Gold and the S&P 500 have traded inversely to each other during this historic (bear) market rally. As of Friday, the two are now essentially flat for 2009.

On March 18, the Fed sent the dollar plunging upon confirming it was ready to print whatever it takes to fight deflation. The plunge lasted just one more day. As of Friday the dollar appeared again ready to resume its climb against the basket of currencies that are still debasing faster than the U.S. dollar can. (The dollar has already regained all its losses against the Euro, the Yen, and the Swiss Franc).

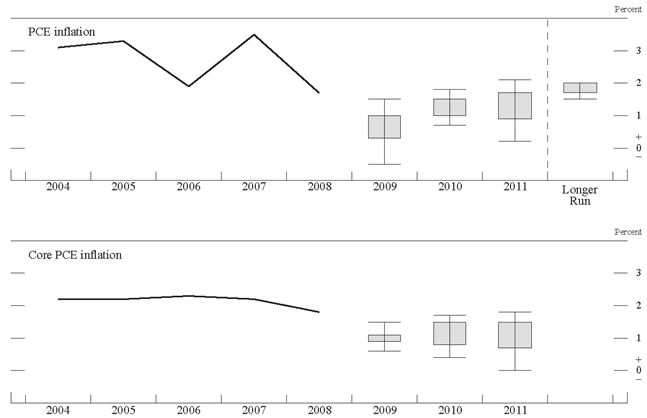

These converging dynamics got me rethinking about inflation expectations. Just as the recent fresh 6-month high in the TIPS suggested an end to our first deflation panic, a rising dollar, a "mild" correction in gold, and a rising S&P 500 all confirm a growing consensus that deflation is not in our near future and any future inflation will be mild at its worst. Indeed, the Federal Reserve's inflation forecast from January showed no deflation and long-term (PCE) inflation around the familiar 2% rate (see charts below). This forecast has since been revised downward slightly.

I recognize that these forecasts are designed to keep inflation expectations well-anchored, aka under control:

"We are...conscious of a potential adverse feedback loop between persistent economic weakness and a continuing decline in inflation and inflation expectations...Then again, the substantial increase in the size of the Federal Reserve's balance sheet as a result of the credit programs that have been implemented have led some to worry that inflation could rise sharply when the economy recovers unless the Federal Reserve moves quickly when the time comes to unwind the programs and limit the growth in credit. Because inflation expectations play a key role in the setting of prices and wages, firmly anchored inflation expectations can help avoid both of these outcomes. To help anchor inflation expectations, the FOMC is now providing extended projections of inflation--along with growth and unemployment--in its quarterly economic projections."

Quote from Federal Reserve Vice Chairman Donald L. Kohn At the Forum on Great Decisions in the Economic Crisis, College of Wooster, Wooster, Ohio (April 3, 2009): "Policies to Bring Us Out of the Financial Crisis and Recession"

Regardless, these forecasts serve as guideposts to what the market likely accepts about future inflation. For now, no deflation, no rampant inflation. But as with any aggregate measure, some important details can become obscured. We are all painfully aware of the on-going asset deflation in real estate and the credit destruction that both continue to buffet the economy. At the same time, many Americans are getting squeezed by important sources of inflation in parts of the household budget - some of which could be considered non-discretionary. For example, health insurance premiums seem to be soaring. From Hawaii to Seattle to Boston, health insurance premiums are on the rise, sometimes quite sharply:

- "More bad news: Many health insurance rates going up this year" - Seattlepi.com, March 24, 2009: rate increases reported from 6 to 18%. Interestingly enough, health insurers are trying to fill gaps left by massive losses in the stock market.

- "HMSA plans to raise rates 12.7% for Hawaii small businesses: Insurer's plan would be largest premium hike for small businesses in 20 years" - honoluluadvertiser.com, April 9, 2009.

- "Premium increases keep coming" - boston.com, April 17, 2009 - author reports that his organization received a renewal notice with a 23% increase in premium on top of several years of double-digit increases.

Finally, anecdotally, my PREVIOUS car insurance company (not-to-be named) increased my auto rates by over 15% citing an increase in costs. Fortunately, I was able to find a more reasonable alternative. A friend of mine also switched home insurers after his previous insurer increased rates by a large amount. I highly suspect that in due time, all competitors will follow along in these price hikes.

Of course, these are just examples. They are all obscured by aggregate inflation measures. But they serve as reminders that deflation/inflation is not felt equally across large swaths of the population.

On the commodities side, the CRB index has flattened out in 2009 between 200 and 250. However, copper has been on a tear, bouncing over 50% from its lows. It seems that China has been stocking up on copper. I continue to read various reports claiming that China is using its tremendous currency reserves to diversify away from U.S. Treasuries and into hard assets. If China is indeed stockpiling copper to satisfy many years of future industrial production, we should be prepared for a second collapse in copper prices once China is finished - assuming that the rest of the planet's demand will not and cannot pick up the resulting slack. This would be reminiscent of the voracious demand that led up to last year's Beijing's Olympics. The end of this historic event reportedly contributed to a steep drop in commodity demand and prices last Fall. To this end, I will be selling the rest of my holdings in Freeport McMoran (FCX). After selling a trading position two weeks ago, I had planned to keep a core position in FCX. Under the circumstances, it makes sense to me to take the remaining profits and stand aside for now.

This leaves me with inflation expectations somewhere higher than consensus and a slightly more concentrated bet on future long-term inflation: TIPS, gold, silver, and oil (looking to swap out of USO and into a better proxy for oil). I will continue to look for opportunities to buy inflation protection on the cheap. Eventually, I will add to this cocktail some puts on the TLT (iShares Barclays 20+ Year TReasury Bond Fund) and/or shares of TBT (inverse to the TLT). I am just looking for the next deflation scare or something with equivalent impact. I continue to be amazed at the world's willingness to continue to lend the U.S. so many trillions at such cheap rates...

Be careful out there!

Full disclosure: long SDS, TIPS, GLD, SLV, and USO. Long SSO calls. For other disclaimers click here.