What Do Speculators Know from High Options Volume? (Part Two)

By Dr. Duru written for One-Twenty

March 24, 2009

Two weeks ago I used data on options expiring on February 20, 2009 to conclude that high volume in options trading provides a weak signal for speculating on the future price direction of the underlying stock.

Specifically, my analysis of options expiring February 20, 2009 produced two main observations:

- The overall (downward) trend in the market dominates stocks' price performance regardless of the options trading. For example, stocks perform nearly the same (mostly negative) between the date of the high options volume and options expiration whether the high options trading volume is only in calls or only in puts. Also, the maximum price gain in a stock improves slightly if just puts are traded in high-volume instead of just calls.

- When both puts and calls are traded in high-volume on the same underlying stock, the stock's price performance is at least equal to the cases where only calls or only puts are traded in high-volume.

As a follow-up, I ran the same analysis using options expiring March 20, 2009. This next analysis produced similar observations as the last one. The environment for trading was slightly less bearish than the seven weeks used in the first analysis. In the first analysis, the market trended downward almost the entire time. For this second analysis, the market trended down sharply for almost 5 weeks straight before bouncing sharply for the last two weeks. This sharp rally is likely responsible for the resulting stock price action being less bearish than the first analysis. Here are the main observations from this second analysis:

- As I found in the first analysis, stocks in aggregate perform nearly the same between the date of the high options volume and options expiration whether the high options trading volume is only in calls or only in puts. The small performance gaps that exist were even smaller this time. The strong rally in the last two weeks of this data sample significantly increased the percentage of stocks with maximum gains over 10%, and it notably decreased the percentage of stocks with losses of at least 10%.

- As I found in the first analysis, when both puts and calls are traded in high-volume on the same underlying stock, the stock's price performance is at least equal to the cases where only calls or only puts are traded in high-volume. However, this second analysis seems to provide even stronger evidence that this kind of trading is the most reliable signal for generating high returns.

I made one small change in the methodology by eliminating the last two days of trading before expiration. I assume that speculators are not generally looking for stock moves greater than 10% in that time period. There were also large numbers of transactions in XLE (an energy-related ETF) across a wide array of strikes on March 19th. (See the last analysis for a full set of assumptions and a description of the data and methodology). Also note well that the trading period of the first analysis overlaps the second analysis by three weeks. It is certainly possible that traders purchasing March options in that period recognized their "maximum" gains before the February expiration, but it should be immaterial for this analysis. Despite this overlap, this second analysis includes far fewer total observations - 413 vs 542. Incidentally, I noticed a SURGE in observations for April options in the final week of this study period; so, it is certainly possible traders abandoned March options earlier and faster than they did February options.

The last time around, I neglected to list one more limitation of this analysis. I did not track what percentage of the volume traded in an option becomes open interest the following day or remains open interest before/after the minimum/maximum stock gains. For the purposes of this study, I would prefer to focus on trading that "sticks" as this should more accurately represent trading in anticipation of future stock-specific news. For example, I find it difficult to explain trading in deep-in-the-money options that does not show up the next day as an increase in open interest. (Perhaps it represents the activity of daytraders who are looking to play stocks short when shares are not otherwise available to short or daytraders looking to increase the potential of their margin limits. I am not trying to measure the alacrity of such trading).

Finally, a commenter from the first analysis pointed me to two earlier academic studies on this topic. In both cases, the researchers use much larger and richer data samples and much more refined mathematical techniques designed to tease out more subtle, sophisticated causal relationships. Both papers conclude that options trading volume contains tradable information. As a point of comparison, note that I am claiming that once you identify the abnormally high options volume, you are better off trading along with the prevailing market trend unless you can supplement your execution with additional information. For those of you so inclined to review these kinds of studies see the following (links are to free downloads of the articles):

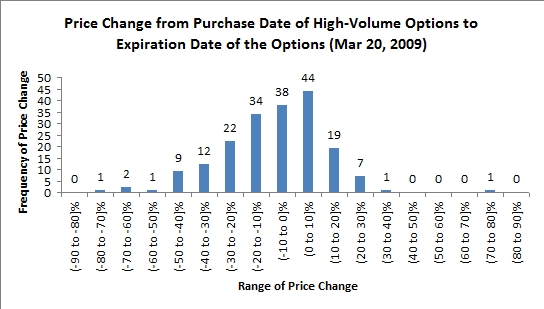

Here are my results for the second analysis in graphical detail. Again, see the first analysis for complete background and descriptions of the set-up.

