Initial Unemployment Claims Provide Poor Trading Signals

By Dr. Duru written for One-Twenty

May 19, 2009

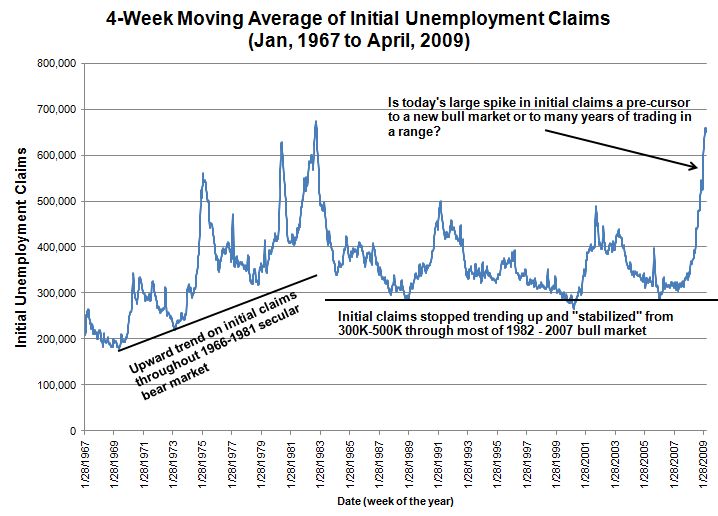

Donald Luskin, chief investment officer of Trend Macrolytics, recently penned a piece in Smart Money with the encouraging title "Acclaimed Economist Says Recession Is Over." Apparently, economist Robert J. Gordon, Ph.D. - one of the seven members of the Business Cycle Dating Committee of the National Bureau of Economic Analysis - has reduced the science of dating recessions to the single variable of initial unemployment claims. Luskin provides a chart from 1967-2009 that clearly shows that the peak of initial claims (4-week moving average) during a down business cycle has coincided with the last 5 recessions before the current one (the indicator made a "double-top" during the 1969-1970 recession). Since employment is one of the factors used to define a recession, this correlation should not surprise us too much. I am more surprised that economists are only now figuring out how to reduce the mystical science of recession-dating to this one variable.

Luskin goes on to conclude that "...because claims data is available nearly immediately, investors can use Gordonís insight to make actual trading decisions." Unfortunately, we are not provided any data or additional guidance. First, there is always the problem of deciding that initial unemployment claims have truly peaked. Luskin tells us that Gordon decided that initial claims for this recession are peaking in a manner similar to previous peaks: "...the pattern of the decline in magnitude and timing nearly perfectly matched all the previous instances, in which no subsequent higher peak developed." OK - for the sake of my argument, I will assume this pattern-matching will work for a sixth time in a row. However, when I juxtapose initial claims data with the S&P 500, I do not observe a clear investing or trading signal.

The S&P 500 essentially went nowhere from 1966-1981. This time period includes three recessions and ends with the beginning of a fourth. So, the initial claims signal added little new information for the long-term investor during this time. The graph below demonstrates the problem. Note how initial claims trended upward during the 1966-1981 secular bear market (a period of negative returns when adjusted for inflation). This trend is one of many signs of the economic stagnation during that time - not a good time for stocks in general. In fact, I am more intrigued by the possibility that the longer-term trends in initial claims tell us something about the fundamental health of the economy and less intrigued about using this to time the stock market. Once the economy recovered from the 1981-1982 recession, initial claims "stabilized" into a range of 300K-500K that lasted until the current recession. The two recessions prior to the current recession were milder than earlier recessions and further apart in time. Perhaps the lack of an upward trend in initial claims tells us to expect any concurrent recessions to be relatively mild (just a thought right now). This stability is even more remarkable given the steady rise in the population and the workforce. The steep ramp in initial claims of the current recession leave me wondering whether we are on the cusp of another extended period of economic stagnation and malaise and instead of eagerly anticipating the imminent start of a fresh, new period of economic boom and prosperity.

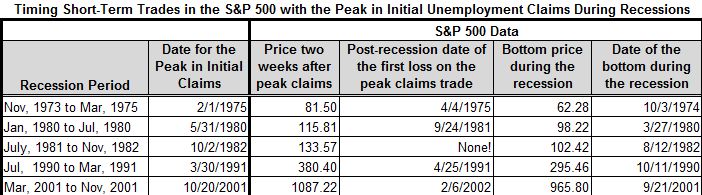

So, out of five recessions, the initial unemployment claims data appear to provide two clear long-term buying opportunities on the S&P 500. The short-term trader may have fared better, assuming the trader knew when to sell. The table below shows that the peak in initial claims provided a low point for trading for some period of time, but it typically missed the absolute bottom by at least 10%. For simplicity, I assume that the intrepid trader needed just two weeks to decide that initial claims have peaked (similar to Gordon's alacrity) and held the position at least until the official end of the recession. Since I am measuring short-term trading, I include a column indicating when the trader first suffers a loss, but I was not able create any sufficiently interesting or relevant rules for selling. In most cases, the short-term trader gets ample time to recognize some profit.

Overall, I would only use a presumed peak in the initial claims data as one very small element in an overall investing or trading approach. It fails to provide a reliable long-term signal, and it cannot generate consistent rules for the short-term trader. The initial claims data do make sense for timing recessions that are partially defined by levels of unemployment. We know that initial claims MUST peak at some point because the labor force has a finite size: at some point, companies run out of workers to fire. This finality also suggests that continuing claims and the unemployment rate will always provide more accurate measures of the on-going misery that the workforce experiences, no matter when the recession is declared over or how much profit stock market investors and traders make anticipating the end of this suffering.

Finally, I will reiterate that there is misplaced mysticism attached to the stock market's ability to bottom ahead of the worst of an economic calamity. Because business cycles always last an uncertain amount of time, the stock market can only make (multiple) guesses. Each new bottom brings fresh announcements that the end is at hand. Eventually, the last bottom (or the retest of the last bottom) becomes the right one...

Be careful out there!

Full disclosure: long SDS. For other disclaimers click here.