Back in March, I mentioned that the biggest risk to the housing bottom thesis was rising interest rates and particularly a break of the multi-year downtrend in long-term interest rates. The 10-year bond now looks to be in a solid up-trend and is nearing a critical test of this down-trend (perhaps around 5.4%?).

As I mentioned before, a failure here may signal a big buying opportunity for homebuilder stocks. But note well that there is little chance the housing market can withstand a sustained hike in interest rates that goes beyond these levels. This housing bottom bull is being forced to revert back to a housing stick-with-trend bear.

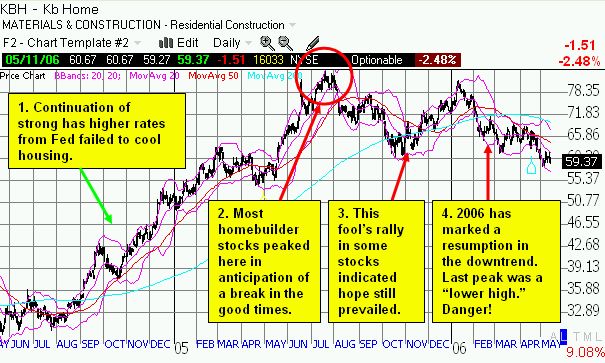

As I came to the conclusion that I needed to make this switch (starting with my missive to start the month), I asked myself "what went wrong?" I did not suffer from hubris from the other successful "bottom" calls I have made this year. The main problem is that we never got a true "despair" moment where some headline or event caused a massive and sudden switch in sentiment - the kind of switch that forces action more on panic than on a complete, rational perspective. The tug of war between housing bears and bulls continues unabated. The negative headlines that are causing the persistent decline in homebuilding stocks have been building slowly and surely over time. This extended action has allowed intermediate counter-trend events to give cause to temporary optimism and renewed buying interest. Pull up the chart of any homebuilder stock and you can see the waves of optimism and pessimism play out all the way down to current levels. In stocks like Kb Home (KBH), we even got a true short-term bottom in October, 2005 which brought large amounts of fresh cash to the long side. This buying also brought fresh optimism and new hands trembling trying not to get "shook." Clearly, the sentimental bottom has not arrived.

Naturally, you might ask, what kind of event could cause the kind of despair move that has proven over and over to provide profitable opportunities? I shudder to think. The housing market relies on income and job growth for its sustained health. The speculators who drove prices up to unfortunate highs have not left the market all at once, and even when they do exit, they look for the next "under-valued" market to buy into. The housing bubble has been popping one region at a time, and there has been enough stregnth in certain markets to prop up more diversified homebuilders with more savvy management (see the story behind Meritage for example).

So, it seems to me that looking for a "bottom" in homebuilder stocks is useless for now. The dynamics in this sector are singing a slow, steady melody; they are not like the jazz band with the abrupt drum solo the serves as the clarion call for a transition. Just as the Fed is no longer certain how and when it will raise rates, so to is the uncertainty high as to how much longer the housing market will continue its decline. I continue to maintain a keen interest in the story here, but I am now officially calling off the bottom-sniffing dogs.

Even as I declare it is time to get back to the trend, I realize that this is not as simple as it seems. TraderMike pointed out last week that TOL is the kind of stock you short into rallies (include link here). TOL has resumed the downtrend that started with the July, 2005 peak. In fact, TOL has cleared the lows for 2005 as well. Centex (CTX) has also broken the lows for 2005, but its downtrend was interrupted by a fool's rally at the end of last year. Beazer Homes (BZH) did not even peak until the end of last year and has only recently succumbed to the downtrend blues by breaking a long-term up-trend in just the last month or two. Finally, Meritage (MTH) is the strongest of the bunch and remains in a short-term up-trend that has broken the back of the longer downtrend that started last summer. (I strongly encourage you to take a look at the charts for yourself). The story overall here is as mixed as is the housing market itself. Given that the drama has pushed past 2005 woes, we should be biased to expect even more pain ahead.

In the meantime, keep an eye out for the potential positives. Unfortunately, the main positives might be interwined some nasty negatives. The main positive would be a declaration by the Fed that they are indeed finished raising rates. But given how strong the economy has appeared to be, this pronouncement would probably not come until the economy has significantly slowed down, maybe even when the economy has been driven to the edge of recession. Think about it. The economy almost could not be better right now. Unemployment is back to historic lows, the kinds of numbers we saw during the bubble. GDP growth has been robust despite higher and higher energy prices. If these homebuilder stocks are swooning under these conditions, we cannot expect even more good news to save these stocks. Ironically enough, these stocks are likely NOT to turn until the economy does start to decline and investors and traders start to look forward to lower rates from the Fed and better times ahead again. Ah, the economic cycle and the ups and downs of sentiment.

As always, be careful out there!