Search past articles here.

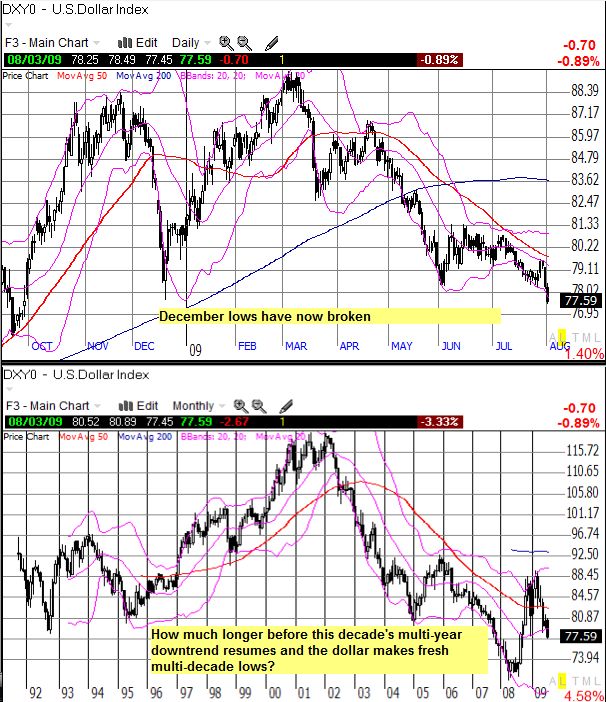

The dollar's steady descent continued with Monday's long anticipated break of the December lows (see chart below). While I fully expected the dollar to reach this point, I thought a stronger relief rally would ensue before we got here. The dollar's "fate" seemed sealed after the Canadian authorities signaled resigned acceptance of their currency's strength against the US dollar. As the dollar continues to roll back the gains from its earlier status as a safe haven currency, I am still left wondering at what point will America's trading partners begin to voice concerns about how dollar weakness will hurt their own exports. Americans are already saving a lot more, and the propensity to save should get stronger as imports continue to get more expensive (this relationship of course was VERY broken during our credit bubble as rapidly expanding debt became a very convenient way to finance increasing net consumption of imports). Then again, economic recovery seems to be all about China and any company fortunate enough to be doing business there, so it is possible that finance ministers outside of China and Russia are not going to worry as much as they otherwise might have done.

From a technical standpoint, a strong US dollar relief rally in the coming week or so still seems likely given the synchronous multi-month highs being made by so many currencies against the dollar (for example, the Euro, Pound, Australian Dollar, and Canadian Dollar). These moves have likely created very crowded dollar shorts.

Finally, I had expected that a break of the December lows would deliver gold above $1000/ounce and silver at fresh 52-week highs. Instead, both metals remain below their highs for the year even as other commodities and materials such as copper and steel continue to soar ever higher (despite growing questions as to whether China's stocking of commodities can or will continue much longer). I suspect that the loss of the fear component of the gold and silver trade is suppressing prices a bit, but as the dollar continues to weaken, these two metals should shine even brighter.

Be careful out there!

Full disclosure: long GLD, SLV, GG. For other disclaimers click here.