Three weeks ago, I wrote that despair had finally reached the homebuilder stocks, and I suggested it was time to start nibbling on some related stocks. As luck would have it, XHB, the homebuilders ETF, managed to put in a short-term bottom right at that time. There was no magic involved. The housing-related stocks benefited from a storm of news that almost could not get worse and a stock market that was already halfway through a complete recovery from the late February sell-off. The tailwinds of the market recovery finally put some lift into the housing stocks this month. While the summer bottom in XHB remains intact, I am reluctant to call this bottom confirmed because several homebuilders have had ugly breakdowns below their 2006 lows. So instead of prognosticating, I will stick with the facts: housing stocks have bounced.

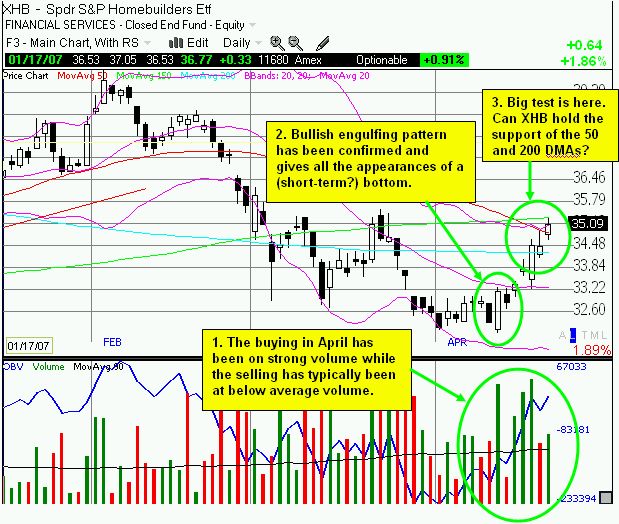

Having said that, I saw some definitive positive action in the XHB that suggests that the recent bottom could hold for a while. The chart below shows that the last 3 weeks have featured several strong volume up days for XHB, leading to a very strong bounce in on-balance volume (OBV). The high-volume bullish engulfing move on April 12th was particulary noteworthy.

So, what now? (See my disclaimer here) I am now out of what I thought to be the best "despair" plays in the housing stocks, IndyMac Bancorp Inc. (NDE) and Beazer Homes USA Inc. (BZH). I managed to play NDE twice successfully. BZH has had a very nice bounce, but the stock is now vulnerable to any follow-up news on the accusations of fraud in Charlotte, NC. Of course, if this follow-up news is good, the stock will lift further, but I think the overall risk-reward simply is not as attractive as it was when the stock gapped down on the news of investigations. XHB offered an excellent way to play the bounce over the three weeks without having to worry as much about the news of invidual homebuilders.

My one remaining housing-related holding is Building Materials Holding Corp. (BLG). BLG did not bounce until after April 11th. Last week, a related company, Universal Forest Products (UFPI), delivered horrid earnings news but swiftly bounced from what was as much as a 10% loss. This tells me that some kind of floor may be building for the companies that supply the housing industry - after all, recent housing starts numbers show quite clearly the builders continue to build homes. But I have been most interested in BLG because of two potential catalysts that could drive the stock much higher in the short-term, and one catalyst for the long-term. In the short-term, there have been several buy-out rumors in the past 6 months that each time have sent the stock higher for short bursts. BLG's now extremely low valuation (forward P/E of about 9 and price/book at 0.90) means that it could indeed be seen as a bargain for some big buyer. While additional rumors could finally put a real floor under the stock, I am more intrigued by the real possibilities for M&A action here. The second short-term catalyst is the coming 2007 hurricane season. Back in 2005, BLG was seen as a strong hurricane play. The stock rallied strongly all year right into the season and Hurricane Katrina sent the stock soaring an additional 14%. As these things go, that catastrophic event marked BLG's peak. It has been mainly downhill from there as the realities of the sinking housing market have weighed heavily. Given last year's hurricane season was a non-event, I suspect that the consensus view is for another mild season, so any amount of hurricane activity that threatens the U.S. could get BLG moving really fast while another calm season should already be priced into the stock. Finally, for the long-term, the dividend yield on BLG has reached 2.3%. While not outstanding, it beats the dividend yield of the S&P 500, and this yield provides a bit of extra cushion. This of course assumes that BLG's cash generation does not get so compromised by further slowing in the housing industry that the dividend gets cut. Overall, BLG is still a high-risk play in the short-term because of the persistent (and ugly!) downtrend in the stock, but I like it over the longer-term. Moreover, I like the prospects for short-term surprise upside that could catch the shorts off-gaurd (as of March 12, Yahoo!Finance reports that shorts have clutched BLG by the neck for the tune of 21% of the float!).

OK, maybe I didn't quite answer what to do now. Clearly, I think it is time to put the housing trade aside for now and be a bit more cautious. I am a buyer on dips, especially a buyer on really bad news that has the look of "despair." I am not ready to hold a basket for the longer-term yet, but if XHB can convincingly hold above the 50 and 200DMAs, I will get much more bullish on the homebuilder stocks (even if the industry continues to suck wind). I like XHB as the main trading vehicle as a bit of a hedge against individual stock drama. I will get interested in individual stocks based on the background news case-by-case. This now includes related financial companies with NDE remaining my most favored given the insider buying. But that's just me. As always, do your own research!

Be careful out there!