Click here to suggest a topic using Skribit. Search past articles here.

"People are looking for a reason to get off the fence. The most asked question in America today other than who Obamaís Vice President is going to be is probably when is the bottom? And if you even smell as though you are in real estate, people ask you that question all day long."

This quote is from Robert I. Toll, Chairman and CEO of homebuilder Toll Brothers (TOL) uttered during the company's F3Q08 Outlook Conference Call on August 13, 2008 (all quotes from that conference call come from Seeking Alpha. You can also go to the company's investor relations page to listen to the call.). True to form, analysts and pundits scrutinized Toll's commentary looking for the ever-elusive housing bottom. For example, Jim Cramer decided that Toll had indeed called a bottom and is willing to hop aboard...again (click here for his video interview). So, I decided to check out the conference call myself to feel the excitement. After all, TOL got a two-day jump of 12% off this call.

Overall, I did not hear Toll directly declare a bottom. Instead, what I heard is that it seems like things have stopped getting worse. Of course, in a bear market that can often be all the excuse traders and investors need to sound the "all clear." But Toll remains circumspect, and from my read, he is still bracing himself for the current period of stabilization to last for an extended period of time:

"With respect to traffic, itís still dismal. Traffic is -- itís consistent, however. It has not gotten any worse for the last three quarters, so we feel as though weíve stabilized but I donít want to give you the indication that that makes us feel good. Itís as though we walked into the tar pits, sunk up to our nose, our feet are touching a ledge and we are not going down any further but that sure doesnít make us feel that comfortable...But we are heartened that at least we are able to spook up the traffic. That indicates that there are buyers out there waiting to be nudged. It will take a general turn in confidence for the big nudge to occur but sooner or later, it will occur."

This "dismal" traffic is helping to drive intense competitive pressures. Until these abate, the financial health of homebuilders will remain tenuous.

"We see the same competitive situation in general as we have seen in the past two-and-three-quarters years...And the reason is that as these smaller builders are failing or as our larger builders are looking for cash flow more seriously, we run into even more competition perhaps than we had before, so until a guy has gone out of business, he continues to offer more and more competition....So I wouldnít say the competitive situation has eased up."

Toll indicates that the bottom will not happen with a punctuation mark. Instead, it will be a very slow-moving trickling process.

"..people have been out of the market for...two-and-three-quarter years...They have accumulated decent wealth. They want to move and thatís generally how these markets finally correct. Itís not some cataclysmic effect, other than in the í74 or í75 time when Congress passed a fairly significant bill for housing. Generally, these markets work themselves out and the pent-up demand just swells until it finally goes over the top of the dam. When it first goes over the top of the dam, you donít get a lot of water -- you get a little water, and then a little more and a little more and a little more, and I think thatís what we are seeing."

Perhaps one sign of a bottom is that land owners are finally being forced to capitulate (to the vulture buyers): "...it is time for the land to be disgorged by the financial institutions and thatís beginning."

Again, overall, I could not quite feel the excitement I was looking for. Back on June 9th, I gave a nod to the massive shorts in the stocks of homebuilders and used the decline in Centex to guess that homebuilders would all soon tumble to fresh 52-week lows. Of course, they continued to tumble along with the market. But before hitting the most recent bottom in mid-July, many homebuilder stocks carved out fresh 5, 6, 7, even 8-year lows! That means the housing bubble in these stocks has not only been completely erased, but the market has managed to take a lot of these companies all the way back to the days when then Federal Reserve Chairman Alan Greenspan first devised his scheme to use a housing market propped up on rate cut steroids to steer the rest of the economy away from deflation and recession. If you needed any further evidence that the plan failed or at least delivered to us even worse consequences, you can pick over the rubble of these homebuilder stocks.

