Google Swoons As Retailers and Homebuilders Bounce

By Dr. Duru written for One-Twenty

January 30, 2008

(Corrected distribution chart and the analysis of it: 1/31/08)

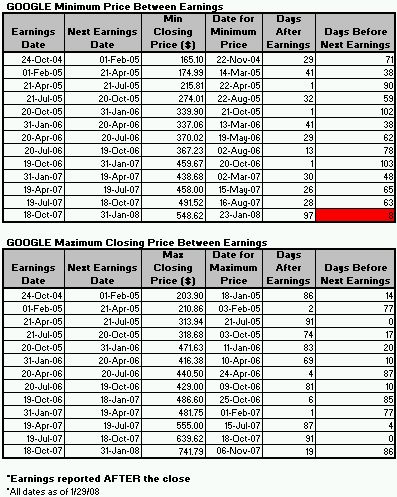

It's time for Google earnings again (January 31, 2008, after the close). In honor of the occasion I updated tables that have languished for over a year now. The tables below show Google's minimum and maximum price points before and after earnings, and when these points happened.

What sticks out is that for the first time, Google is hitting its lows after the last earnings within days of the next earnings announcement (see red box). In fact, before this month, Google had reached its low before the next earnings release no later than 5 1/2 weeks before those earnings. The average has been 7 weeks. At the rate the stock is falling now, that low may come right at the closing bell before earnings are reported.

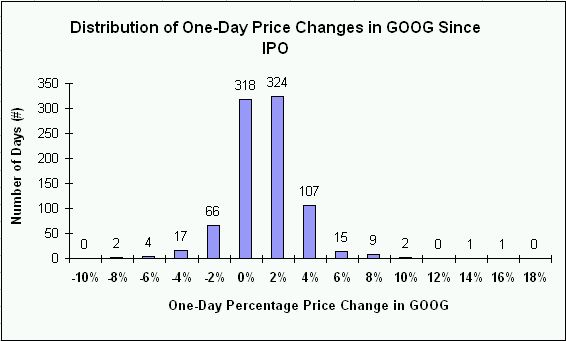

Does this predict anything for the reaction to earnings on Thursday? I am not sure. I have only used this table to understand Google's "typical" behavior between earnings. The chart belows shows the distribution of Google's one-day performance ever since its IPO in August, 2004 through January 29, 2008.

Google has been on an impressive long-term uptrend. Accordingly, it spends more days finishing positive than either negative or flat (not helped by the 15 down days out of the 19 trading days this year!). The two biggest one-day moves in absolute magnitude were impressive rallies the day before and the day after GOOG announced its first earnings report (15.4% and 12.1%). The biggest one-day loss GOOG has ever suffered has been a drop of -8.4% (on January 20, 2006). Overall, Google has been a pretty consistent market darling. Interestingly, it has only posted double-digit closes after earnings twice in its entire history (10/21/05 and 10/22/04). Both were positive gains and the worst post-earnings performance was a close of -7.1% on 2/1/06. Given these numbers, I am guessing that no one even worries about the chance that GOOG could ever drop 10% or more in a given day. But given how high expectations are for GOOG, how crowded the long side is (Yahoo!Finance reports that as of Dec 26th, that shorts represent only 1.7% of the float), how frequently Google management has warned us that the "law of large numbers" will inevitably catch up to GOOG, I have to think the likelihood of a monster one-day decline is much more likely than we might initially believe (remember, just because it has never happened does not mean it cannot happen). Consider that GOOG never provides forward guidance. This means that analysts have to "make up" their estimates, and this increases the chance of being way off the mark. Things have been so good for GOOG to-date, that these misses have tended to be to the upside (that is, positive). Now, if Google had closed at its low last week, it would have experienced a -11% drop. Instead, a big late-day bounce reduced the pain to a -6% drop. GOOG has now broken back down below the 200DMA and is breaking back below its long-term trendline...buckle your seatbelts and hold on tight (I currently hold a hedged position in GOOG: read disclaimer here).

While GOOG swoons, the former dogs of the market have been barking up the right tree the past week. Homebuilders, retailers, and financials have all been on a tear. Many of these stocks have bounced 50% and more already. It is as if last week's traumatic selling finally shook the last sellers and convinced the shorts to close shop. The Federal Reserve's eagerness to buttress debt has sure helped. I daresay that now that the XHB has broken its steep downtrend (see Trader Mike's chartfest from last week), you have to seriously consider starting to add some homebuilder exposure to a longer-term portfolio. As they say, if you wait for the economy to be good when you start, you will feel like you are too late. I know, I know. It's painful even to think about it. I will try to jot down a timely note if I decide to share in some of that pain anytime soon. The ETF for the retailers, RTH, has not yet broken its 6-month downtrend, but as you know, I already started nibbling on Best Buy (BBY). I am frankly amazed that I am already back on the plus side. Don't worry - I am not holding my breath to stay there!

Now you might ask: "But Dr. Duru...aren't you now a bear? Haven't you described the economy as being in trouble?" True. True. Very true. But I also know that I have no clue how to time economic cycles. For example, the last recession was barely a recession. If you bought almost any high quality company during that period, a five-year wait brought you nice returns. So, buy 'em when they are on sale. I also remain skeptical that we are in a recession or can get into one with unemployment as low as it is. A slowdown. Sure. A housing slump and a credit crunch? Oh yes, indeed. Those two alone are enough to keep me bearish in the shorter-term. But I have to periodically remind myself that I cannot completely ignore the clearance racks and bargain bins.

Speaking of which, I took my first dip into casual dining chain Brinker International (EAT). I really wanted Darden (DRI) - I love me some Olive Garden and Bahama Breeze! - but I feel like EAT is a slightly better bargain here. Both stocks now sport healthy dividends and both seem priced for a deep recession (or stagflation, given the increasing input costs they face). In particular, EAT was at SEVEN-year lows last week before the big pop. It is now "only" at five-year lows. I meant to do my nibbling in the middle of last week's panic, but I did not have my shopping list ready. Anyway, my jaw drops everytime I look at the stocks of these eating establishments. In the span of 9 months or so, the stocks of a majority of these companies have received gory beatings. Not even the homebuilders were sent to 4, 5, and 6-year lows this quickly! (Note that McDonald's (MCD) still maintains a healthy multi-year uptrend despite being down 16% this year. Its spin-off, Chipotle Mexican Grill (CMG) also continues to defy casual dining hell).

Bottom-fishing aside, don't worry. I am still focused on the increasing risks facing these markets in the nearer-term. I remain skeptical of anything that does not seem priced for recession, and I am especially skpetical of anything that is using the global growth story as its crutch for waiting out the slowdown in the U.S. A climatic penance for our debt-laden ways remains outstanding...

Be careful out there!