Nothing works better to reveal the eagerness of sellers than a news story that incites wholesale panic. As you faithful readers know, I have spent much of this year looking for the opportunity in the ugly headlines and finding the gems in the tar pits. Today's despair occurred in certain silver stocks.

The President of Bolivia declared that he will nationalize the country's natural gas fields. While I read the WSJ article covering the "shocking" story, wondering what the fall-out would be, it never occurred to me to extrapolate this news to cover all of Bolivia's natural resources (according to the WSJ, the President later declared that this move is "only the beginning"). But that is why we have a market. Lots of folks who were looking for a reason to sell, started dumping the stocks of potentially effected companies. The silver miners with Bolivian properties took particularly severe beatings: Apex Silver Mines (SIL), Pan American Silver (PAAS), and Coeur d'Alene Mines (CDE). Mind you - the President never said he intended to snatch those mines as well, and the oil and gas companies effected by the nationalization have threatened to sue to regain their propery rights. The biggest economic impact of this move will be on Brazil and its national energy company Petrobras (PBR). Neither the Brazilian ETF, EWZ, nor PBR sustained losses on the day. Natural gas tends to be regional in nature because of the expense and difficulty of transporting it. Bolivia happens to border Brazil, and the country supplies about 50% of Brazil's natural gas using 47% of its exports. So, you would think the panic would also slam related Brazilian stocks. The fact that it did not would have been our first clue that the despair in silver could be overdone. Anyway the sellers decided not to wait for an invitation to sell silver. Later in the day, it seems the Bolivian government clarified itsposition by claiming that it does not intend to nationalize the silver mines, but the owners should expect to pay higher taxes to the people of Bolivia. This may have had somewhat of a calming effect as all three stocks rallied sharply into the close.

So, where is the opportunity here? Well, the biggest reason to consider entering the fray is that nothing has actually happened yet. So, if you are a silver bull, the market today gave you some potentially ripe entry points or opportunities to add to existing positions. The second reason there may be opportunity here is that the nationalization of the mines might actually increase prices for silver if these mines are subsequently mismanaged or taxed into idleness. Word has it that the Bolivians may not yet be ready to operate the facilities they want to repatriate. Also, if this is the case, the Bolivians may yet negotiate an arrangement that keeps reluctant companies operating in Bolivia. Regardless, there can be no doubt that the situation looks dicey, the risks high, and uncertainty abounds. So, you must do your own homework. I know much more about PAAS than any of the other silver plays, and I am not budging. I even took the opportunity to add to an existing position (Click here to see my disclaimer). {Note also that earnings for PAAS are coming up on May 3rd!}

Let's take a closer look at the technical damage that was done to these silver stocks.

Pan American Silver is the "gold standard" of silver stocks. My favorite perma-bear Bill Fleckenstein is a director, so I trust that the company is in very capable hands. Recently, PAAS has experienced some strong swings. The past nine trading days have included three days of very high-volume selling. Earnings are coming up May 3rd, so this could be one to watch closely for fireworks. Have the weak hands been relieved of their PAAS holdings, or did they get out just in time...? I am currently thinking the former...

Coeur d'Alene Mines (CDE) calls itself "the world's largest publicly traded primary silver producer." That alone gets a gold star in my book. CDE went so far as to issue a press release clarifying the ownership of its silver interests in Bolivia. I reproduce the bulk of the statement below. Essentially, CDE tells us that it leases its silver mines from the Bolivian government and that the company is already covered with risk insurance against just the kind of political uncertainty it may now face. CDE also has interests in "Alaska, Argentina, Australia, Bolivia, Chile, Nevada, and Idaho."

"The Bolivian national mining company, Corporacion Minera Bolivia ("Comibol"), is the underlying owner of all of the mining rights relating to the San Bartolome project (with the exception of the Thuru property, which is owned by the Cooperativa Reserva Fiscal, a local miners cooperative). In essence, Comibol already owns virtually all of the mining rights for the associated land package at Coeur's San Bartolome project.

