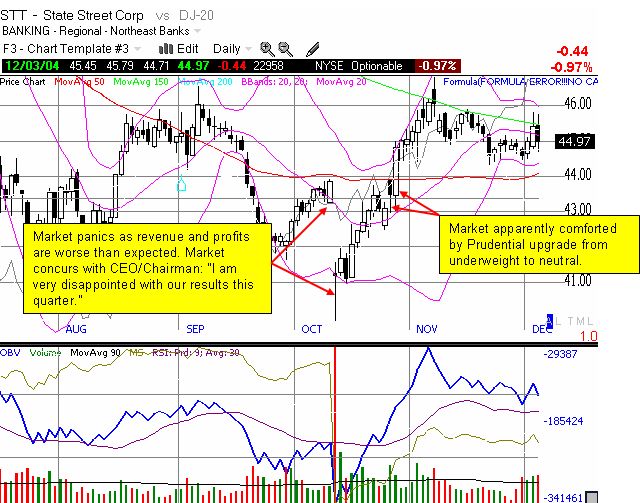

State Street

has been trapped in a persistent downtrend all year, and the stock has still

not broken out of this malaise. However, the latest earnings report took the

stock down to news lows in a very climactic way. That is, volume far exceeded

anything seen all year. Unlike the prior earnings report that also featured

record-breaking volumes, the stock quickly recovered the same day and went on

to recover all losses within a week. Only time will tell whether the sellers

have finally capitulated and left the building.

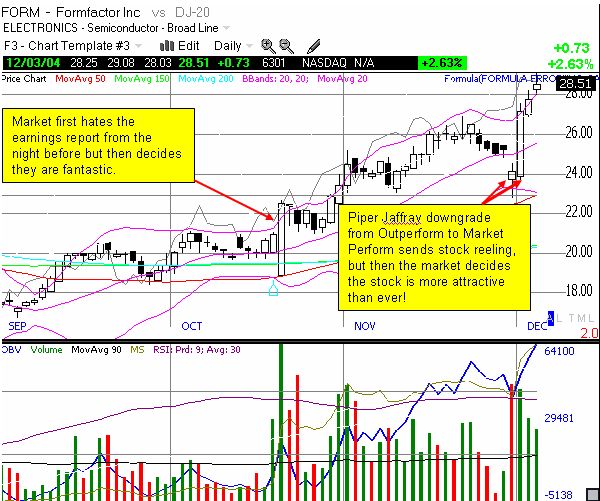

FORM is one

amazing stock. It has now hit all-time highs but the road to these lofty levels

has been far from straightforward. There is obviously a strong foundation of

buyers who really believe in this stock. These buyers have stepped in at very

critical moments of late as shown above. If you did not maintain your conviction

on this company, the market would have shaken you out several times…and probably

destroyed your confidence in the process.

OVTI is the

classic "manic" stock. In the moment, the stock seems extremely

volatile and erratic. But take a step back, and you can see that it has very

strong trending tendencies. Note well the spikes in volume as various drama

unfolded. The buyers are slowly but surely wrestling control away from the

sellers. You can almost feel the confidence in this company rebuilding.

I have not

observed MCHP as long as the other stocks featured in this piece, however, I

was intrigued by this one because despite the intense short-term drama that

often surrounds this stock, it has essentially gone nowhere for a year and a

half. Something told me that the latest drama would generate as mixed a

response as ever. Sure enough, after the sellers were done with their usual

panic, the buyers stepped up and recovered most if not all losses. Hard to say

where this one is going next, but if history is any guide, you can find it

here, same bat-channel, in another three months or so. If you are looking to

develop some sort of conviction on this one, the key is to figure out what

exactly does the market want to hear, and what exactly is it most afraid of?

I plan to do

more of these in the near future from time-to-time. If nothing else, I hope they can help

some of you firm up your ability to cope with the madness of the markets.

Be careful out

there!