Share Click here to suggest a topic using Skribit. Search past articles here.

By my count, the stock market has now tried to bottom four times since the bear market took its most vicious turn after Labor Day weekend. I did not even have time to think about fishing for the bottom on the first two attempts. The third attempt was pretty convincing: it featured a violation of the 52-week lows and a sharp, high-volume snapback. Unfortunately, it also formed part of the dreaded triple bottom, and it quickly gave way to reactionary selling. This last attempt at a bottom is the most convincing of all four. The market has actually managed to string together two large up days in a row. I am now finally looking for a good bottom-fishing story. To get a lasting bear market rally, the market needs a good story, a catchy narrative. Nassim Taleb criticizes market participants as "...suckers for stories" who fall for the fallacy of narratives. However, these narratives can serve a purpose besides entertaining those of us who dare to write about the financial markets. If these narratives are convincing enough, if they are sticky, if they have staying power, then they can motivate action. For two months we have lived with the depression (Armageddon?) narrative that has helped drive massive liquidations. We finally have a story in President-elect Barack Obama that could provide some relief. A disciplined, pragmatic, and committed Obama is building an economic team and administration that is winning over skepticism and fear and introducing a tentative hope. We finally have a credible bottom-fishing story.

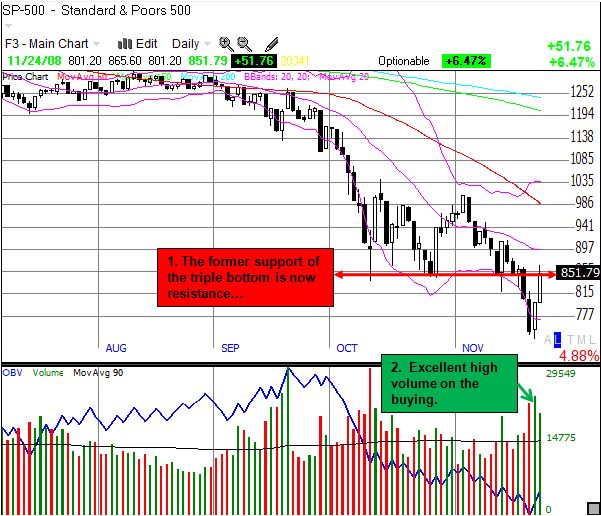

As with any bear market, plenty of overhead resistance lies in wait to give sellers fresh excuses to sell the rally. For example, the S&P 500 has rallied smack back to the former support of the triple bottom (amazing how this works sometimes):

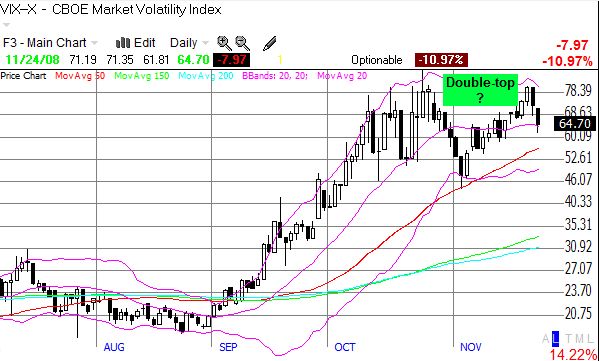

I like the way the VIX appears to have punched in a double-top. The current insanity of up and down days match what used to be considered a week's worth of performance. This churn has to end for the market to be taken seriously (I like how Dylan Ratigan from Fast Money called the market a "carnival"). If the VIX can break through 45, the last low, we could see 30 pretty quickly and perhaps then we get more "normal" trading.

But most interesting to me is that T2108, the percentage of stocks that are trading under their 40-day moving averages, has almost reached another milestone. T2108 has now traded at 20% and under for 41 days through November 24th. During the crash of 1987, the market traded under 20% on the T2108 for 42 days. 20% is considered a threshold for oversold levels. Assuming we do not get an up day of 15% or 20% on Tuesday, we will add yet another superlative to this bear market (my data only goes back to 1986). The stock market has achieved another historic level of oversold conditions. I like fishing for bottoms with these numbers. (Click here for a counter-point suggesting a Dow target of 6600-6700).

So what gives me pause? Certainly, the on-going onslaught of horrible economic numbers prevents me from getting exuberant. Some giveback is very likely after two strong days right into the technical resistance described above. But I also took pause to see the (in)famous Jim Cramer switch from screaming about a looming depression to suggesting "...with the good news starting to trickle in, it'd be irresponsible to become a permanent bear." For some reason, I would prefer for him to remain negative and without hope while the rest of us expand our scope of opportunity. But alas, Cramer's latest segment, "A Ray of Hope," hinges on the same Obama narrative that I think will provide some stickiness to the latest attempt to get a bear market rally going. Cramer thinks that Obama's recent actions have removed uncertainty and instilled some much-needed confidence. While I do not buy the tired cliché that the markets hate uncertainty - if the world was certain, we would all be billionaires - I have to agree with Cramer that this story is worth fishing (I consider Cramer the king of stock market narratives). I will again say that I am playing commodities, infrastructure, and technology in anticipation of stimulus largesse and the inflation that will follow the deflation.

Be careful out there! (And note that I am NOT calling THE bottom. I know I will never be able to do such a thing, and I never believe anyone else who lays claim to such magical powers. We only know the final bottom by looking in the rear-view mirror).

Full disclosure: long S&P 500 in an index mutual fund. For other disclaimers click here.

Share