Share Click here to suggest a topic using Skribit. Search past articles here.

I would like to say that nothing has fundamentally or materially changed in the solar energy sector since I wrote my first piece on solar-related stocks in June. In that piece, I laid out the case for being short-term bearish on solar stocks even as I looked positively over the longer-term horizon. I wanted to buy solar stocks at cheaper valuations given my concerns about the potential for commodity prices to correct, the pricing premiums that assumed flawless execution, the potential for the credit crisis to impact project financing, and other concerns. The main change in the past several months is that many of the risks in the sector have not only been realized but look more daunting than most people could have expected. Now that almost everything seems to have come apart for solar stocks, it can be too easy to lose sight of the remaining longer-term potential. Some of the currently publicly-traded solar companies will probably not survive the current economic turbulence. I originally maintained my long-term optimism because I figured that even in a recession, countries would look to investments in alternative energy, and solar in particular, as an excellent way to support economic growth, create new jobs, and increase energy security - the U.S. is currently the best example of all of this. But with the concurrent steep deflation in commodity prices, I now expect that many countries will feel pressure to get more selective in their projects. Lower energy prices will afford them the "luxury" of allocating resources to what will seem like more immediate problems threatening economic and social stability. Under these conditions, I have chosen not to get aggressive taking advantage of today's "cheap" prices.

While caution rules, I have used this opportunity to add to two long-term positions, Solarworld (Germany) and 5N Plus (Canada). I have not yet added to my position in TAN (one of the solar ETFs) and will likely wait things out at least another month or two. I will reassess these positions by next Spring. I want to make my first longer-term purchase of Sunpower (SPWRa), but I am waiting for more weakness to get flushed out. Energy Conversion Devices (ENER) is well-below the point where I thought passage of the ITC would provide support, and I now have no plans of making a play there. My short-term positions include net short in FSLR (explained below), short WFR (did not like news of executive departure and think they will experience on-going operational issues), short LDK (anticipating financing problems or need for more capital, but this may not materialize anytime soon), and net long STP (earlier technical strength that I observed has since been violated, now playing a bounce).

October was full of important solar-related news. October should have been a month of celebration with the passage of the U.S. Investment Tax Credit (attached to the mega-bailout bill). Instead, it was a month that continued the steep selling in solar stocks that began in September and coincided with the general panic in global stock markets. Analysts applied even more negative pressure on the sector as they scrambled to adjust expectations downward in the face of worsening economic conditions. Four sets of downgrades stood out the most to me: Goldman Sachs, Thomas Weisel Partners, Friedman Billings, and UBS.

On October 7, 2008, Goldman Sachs downgraded the solar sector. This move seemed to be the most damaging of any of the analyst actions. Goldman made explicit the growing concern that the solar sector could not escape the impact of economic panic: "The risk of oversupply in the solar market will soon become a reality as considerably less generous demand subsidies take hold just as a wave of supply and tight financing hit the market. We believe that liberal subsidies of the past in markets like Germany and Spain are unlikely to be replicated in the future given fears of their ultimate cost in a bad world economy." We have all read press release after press release announcing plans for new capacity, silicon supply agreements, and other related commitments stretching for years into the future. Given the confidence that most solar CEOs have expressed to-date, we can only assume that a lot of optimism resides beneath these plans and commitments. We can even recall all the earnings pre-announcements that guided revenues, earnings, and capacity output expectations upward for much of 2008. As reality descends upon these plans, we should expect to see the news switch to earnings warnings and disappointments going forward.

The week after Goldman's downgrade, Thomas Weisel Partners followed with a similar downgrade: "The credit crisis upon us is leading to waning demand due to limited capital flows to project developers." Friedman Billings warned that "the increased risk to poly suppliers' ability to deliver polysilicon is, in our view, significant" presumably because of problems in financing manufacturing operations.

And then this past week, UBS chimed in with its own dour outlook. The UBS analyst expects "solar demand in 2008 and 2009 to be between 4.4 gigawatts and 5 gigawatts, down from a previous estimate of 5 gigawatts to 7.3 gigawatts...much of the drop is [from] a decrease in demand from Germany." Their "industry research suggests the residential segment in most regions is becoming less elastic in a global recession with difficulty obtaining credit."

I think you get the point. Needless to say, downgrades of several individual stocks accompanied this analyst commentary.

After all this bad news, I am sure many solar enthusiasts looked ahead to First Solar's (FSLR's) earnings with a nervous mixture of dread and fleeting hope. For anyone interested in following the solar industry, I highly recommend listening to FSLR's earnings report (you can also review the transcript on Seeking Alpha). First Solar's management was quite open, direct, and explicit in their assessment of industry conditions, including their views on the impact of the on-going credit crunch. I suppose First Solar can afford such frank talk given their leadership position in the industry and given a financial position that is probably the strongest in the industry.

The biggest downer from this report was FSLR's observation that "...solar projects lending outside of Germany has essentially stopped for the time being" (although it made me a bit more confident in my Solarworld holding). FSLR proceeded to reassure analysts that FSLR is well-positioned to cope with these weak conditions: "However, we believe most of our IPP customers have adequate funding to bridge lending delays into 2009 and we assume that neither these delays nor higher debt costs will impair project economics for our customers at First Solar's current module prices." In other words, this financing drought is much more likely to hurt FSLR's competitors. Moreover, FSLR has the financial muscle to support their customers until conditions improve: "...because of the uncertainty over how the capital costs and availability will evolve in 2009, we also believe it's sensible to model the contingency scenario in which First Solar provides financial support to enable higher project returns if needed to support the market." How many solar companies could make such a bold claim? FSLR further reassured analysts that they can navigate around risks to European demand: "Today, we have identified potential financial risk in our customer base that represent approximately 15% to 20% of our planned sales in to Europe in 2009 and we have identified the demand to reallocate such volumes."