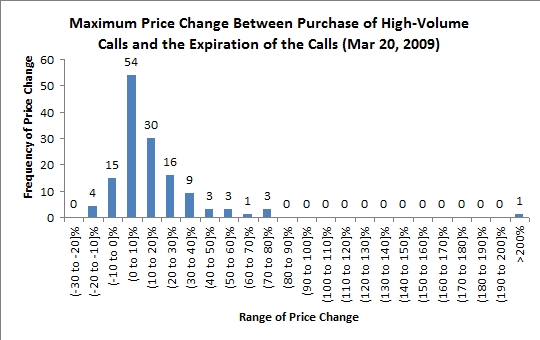

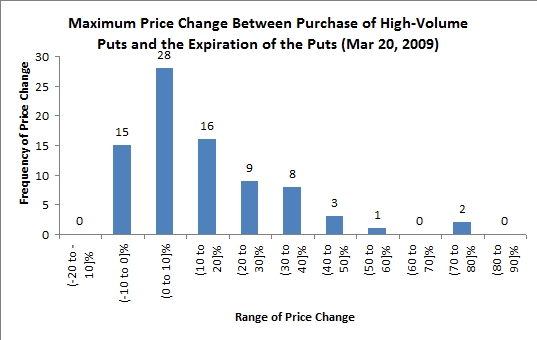

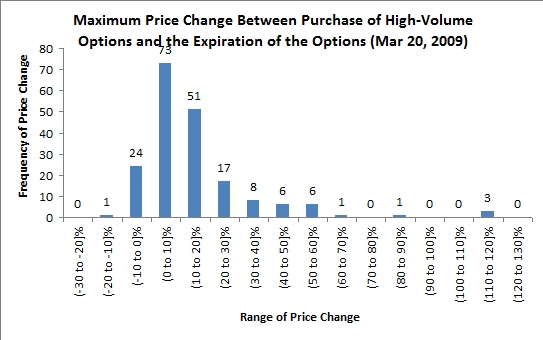

Price change from the day of high-volume options activity to the day of maximum stock price before option expiration

48% of the time (66 out of 139 observations), buying stock after observing high-volume trading in calls generated a maximum return over 10% before options expiration (these are all the bars from left to right starting with the one with a frequency of 30")...

However, 48% of the time (39 out of 82 observations), buying stock after observing high-volume trading in PUTS generated a maximum return over 10% before options expiration! The distribution of price changes is nearly identical to the call buying above after excluding the performance outlier above 200%.

Moreover, 49% of the time (93 out of 191 observations), buying stock after observing high-volume trading in puts AND calls generated a maximum return over 10% before options expiration. Again, the distribution is nearly identical the two histograms above. Overall, for maximum return, it only matters that a trader observes high volume in the options trading.

