This year, we have had overall success buying into situations where sudden bad news causes panic selling. This kind of selling typically takes stocks beyond the point of "reason" - at these times you can actually weight the odds of the market being "wrong." However, I am sure some of you must wonder whether I just enjoy chasing falling knives. Far from the truth. And to demonstrate the opposite case, I thought it would help to show three stocks where bad news has caused a lot of selling, but little to no buying interest in me.

The latest scandal in the financial markets has involved the backdating of stock options. It seems every year since the bubble popped we find out one more way in which the scamsters that roam Wall Street have found to take advantage of the money game to their illicit benefit. I believe the backdating scandal started with a study publicized by the Wall Street Journal that examined cases where options were conveniently timed at low points that preceeded nice rallies in the stock. I featured one suspect, United Health (UNH), because I thought the billionaire CEO was being overly scrutinized for the sole fact he had gotten obscenely wealthy (mostly on paper of course). I thought folks were ignoring the more obvious fact that his company has become wildly successful for over a decade, and the CEO would be rich regardless of the timing of these options. It is just a matter of degree. The UNH case is still pending and apparently in its early stages. In the meantime, more and more cockroaches are coming out of the woodwork. Technology companies have traditionally been the heaviest and most dependent users of stock options to compensate employees, but the SEC's dragnet on this issue has spanned far and wide. I want to feature three of the trapped companies: Caremax (CMX), RSA Security (RSAS), and Vitesse Semiconductor (VTSS).

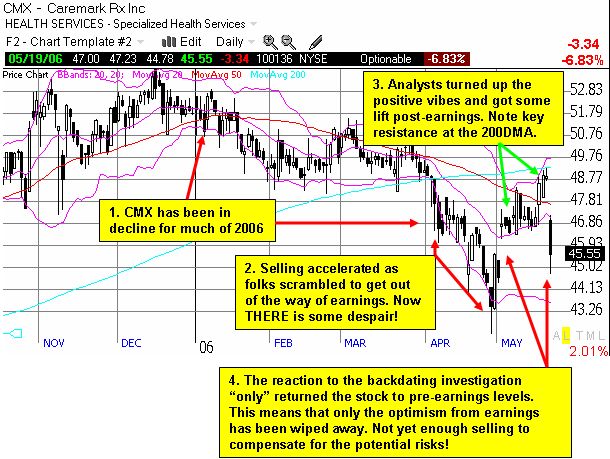

Caremark has had a stellar rise from the cellars of 1998 when the stock lost almost ALL of its value in a sickening one-year decline. From the bottom to the recent top in 2005, the stock increased in value 20x or more. Apparently, folks had some acquired some serious faith in this stock! Well, CMX last reported earnings on May 2nd. The stock had been down on the year about 17%, but the recent earnings rejuvenated things a bit. The stock popped modestly, and the analysts came out happily applauding CMX all over again. Price targets were raised to $58 and $60, and upgrades flowed freely. It was enough to keep CMX from getting clobbered in the overall market correction that occured during this same time. But the good vibes came to an abrupt end as the stock immedaitely closed the earnings gap on news that the SEC issued an informal inquiry and the U.S. Attorney's office issued a subpoena regarding the possible backdating of stock options. Thomas Weisel immediately came out and defended CMX. They reminded folks that the company had already addressed the backdating issue at the earnings conference call; the company had assured analysts that all grants were done at regularly scheduled intervals and were on the up-and-up. So, this looks like a clear-cut case of despair, right? Time to buy, right? Perhaps. But I cannot get excited just yet...

Let's look more closely at the situation. First of all, the stock had been selling off all year and got a modest bounce off the earnings report. This action tells me that hope has not been lost on the stock. The rash of positive analyst opinion inflated a lot of hope and optimism back into the stock. Finally, an analyst came out and immediately defended the company in the face of the bad news. True despair happenswhen the analysts come out with downgrades and warnings - as we saw with SHW and BOL. Finally, the stock "only" dropped 7% after holding its own during a big market correction. True despair is when the sellers cannot unload stock fast enough. Those kind of drops typically generate 15, 20, and 25% drops in one day, maybe two. All we have so far is the closing of an earnings gap and a lot of hopeful investors clinging onto their shares in expectation of eventual exoneration for CMX. Finally, a 7% drop is not enough to compensate for the risk you would take buying into such a situation that is clearly in its early stages. So, for now, I am not interested. Despair leading to overdone selling is nowhere to be seen here. The stock could certainly bounce right back from this blip and never look back, but betting on such a move is simply not worth it here. The chart below summarizes the situation:

I have followed RSA Security (RSAS) since the bubble days of 1999. I first invested in them because I thought they had a great business model, valuable products, and a relatively cheap valuation compared to all the bubblicious tech stocks that were so popular back then. Unfortunately, my notion of "cheap" did not save me from losing plenty of money on RSAS as the tech bubble went pop and fizzle. RSAS also could not escape persistent negativity regarding increasing competition from the likes of Baltimore Technologies. After I finally sold the last of my holdings, I never looked back. Every now and then RSAS would return my radar screen, but I was like a lover scorned...too salty to reconsider my current distaste. My stubborn ways also had me miss what has been a most amazing recovery and comeback over the last four years from less than $3 to over $20. 2005 was a rough year, but RSAS came back strong in 2006. All was well until the stock got hit with a 12% one-day loss on a day where technology stocks finally had an up day after correcting for the entire month of May. The news was familiar. The SEC had issued a letter requesting documents relating to the issuance of stock options. Although the SEC made clear that this request should not be interpreted as an indictment or any other indication of criminal activity, sellers showed little desire to hang around for further news or clarification. A sure sign of despair overdone, right? Hmmm...not quite. And I am not just saying this as a lover scorned!

