Time

Ticking Away On Complacency

By Duru

March 2,

2005

The post-earnings complacency I

spoke of earlier continues to travel a bumpy road. The market has been

extremely volatile day-to-day lately with sharp moves in the market following

the latest gyrations in oil or the words of the Fed. Folks are trying to stay

calm, but their trigger fingers cannot help but fire nervously away. Witness

the three or four sharp sell-offs we had in February and look at the sharp

reversals that have occurred within the day --- there has been a lack of

conviction for taking out the 2004/2005 highs (in the Dow and S&P 500) as

sellers get nervous about protecting profits and capital. Finally, the poor

NASDAQ cannot even take out its now declining 50-day moving average line. Techland has been lagging the market ever since getting

absolutely crushed to start the new year. Ever since, it

has languished, it has jerked up and down, but in the end, it has refused to

show enough life to even care about the ball, much less get dressed up and look

respectable. Note carefully how the old resistance around 2100 set with the

post-9/11 snapback rally is STILL acting like a magnet for this index. So,

while the other two major indices have flirted with their 52-week highs, the

NASDAQ has lowered its standards to teasing us with dances with a line that

threatens to drag it down like it did so effectively for much of 2004. The Nazz needs to take dancing lessons from the Down Jones

transports. Last week that resilient index punched convincingly through the 50

DMA on its way to joining the Dow Industrials for a potential confirmation of a

break to new highs.

An example of some

rapid-firing can be seen in the sharp breaks in stocks like CMI, DE, and NKE

where sellers fled at the smallest sign of trouble only to open the way for

bargain-hunters to walk the stocks right back up past pre-earnings levels. Then

you have a stock like CME where buyers excitedly propelled the stock right past

pre-earnings levels only to have a downgrade crush the stock back into the

earnings gap the following day. MMC has had a bumpy but steady comeback since

the latest scandals took out the stock to levels last seen in 1999 (Spitzer's

latest crusade…this time he has been dutifully cleaning up the insurance

industry). The immediate reaction to its earnings was a small, but prompt,

sell-off upon which bargain hunters and the like seized upon the opportunity to

walk it back up to highs not seen since this four-month recovery began. But,

you guessed it, the stock reversed right back to

pre-earnings levels the following day. In techland,

you have a stock like SYNA which fired on all cylinders following a stellar

earnings report only to have the doubters and haters crush the stock two weeks

later as fears surged that the good news was merely a mirage. (Come to think of

it, tech stocks have shown a strong bias to the downside lately. Traders are

definitely shooting first and asking questions later when it comes to tech.).

Finally a whole host of tech IPOs that seemed to

promise nothing but infinite riches just a while ago, have suffered nothing but

indecent exposure of their true shells. My favorite whipping boys on this point

are SHOP, INCX, and ECST. Talk about manic behavior!

Nothing is

secure and no opinion lasts longer than the time it takes to read another

article telling a tale in the exact opposite way as the day before! Of course,

these example are just sample windows looking onto the

madness, but the lessons should be heeded. If we finally get a break of

resistance and the major indices climb to new highs, I strongly suspect the

excitement will not last long. We will get one of those classic marginal

breakouts that become fake-outs and pre-cursors to much lower prices. However,

given earnings season has about another month before returning to the ball, I

also do not look for this story to play out simply and directly. Look for more

churn, froth, and "to-and-fro" as the markets do their best to

disguise their true intentions. The end result appears to be complacency at the

surface but a lack of conviction is creating a dangerous undertow.

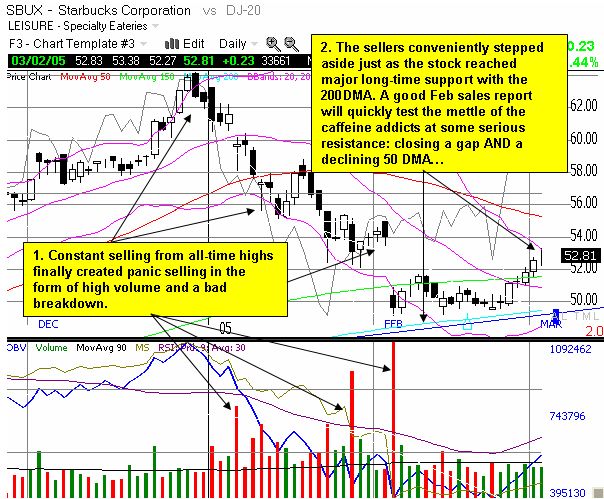

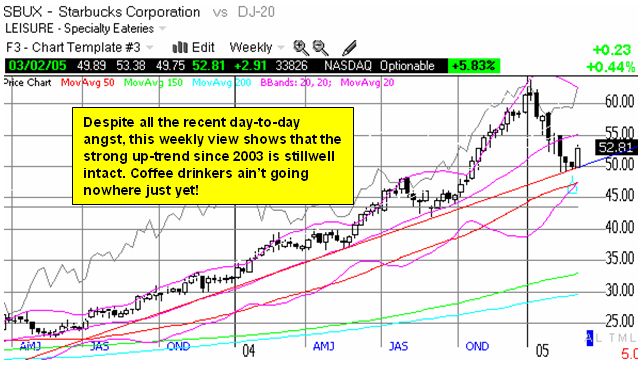

To end the

show on a positive note, let's take a look at some bottoming action again. I featured EBAY in the past two missives.

This time, I am intrigued by the moves in PLAY and SBUX. The charts and

annotations below show compelling cases for lasting bottoms. As usual, time

will tell, but these kinds of tests can provide for dramatic theater at the

very least. (Click here to read my standard disclaimer

when it comes to talking shop about stocks).

As usual, be

careful out there!