Steel Bubble?

By Duru

July 4,

2005

By now, most

of us have heard of the woes experienced by

As I noted

earlier, March marked a month

where I finally got serious about commodities. My timing could not have been worse. Heck, even Doug Kass

fought the growing consensus as he proclaimed in a March issue of Barron's that

steel had topped. Regardless, I have

learned a lot while watching steel quickly fall apart. It turns out that there has been a bubble in

steel prices, and, as so often happens with bubbles, an abiding faith in the alleged

fundamentals provided all the rose-colored blinders I needed to ignore the

danger all around. However, as many

steel stocks print out classic bubble patterns, even the worst collapses have

only brought steel stocks back to the average levels seen in 2004. Our conclusion then is that either the bubble

has not finished popping and more pain lies ahead, or that there was only a sharp

pullback in a market that temporarily got ahead of itself. For example, the commodity index has not

followed steel downward. The commodity

index, shown below in a 9-day chart, indicates that the bull

run in commodities from the 2001 bottom continues.

Certainly the

Fed sees charts like this and sees the need to continue hiking short-term

interest rates. Sectors like steel that

are weakening should only get weaker under such conditions. I print below several charts of steel stocks

that I follow to show how mixed the two-year story appears. We have steel stocks which have clearly

popped short-term bubbles. We have stocks

that have been making slow and tentative recoveries from catastrophic lows in

March (see an earlier posting for

a more detailed look at the charts of Oregon Steel). Finally, we have stocks whose long-term story

amazingly remains intact. You can be the

judge, but isn't amazing that so many public steel companies remain after all

that angst we saw earlier this decade over bankrupt steel companies and

chronically poor financials?

Also realize

that in these days and years of bubble-talk, we have become highly sensitized

to what appear obvious bubbles (like housing prices around the globe and some

think oil prices are extremely over-extended), and nearly oblivious to

potential bubble-like conditions that remain off our radar because we consumers

do not purchase these goods directly.

Oregon Steel

dropped about 50% in less than three months.

Despite this bubblicious looking chart, prices

have merely returned to levels last seen in the fall of 2004.

The close-up

of Oregon Steel shows the development of a "do-or-die"

situation. The stock is below the (still

rising) 200-day moving average, struggles to cling to a declining 50-day moving

average, and tries to climb a recent up-trend in recovery from the sharp

two-month collapse. I suspect an answer

is around the corner…

CMC tries to hold the gap up

from late 2004 that marked the beginning and end for this bubble.![]()

![]()

![]()

NUE is in a

similar situation to CMC. While a

mini-bubble has clearly popped, there remains plenty of downside. Erasing 2004's run would mean an additional

40% price drop.

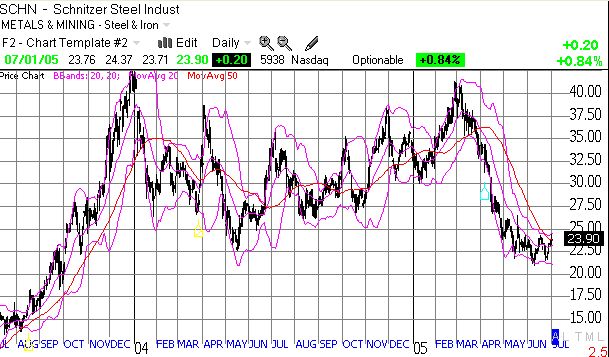

Scrap metal

has been scrapped. An eradication of

2004's prices happened extremely quickly after SCHN failed at the highs printed

in January of 2004. Stay tuned on what

the market chooses to do with 2003's prices.

SCHN started that year at $6.67!!!

STLD has been fessing up about poor results recently. STLD's

bubble was extremely sharp. The complete

destruction of 2004's prices is only another 20% drop away.

And we end

this horror show with one steel stock that refuses to give up. While it experienced a quick run-up in price from

February to March, this run was "only" around 25%. The return to normalcy has simply returned

the stock to a year-long trading range.

The company continues to insist that things look pretty good, so 2004's

prices still seem safe. So stay tuned on

this one!

As always, be careful

out there!