Economic Data Tries to Cap Rate Surge (a missive do-over!)

By Dr. Duru written for One-Twenty

June 24, 2007

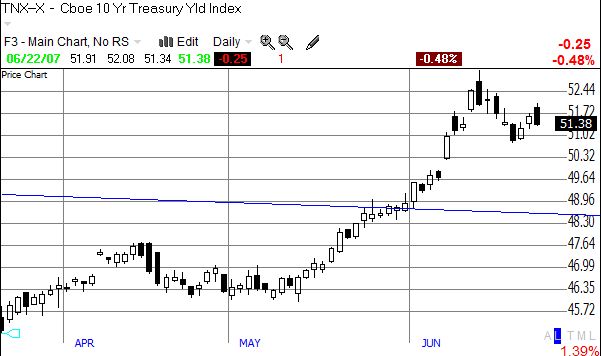

After reviewing a recent post by Trader Mike on the trend in the 10-year Treasury, I realized that I needed to "do-over" my own recent post on the 10-year. I misapplied my downward trendline and incorrectly concluded that the 10-year yield is still trending down over the long-term. Quite the contrary! The long-term downtrend was finally broken at the end of May. For the following two weeks, rates surged nearly straight up before taking a "pause" over the past week and a half. So, given this new view I am recasting the missive I wrote last week. Sorry for the gaffe, folks!

-------------------------------------

Saved by the economic bell? On Wednesday, June 13, we got word that retail sales came in surprisingly strong: up 1.4% versus expectations of a 0.6% gain. That's extremely good considering oil prices were reaching for last year's highs and gas prices had already passed it. In general, consumers continue to ante up for gas and do what is needed, aka debt, to keep consuming. The bond market responded in kind by sending rates up again in line with the strong trend nearly straight up since mid-May. But by the end of the trading day, rates were down from the previous day. Two tame inflation reports later and a tepid industrial production report to boot, and we found ourselves at the end of that week inching back down into Tuesday's dramatic gap upward. A whole lotta drama.

The bond market has been served up two big reality checks: the Fed is not lowering rates anytime soon (if they had only listened to me way back when), and the struggling housing market is still not sending the economy into the toilet. But with inflation still being reported as under control (nevermind the prices of stuff we really care about like childcare, healthcare, food, and energy!), the bond market also cannot get overly concerned. The economic data is saying we are hot but not too hot but will this be enough to stem the rising tide in interest rates? That's right. The 10-year Treasury finally broke through its long-term downward trend, and it has been scorching upward ever since.

Let's do an update on where we stand relative to the historic long-term erosion of interest rates.

We now see that 2006's rate scare, where 10-year rates attempted a break-out but failed, may now become 2007's rate nightmare. We have now clearly broken the long-term downtrend. And that break-out has caused a mad scramble of selling in the bond market. A close-up on rates shows the "mini-panic" more clearly.

Clearly, we are sitting at an important juncture. While recent economic data has provided some rate relief and rest, the onus is now on the bulls to prove that the market can continue to be impervious to rates. In 2006, the scare of higher rates was enough to send the market tanking for the summer. We already got one sell-off this year, and I suspect the relatively rapid bounceback and recovery to new highs has sellers hesitant to get fooled twice.

Trader Mike points out that until the S&P 500 breaks the June low, the market is technically still alive. But we should assume that it is no coincidence that the S&P peaked at its multi-year high in early June just as interest rates were breaking the back of the long-term downtrend. So, what will it be? A pullback in rates back below the long-term downtrend to provide fresh reasons to keep buying stocks? Or do we get higher and higher rates and some sort of July correction or a Sept/Oct seasonal sell-off? And if the importance of rates over the long-term escapes you, I point you back to a missive I wrote in February pointing out how important the 25+ year decline in rates has been to our historic bull market!

The financials may already be telling us that trouble is right around the corner. The chart of the bank index (below) shows that the financials as a group never recovered Februrary's high and, even worse, the bank index has already fractured June's low in dramatic fashion. All we need is the equivalent of two more sell-offs like Friday's to take us right back to the lows of the year. Hmmm....let's see - we have the Fed yapping again this week and yet another earnings report cycle is right around the corner...

Be careful out there!