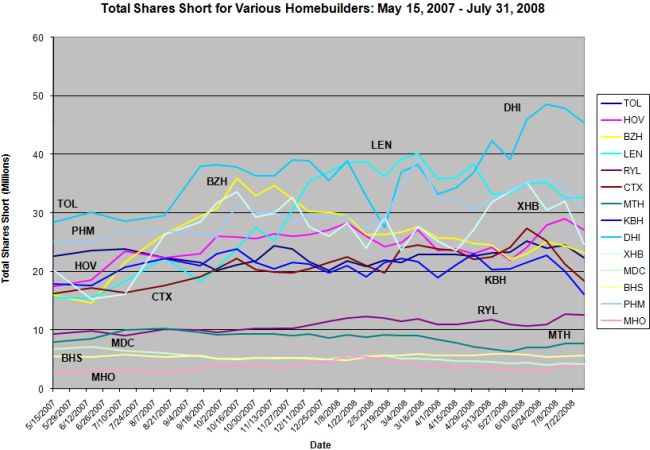

The shorts in homebuilders are now telling us a mixed story. Two months ago, the shorts in homebuilders were relatively steady. Now, we are seeing some more differentiated movement. For example, shorts have declined sharply in Kb Home (KBH) and Centex (CTX) whereas shorts have increased sharply in D.R. Horton (DHI).

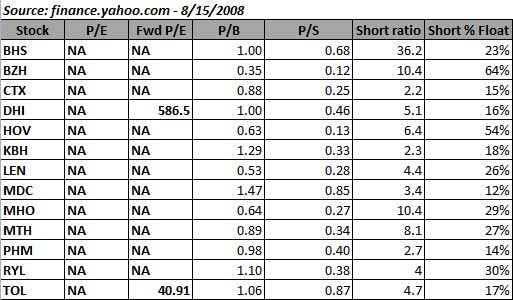

I use the total shares short to get a picture on trends and magnitude. I know some folks like to measure shorts relative to float, but this picture is distorted if a company changes the float through buybacks or stock issuance. These data are mainly useful for determining the potential for a short squeeze or measuring the crowding in a bearish trade. I provide the data below along with some other fundamental metrics.

The first thing that sticks out to me when looking at this chart is that all of these builders have dropped to losses and analysts are expecting more losses 12-months out (the source of the "NA" in trailing and forward P/Es). Also note that despite massive declines in share prices, many of these builders are still trading around book value. The typical time to buy builders has been at these P/B ratios, but as long as book values continue to erode, so will share prices.

Before closing out, there are two other housing-related news pieces I want to point out.

Back on August 6, 2008, Nightly Business Report interviewed Freddie Mac (FRE) CEO Richard Syron. I encourage you to read the transcript for yourself. I found some of Syron's responses a bit scrambled. He danced around the issue of whether Freddie Mac needed to raise more capital by saying that it would wait to do so when the financial markets were better. He also suggested that FRE could issue more preferred shares to avoid diluting the common. The interviewer, Darren Gersh, rightly points out that Congress passed legislation to help Freddie (and Fannie) prop up the mortgage market yet they are in essence retreating from it in order to preserve capital ratios. In watching the interview, I found Syron a bit scattered, but perhaps this is to be expected when you are trying to manage a behemoth of a company through such a tight dilemma. Syron concluded his remarks by stating: "I think [this] is going to be if not the bottom of the trough, approaching the bottom. There are some straws in the wind, preliminary signs that housing is turning around in some parts of the country." Bottom-fishers take heart?

Finally, on August 8, 2008, CNBC interviewed one of Freddie and Fannie's overseers, Steve Preston, U.S. Housing & Urban Development Secretary. This interview came right as Fannie reported its awful earnings. Starting at the 2:40 mark, Preston presents a quite conflicted view about regulation in the housing markets. Preston is asked "...this is a Republican administration - I assume you are a Republican - do you feel strange preaching regulation?" Preston admits that the market did not regulate itself with regards to Fannie and Freddie, but he claims that what is being installed now is just "safety and soundness" regulation. It is not something that "goes dramatically beyond what is in the best interests of everyone." He made the argument that FRE and FNM are so big that you want to have regulation around what they can invest in. Funny...what regulator believes his/her regulations are not in the best interests of everyone involved - net-net? Preston also had no response to Becky Quick noting that 120 regulators were already looking at both companies and yet they still failed. Just more signs and confirmation of the deep dilemmas we face trying to dig ourselves out of this historic economic mess.

Be careful out there!

Full disclosure: No related positions. For other disclaimers click here.