Comibol's ownership derives from the Supreme Decree 3196 in October 1952, when the government nationalized most of the mines in Potosi, except for Thuru. Except for Thuru, Comibol has leased the mining rights for the surface sucu or pallaco gravel deposits to several Potosi cooperatives. The cooperatives in turn have subleased their mining rights to Coeur's subsidiary Manquiri through a series of "joint venture" contracts. In addition to those agreements with the cooperatives, Coeur, through its subsidiary Manquiri, holds additional mining rights under lease agreements. All of Manquiri's mining and surface rights collectively constitute the San Bartolome project.

As previously announced, Coeur has been proceeding with its capital investment in the project at a measured pace as it gains additional clarity concerning the political situation in Bolivia. The company currently expects to resume full-scale construction activities at July 1, 2006.

At December 31, 2005, the company had approximately $35 million invested in the San Bartolome project. Such amount is insured by a risk insurance policy from the Overseas Private Investment Corporation (OPIC). The policy is in the amount of $155 million and covers 85% of any loss arising from expropriation, political violence, or currency inconvertibility."

Something tells me that the despair exhibited in the selling on Tuesday was way overdone in CDE. And for you folks that do not believe in the technicals, note how CDE recovered lated in the day to neatly rest at the lower Bollinger Band and the 50 day moving average (DMA).

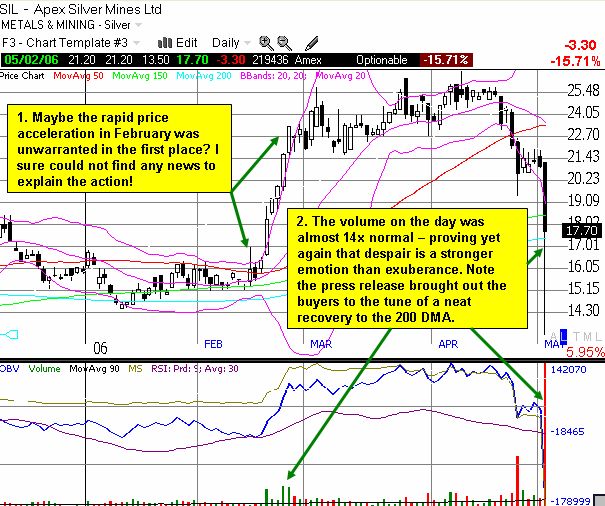

Last and definitely not least, is Apex Silver (SIL). SIL suffered the brunt of the despair given its high concentration of assets in Bolivia. On its website, SIL tells us that "Apex Silver’s wholly-owned San Cristobal property is considered to be one of the world’s largest silver-zinc-lead development projects. San Cristobal...hosts approximately 470 million ounces of silver and 8 billion pounds of zinc and 3 billion pounds of lead contained in 231 million tonnes of open-pittable proven and probable reserves." Wowza! That is whole lotta precious metal! And from what I can tell, just about everything SIL wholly owns is in Bolivia. So you can understand why sellers really gave SIL a good beating today. The beating was so severe, SIL was compelled to issue its own press release trying to cure the despair by suggesting that the Bolivian government is not going to next target its mines for nationalization: "The company is not aware of any plan by the government of Bolivia to follow a similar policy in mining. Apex Silver was particularly encouraged by recent statements made by the Bolivian Minister of Mines and Metallurgy in which he emphasized that 'the mining policy does not contemplate nationalization and even less incorporation of private companies such as San Cristobal.'" If what SIL says is true, then silver bulls were handed one tremendous buying opportunity on Tuesday. At a minimum, I am sure the press release added to the sense of relief amongst investors as they scooped up "cheap" shares of their favorite beaten up silver company. The chart below reviews the despair and the drama in SIL. Two more things to consider about SIL before you get too excited: (1) the SEC began an investigation related to the company on March 31st. I am not sure of the exact nature. (2) On April 6 SIL issued a public offering of 6.375 million shares. This just so happens to correspond to the recent high in the stock and about 4 weeks before the disastrous Bolivian news. Methinks there are a lot of angry shareholders from that offering! It is likely many of them rushed to dump those shares in disgust.

So, should you go run out and buy up all the silver you can? I am certainly not saying that...yet. But I am saying that once again, we are probably witnessing the market over-doing the despair and opening up at least a window of opportunity. I am currently neutral on whether Bolivia should seize control of its natural resources. We can save that polemic for another day when the situation on the ground gets clearer for us spectators.

Be careful out there...and polish that silverware!