Welcome to

the Second Term

By Duru

January 23,

2005

(Warning! This piece

uses the latest market drama as another excuse to indulge in political banter

and gratuitous jabs at the returning American regime. Read at your own risk!)

Three weeks of

selling. Three weeks is all it took to erase all of the Dow's gains for 2004.

Sure it registered its 2004 green on a late December surge, but certainly we

cannot help but fear that the NASDAQ and S&P 500 are next up for a buzz cut.

Given that 2004 was saved by a two-month post-election rally, it seems like

poetic justice that the market greet the re-inauguration

of Bush with more red than the eye can take. The deficit is as red as red can

be. Our former allies in the world are red with fury that America could

make the same mistake twice. Our remaining allies are red in the face over

supporting our bogus Iraqi war rationale. Our most hardened enemies are red in

the eyes - well, lunatics and fanatics are usually red-eyed I suppose.

Despite the

controversy that should be swirling around this President, America on the whole seems on the

surface blissfully satisfied with itself. Those of us who like to think of

ourselves as progressive might call this bliss a proxy for ignorance. But I am

reminded of something I read in the latest Newsweek (January 24, 2005) with the

scary cover titled "A Man In a Hurry: Why Bush Is

More Ambitious - and Hands-On - Than Ever"). In an article discussing what

has made past Presidents great, Bush Sr. is quoted responding to a question in

2000 about how Bush Jr. could gain a legitimate presidency: "It's going to

be difficult, and he knows that. But soon all the pundits and experts and

professors are going to be talking about something else all the time. Maybe world peace. The subject'll change." Once I got

over the subtle but signature Bushie disdain for folks who actually know

something, I realized that he shed a sliver of light on the Bushie strategy. That

is, if you manage to push through with some controversial action, you can then

disregard your opposition. They will surely tire of pounding away on the same

old topic. Moreover, the American public likes to forget about the past and

look wistfully to the future. This means that your opposition will only have a

small window in which to get the public to pay attention to alternative logic -

no matter how reasonable it is. Think about it…even Kerry could not stand up

straight and state in clear and simple terms his opposition to the invasion of

Iraq. He had to take the invasion as a given and present a pseudo-optimistic plan for how we would turn Iraq

into a bastion of freedom and democracy of the Middle East.

That strategy failed miserably, particularly because the

Bushies were the first to re-shape war policy into such hopelessly Pollyannish

(and insincere) goals. Never fear faithful readers - I will keep jumping

up and down and waving my arms over this madness until I am blue in the face!

Woo-hoo!

But is it

possible that the "act first and apologize never" strategy can fail?

Sure. Clinton

was dogged with Lewinsky to no end. Watergate did take out Nixon. And wars have

a sad quality to them…people die, and die, and die, and keep dying…and many

more get hurt and maimed. Once enough sons and daughters fall for a

questionable cause, enough parents begin to question and then object. Future

potential draftees begin to speak out more vocally for fear they could be next.

And as ultimate victory fades further and further into the future, it

out-distances the most idealistic of ideals America can muster. But who knows how

long it takes for the chasm to widen enough to obliterate the stubborn shreds

of logic for war. This shock to the system has not happened often in American

history; American has typically gone to war very reluctantly. The

chasm opened slowly but surely in Vietnam. It opened with a quickness in Somalia

(under Clinton).

Hard to say where we are with the incursion into Iraq. Our expansionist, "might

is right" policy surely has Syria

and Iran

in its cross-hairs. Maybe the chasm will finally open up too wide then. Maybe

it is already opening…

The last NBC News/Wall Street

Poll before the inauguration shows that only 50% of the public approves of the

job the President is doing. This is supposedly the worst rating for this season

since polling began some eighty years ago (Nixon may have been worse?). However,

I do not understand why this is such a surprise since only 51% of the

population voted for the guy anyway. We should be instead asking why these

approval ratings ever get significantly higher than the percentage of the folks

who voted for the incumbent. Even more ironic about the fuss over this number

is that it is actually a percentage point or two higher than it has been since

May, 2004! Ah, but I quibble with the details…

So, is the

market mirroring the public's apparent dissatisfaction with the very man that

same public so wisely voted in again? (Imagine how high the disapproval rating

would have been the day a President Kerry first set foot into the White

House?!?). So far, this seems to be the case. Notice how the bond market

continues to tell us that the prospects for future growth are muted at best as

long-term yields continue to languish. Notice how the job market continues to bumble