Upon closer examination of the news, I found that the Chief Accounting Officer had resigned on May 16th on the heels of the appointment of a new CFO. Right before this news, an analyst at Jeffries issued a generally positive report on the company's products but admitted that investor sentiment was too optimistic. Wedbush Morgan was more supportive by jumping right on top of the bad news and issuing assurances that the resignation was a non-event. And three days letter we get an SEC inquiry? Hmmmm... a 12% drop is pretty bad, but this situation stinks. Jeffries already told us that investor expectations are probably too high and an analyst issues assurances even as more bad news is right around the corner. At a forward P/E of 20, and a price/slaes ratio over 4, I need more selling to make this risk worthwhile. I will let the despair ride some more. Perhaps after one more shoe drops, RSAS can begin to look attractive...

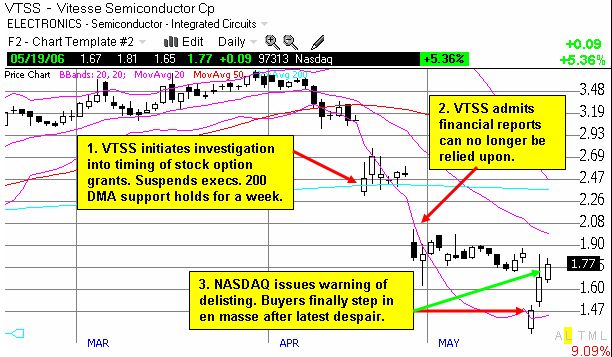

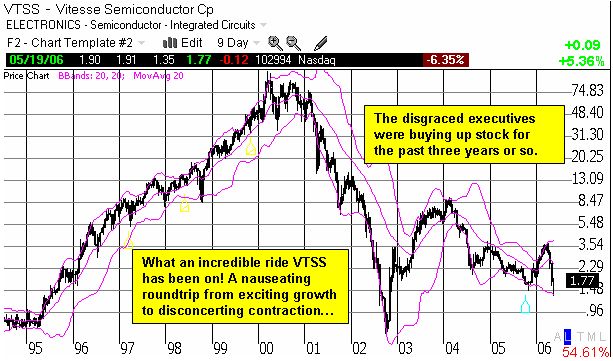

The toughest despair to let ride has been in Vitesse Semiconductor (VTSS). I have long been a fan of this company and its products. I always felt it was over-shadowed by its over-hyped bretheren at such networking chip companies like AMCC or PMCS. I was particularly intrigued by the great record of insider-buying at the company. The CEO, CFO, and an Executive Vice President have all been active buyers of the stock. I followed suit by consistently buying VTSS on corrections. Although I sold into rallies because I thought valuations or technicals told me to do so, I watched vigilantly for the next buying opportunity. On April 18, it looked like I had received just such a buying opportunity. In after hours the company announced it had appointed a special committee to investigate the timing of stock option grants. Three executives were placed on administrative leave. Yep, you guessed it. These three execs were the same ones whose insider-buying I had followed all these years. Oh, the horror! I was left paralyzed. If these trusted stewards of VTSS's stock were implicated in criminal conduct, then how could I believe that those purchases really meant anything? I stayed my hand even as the stock dropped 20% the next day and seemed to find stable support at the 200DMA over the next week. Investors even held firm as VTSS cancelled its earnings call. My paralysis saved me as the stock next dropped another 27% on April 27 as the company next admitted that as much as three years of financial reports could no longer be trusted. Suddenly, the very fundamentals of this company were being ripped to shreds. With the top executives on leave and the financials a complete mess, we bottom-fishers could only look to our faith in VTSS's products. Such faith is often misplaced. It takes good management to revive a troubled company. Good products are not enough. I was no longer paralyzed...I was now adamantly refusing to plunk even one penny down in support of an eventual rebound. The news just seemed to be getting worse and worse and my faith in VTSS was rapidly fading.

VTSS's stock next held steady for about three weeks. Enough time to get lulled to sleep and to start believing that perhaps the worst was finally over. But more bad news did hit. Last week, the NASDAQ notified VTSS that it was at risk for delisting. The stock dropped yet another 20% as insitutional investors and retail investors alike scrambled to get out of the way. Very few people like to hang around in a delisted, extremely speculative name. This time, the stock bounced back very quickly and in less than three days had closed the gap. In hindsight, this buying made sense...after the company dealyed its earnings report and put past financials in question, the threat of delisting was imminent. Those who sold on the news simply had never thought about the risks. BUt the vigorous buying was finally somethinBg different. It had me wondering whether the stock was now appropriately priced for the existing risks. Even the announcement of the official SEC investigation on Friday did little to re-ignite the sellers. Has the despair finally reached its peak pitch? It sure seems like it. But the risks here are very real and too strong to ignore. The valuation on the company has still not reached discount levels, and we cannot even assess what the company is really worth. I remain on the sidelines but intrigued about the possibilities of quick trades. The company can survive delisting if it comes out with financials that indicate the company is not beyond repair. Certainly, one more heavy dose of bad news should get the stock down to "bargain" levels. But even then, it will be hard for me to scoff at the sellers and join the buyers. Analysts have been largely silent to-date. A rash of downgrades might stir more interest in me. But until then, I cannot issue a buy on this despair. The chart below summarizes the carnage:

Be careful out there...!