Share Click here to suggest a topic using Skribit. Search past articles here.

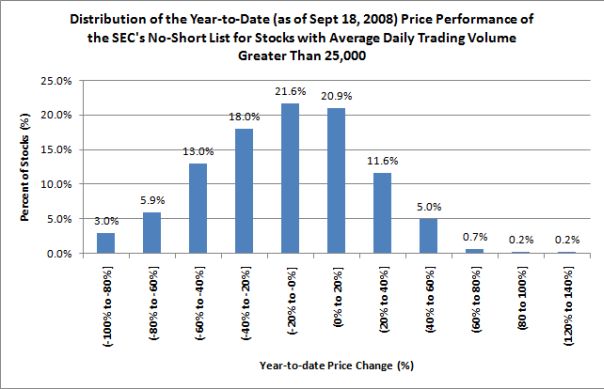

Soon after the SEC released its first list of financial stocks that could not be shorted, I posted a chart showing that 46% of the stocks on that list had positive gains for the year. The ban ended as of 11:59 p.m. ET on Wednesday, October 8, 2008, so now it is time to review what impact the ban had on stock prices.

The SEC instituted the ban to "...restore equilibrium to markets...", to call "...a time-out to aggressive short selling in financial institution stocks, because of the essential link between their stock price and confidence in the institution....", and because "...it appears that unbridled short selling is contributing to the recent, sudden price declines in the securities of financial institutions unrelated to true price valuation." The persistent high volatility in the stock market demonstrates that we did not achieve market equilibrium during the ban. How about stock prices?

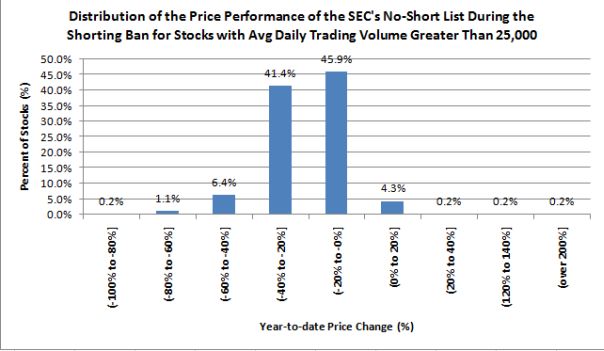

On the first day of the ban, the S&P 500 jumped 4% as buyers rushed in to enjoy the government's protective umbrella and shorts were sent packing. Almost all of those gains were erased the next day, and the S&P 500 continued straight down. By the last day of the ban the S&P 500 was down 18%, and it fell a historic -7.6% the day after the ban expired. So much for protecting prices. Shorts could not suffer the brunt of the blame for that drop since the S&P 500 had already been in freefall during the shorting ban. So what about the performance of the individual stocks on the no-short list?

First, I made a small adjustment to the last analysis and measured year-to-date (YTD) performance of the SEC's no-short list up to the day BEFORE the ban. There is no material change to the distribution of performance, but it makes the rest of my analysis more accurate (note that 4 stocks have dropped from the analysis because they are no longer trading). I did not include any of the stocks that were added to the SEC's list after the initial list was created.

As a reminder, here is a guide for reading this chart:

- x-axis: This is the range of year-to-date price performance. For you math majors, the "(" means exclusive of the range, the "]" means inclusive of the range. For example, (0% to 20%] represents a price range from 0 to 20% excluding 0%.

- y-axis: This represents the percentage of the 440 stocks that each bar in the graph represents. Each bar is labeled with the value from the y-axis. For example, 20.9% of the 440 stocks from the SEC's no-short list have YTD performance of within the range of (0% to 20%].

- The bar: The height of each bar in the graph represents what percentage of stocks fall within the range of price performance shown underneath the bar.

I can also review performance looking at the relative shift in performance ranking. I assigned a rank of #1 to any stock that performed in the best group, the "over 200%" group. I assigned a rank of #16 to the worst performers with drops between -80% and -100%. So each numerical rank represents an ordered range of 20 percentage points. A stock's relative performance improves if its ranking moves closer to 1, and its performance declines the closer it moves to 16. Using this yardstick, I found that 21% of the no-short stocks maintained their ranking and 27% improved their ranking. So, despite the continued drop in prices, we could be generous to the SEC's ban on shorts and say that almost 50% of their protected stocks achieved "stabilization." Then again, 50% did even worse under the SEC's protection even using this metric of relative ranking.

Finally, what happened to the stocks that had positive gains at the time the SEC's short-selling ban went into effect? Only 6 of these 171 stocks managed to stay positive during the ban on short-selling: Citizens (CIA), Corvel) CRVL, Home Federal Bancorp (HOME), Heartland Financial (HTLF), Nymagic (NYM), and United Financial Bancorp (UBNK). CIA had the largest price gain at 1.5%. 37% of the 171 stocks lost -20% or more in price.

Supporters of the government's manipulation of markets will claim that these statistics would have been even worse if it were not for the ban on short-selling. We will never know of course. But looking at the data we can collect, we should conclude that the SEC's ban on short-selling failed to accomplish the mission. Indeed, such is the ultimate fate of most attempts by the government to manipulate and fix prices.

Be careful out there!

Full disclosure: Long S&P 500 in an index mutual fund and SSO. For other disclaimers click here.

Share