The Percentage of Stocks Trading Above Their 200DMAs Nears A Recovery

By Dr. Duru written for One-Twenty

April 26, 2009

The stock market has spent the entire month of April in an historic overbought condition. For 17 days now, the percentage of stocks trading above their respective 40-day moving averages (DMA) has exceeded the 70% level that can define an overbought market. This string of trading days places the stock market in the 90th percentile of all overbought conditions since 1986. The market is well past the average of 9 days and the median of 5 days. Every correction this month has been met by eager and happy buyers, relieved to get even a small opportunity at cheaper prices.

These fresh bids supporting the market have sent many stocks hurdling ever upward, many to the point that they have recovered much of their losses from last Fall's swoon. In particular, consumer discretionary is full of examples of retailers and casual dining establishments that are right back to their September or early October prices. XRT, the SPDR S&P Retail ETF, summarizes this remarkable milestone. The graph below shows that the XRT is back to the low from July, 2008, essentially signifying an entire rollback of last Fall's swoon in retail.

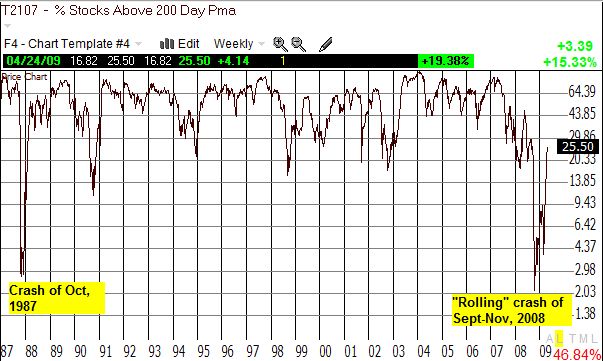

Seeing all this notable action compelled me to check in on Worden's T2107, the percentage of stocks trading above their 200DMAs...a very bullish threshold. I used T2107 in May, 2006 to suggest that the bull market was tiring. I used it again in Nov, 2007 to suggest that a large correction was finally underway. Fast forward back to today's bear market and, incredibly, this indicator is now in recovery mode. The daily line chart below shows that at 25.5%, T2107 is back where it was just as last Fall's massive sell-off began.

Bulls will also duly note that T2107 did not make a fresh low at March's fresh 52-week low for the S&P 500; although at such low levels this kind of bullish divergence likely means little. The longer-term view on T2107 demonstrates the severity of last Fall's sell-off: T2107 fell as low as 2%, just below the low of 3% set during the crash of 1987. This view also shows that T2107 tends to bounce between 30% and 80% with infrequent (and swift) trips outside of these levels. T2107 has almost regained its typical trading range.

Am I ready to suggest that the new bull is around the corner? Not now. The bearish calls from 2006 and 2007 using T2107 demonstrated how slowly the market can "react" to its signals - not surprising given the long-term structure of the 200DMA. I do remain a "little less bearish" in the face of these impressive trading conditions, but I am still looking for a true correction and even re-test of the 52-week lows once the economic data finally fail to support the soaring expectations for a healthy second-half recovery. This may also be around the time when companies run out of options for aggressive cost-cutting which does not cripple revenue-generating capabilities. I also still expect that any recovery beginning in 2010 will be much weaker than currently expected. Perhaps the related correction in the stock market happens as late as this Fall. In the meantime, caution is the rule. As the S&P 500 continues to toy with the 875 resistance level, I would not be at all surprised to see at least one false breakout to 900 or so and several "false" breakdowns that complete a circle of frustration for bears and bulls. Both T2108 and T2107 will remind us that a good number of stocks stand strong throughout such a (potential) period of churn.

Be careful out there!

Full disclosure: Long SDS and long SSO calls. For other disclaimers click here.