Market players were spooked enough at first to send FSLR's stock price as low as $106 in after-hours trading. The stock bounced almost $30 back up and tacked on another $10 in regular trading the following day. For the time being, the market seems willing to bet that not only will FSLR be a survivor but also that FSLR will manage to remain stable through the global economic downturn. The market was likely reassured by FSLR's sober assessments, pragmatic plan of attack, and apparently confident understanding of market dynamics. I am willing to believe it too, but I am not willing to pay up for it. FSLR's valuation is much cheaper these days, but it is still not cheap enough considering the economic risks that likely lay ahead of us. FSLR has a forward P/E of 21, which is "OK" given a PEG ratio 0.7, but not great. FSLR still has a very high price-to-book (P/B) ratio of 8.4 and even higher price-to-sales (P/S) ratio of 11.5 (stats from Yahoo!Finance). First Solar has $582M of cash on the balance sheet with only $167M in debt, but that cash will be in peril if FSLR is forced into the financing game in a significant way. I would consider going long FSLR after a retest of the 52-week lows of $95, but I would be much more comfortable dipping in around $85.

One last little tidbit that was lost after the FSLR earnings news is that FSLR's executive vice president resigned at the end of October. The Arizona Republic says that Mr. Schultz "ranked No. 3 in [Arizona] among top paid executives. ...with a $40.7 million a year job." No explanation has been given for the resignation, but perhaps it has less meaning coming after the earnings report. Time will tell... (You certainly cannot blame a guy for cashing in his chips at this point after amassing such impressive wealth off solar panels).

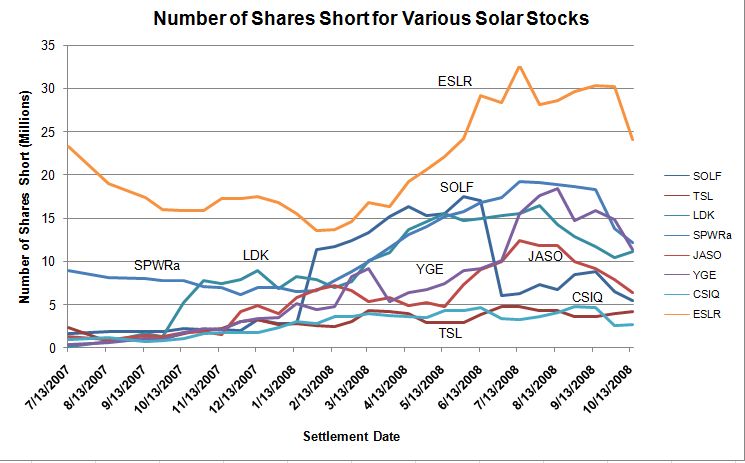

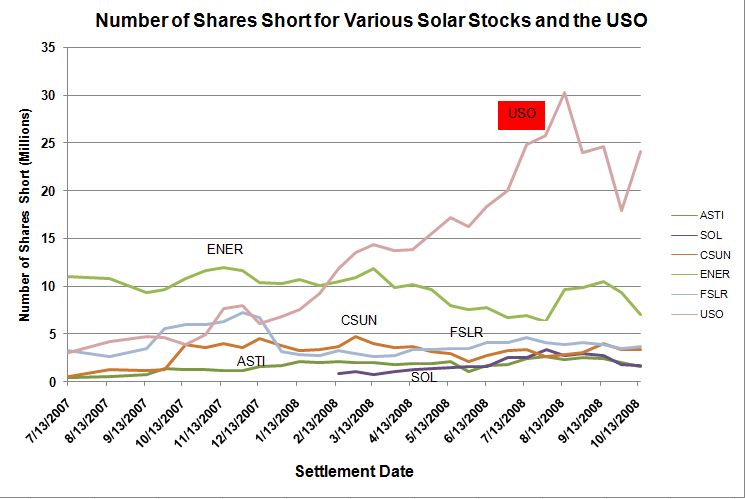

Finally, I decided to take a look at what the shorts think of the sector these days. In terms of the absolute number of shares short, it looks like shorts have generally used the last two months of selling as an opportunity to reduce positions, and presumably nab profits. The only solar stocks in my list to experience an INCREASE in shorts from August 29 to October 15 are TSL (+14%), CSUN (+7%), and STP (+8%). It is hard to come up with a general conclusion since the overall shares short are still high relative to the first half of the year. But perhaps we can tentatively conclude that the risk of further downside is beginning to soften. Since shorts in the oil ETF peaked in mid-August even though oil has continued to slide (losing around 40% more since then), I cannot over-interpret what the shorts are doing here. We are also still in a period in which the government may arbitrarily change the rules of the game (a la banning short sales), so shorts may be less willing to hold onto positions here.

Be careful out there!

Full disclosure: (Net) short FSLR, WFR, LDK; (Net) long STP, long Solarworld, long 5N Plus. For other disclaimers click here.

Share