along. Notice how anxious the market gets over foreign purchases of our

ballooning debt. Notice the furtive looks over our collective shoulders at the

rapid economic progress in India

and China.

Notice how countless technology CEOs continue to caution that their customers

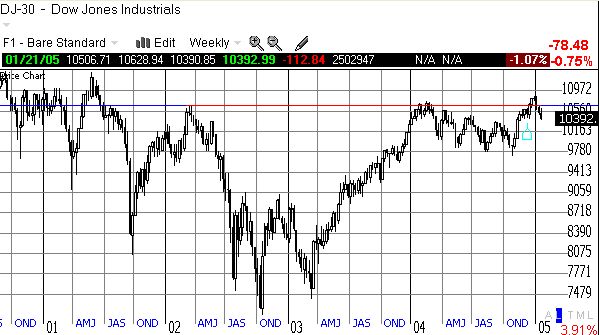

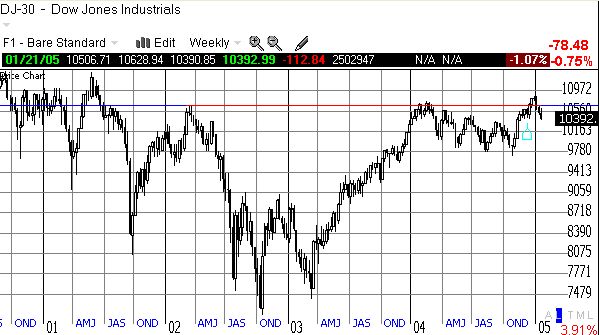

are cautious and uncertain about the future. Even more telling are the graphs

below…see whether you can spot a pattern.

I stripped

down these charts and showed one bare bones line of resistance. Hopefully,

clarity descended upon you rapidly. For three years, the major indices have

struggled to get past the snapback rally that followed 9/11. The major indices

began and ended 2004 with unsuccessful attempts to break free once and for all.

2005's sell-off now threatens to plunge us back into the trap. If we cannot

rally soon here and resume 2004's late rally, I will be forced to rejoin the

bears 100%. Unlike a lot of bears, I am not fearing a

retest of 2002 or 2003 lows - although it is easy to see from the chart how little

resistance there may be to such a disaster. I am more inclined to think we will

be stuck back into some kind of new trading range. Perhaps the lows of 2004

will be the new floor? However, the next bear cycle works out, the current

action only serves to solidify further my suspicion that this decade will

feature one big trading range.

For more

optimism, you might do well to check out the charts of other indices that hit

all-time highs in 2004 or highs that have not been seen since BEFORE the bubble

reached its peak. I am looking at charts like the Advance/Decline line, gold, the

Philly banking index, the S&P 600 (small cap index), the Dow Jones

Transportation Average, the energy sector, and even the utility index. Even the

housing index is still going strong (recall that long-term interest rates are

still languishing). If so many other indices were not looking so good, we would

have to immediately close up shop on the entire market. However, in the

optimistic case, there will remain money to be made in these various areas OR

leadership in the market will soon transfer from the hot to the cold. Time

should quickly tell us in 2005. I know Bushie is anxiously watching the action.

After all, part of his claim to Presidential success was his single-handed resuscitation

of a market whose collapse had started before he could even get elected. What

would market weakness say about his economic virility? And let us not even

mention the security of a Social Security reliant upon the stock market's

health?!

In the

meantime, be careful out there!

© DrDuru, 2005