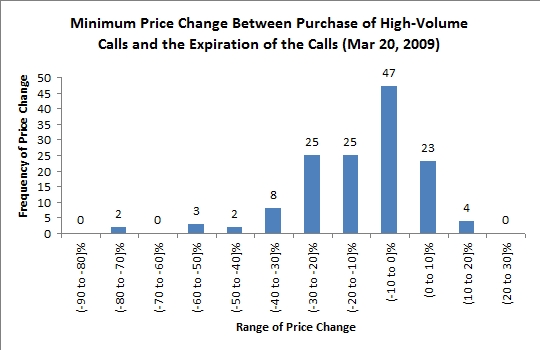

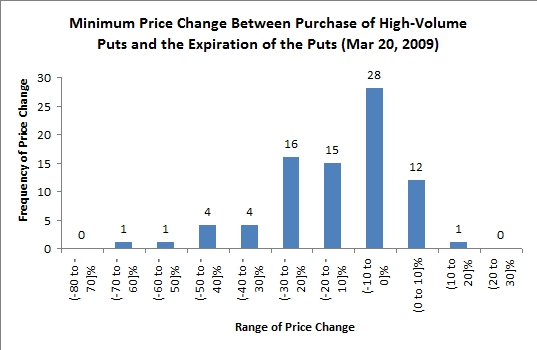

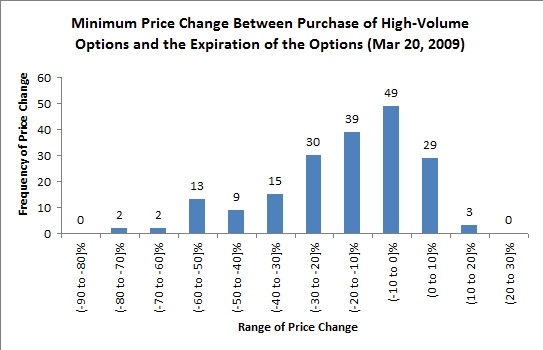

Price change from the day of high-volume options activity to minimum stock price before option expiration

47% of the time, buying stock after observing high-volume trading in CALLS generated a minimum return (maximum loss) of at least -10%.

41% of the time, shorting stock after observing high-volume trading in puts generated a maximum gain (listed below as minimum return) of at least 10%.

58% of the time, buying stock after observing high-volume trading in calls and puts generated a minimum return (maximum loss) of at least 10%. For minimum return (maximum return from going short), it again only matters that options trade in high volume and not whether they are calls and/or puts. However, if BOTH trade in high volume, the downward pressure on price increases.

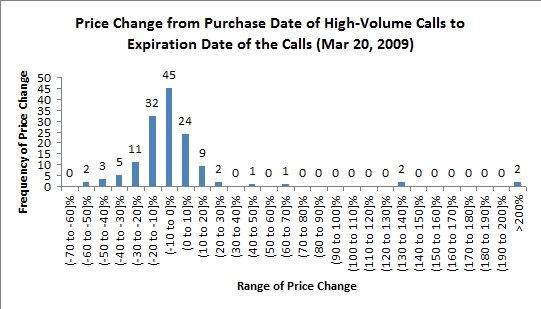

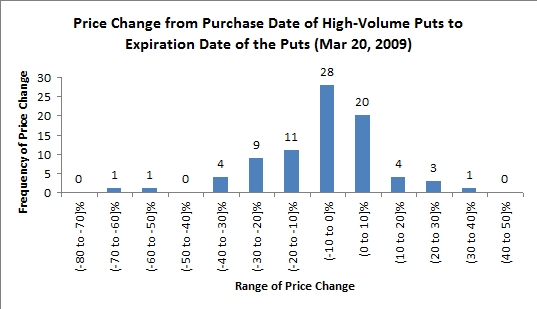

Price change from the day of high-volume options activity to option expiration

38% of the time, buying stock after observing high-volume trading in calls generated a minimum return (maximum loss) of at least -10% at options expiration. 12% of the time buying stock after observing high-volume trading in calls generated a maximum return over 10% at options expiration.

32% of the time, shorting stock after observing high-volume trading in puts generated a maximum gain (listed below as minimum return) of at least 10% at options expiration. 10% of the time, BUYING stock after observing high-volume trading in puts generated a maximum gain of at least 10% at options expiration.

42% of the time, buying stock after observing high-volume trading in calls and puts generated a minimum return (maximum loss) of at least 10% at options expiration. 15% of the time buying stock after observing high-volume trading in calls and puts generated a maximum return over 10% at options expiration.

Overall, I am satisfied that I am finding a sufficiently consistent pattern. I will continue to collect data as best as I can. The next update is not likely until we get a sustained up-trend in the market...and I don't see anything like that happening for quite some time to come. (Click here for a technical analysis on whether the current run is just another bear market rally or a serious reversal)

Be careful out there!

Full disclosure: No positions. For other disclaimers click here.