Today's lesson is an update for the post-Labor Day analysis from last year.

Many traders look forward to the action after Labor Day. The Tuesday following Labor Day effectively marks the end of summer and the listless, low volume trading that supposedly occurs every year. Of course, the summers of 2006 and 2007 were anything but listless. We also have all heard how September and October have historically averaged the worst monthly performances (on the S&P 500) of all months. Of course, September for the last 5 years or so has been an up month. Regardless, we have learned to dread the return to trading in the early Fall, so how do we reconcile the anticipation versus the anxiety?

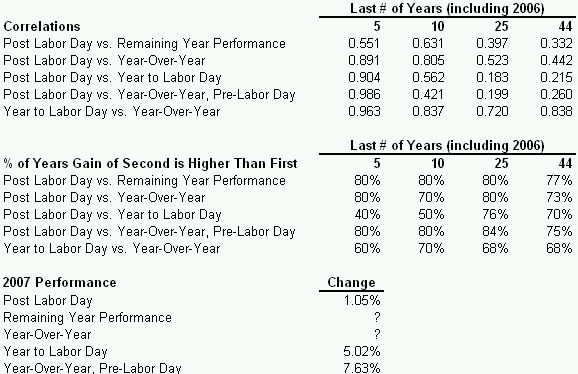

I tackle the issue from a perspective beyond trying to predict the move for the day after Labor Day. Instead, I examine how strongly correlated the post Labor Day trade has been to other price changes over the year. I also examine whether these various time periods tend to show higher or lower % gains than the post Labor Day trade.

I measure several time periods all based on the closing price of the S&P 500 on the day in question:

- Post Labor Day: Friday before Labor Day to the Tuesday after Labor Day.

- Remaining Year: The Tuesday after Labor Day to the end of the current year in question.

- Year Over Year: The last day of the prior year to the last day of the year containing the Labor Day in question.

- Year to Labor Day: The last day of the prior year to the Friday before Labor Day.

- Year Over Year, Labor Day: The Friday before Labor Day of the prior year to the Friday before Labor Day of the current year in question.

The time period covers 1962 to 2007. I measure the correlations of the post Labor Day trade to the other four time periods. I also measure the correlation of the Year to Labor Day vs Year-Over-Year. Since all the correlations turned up positive, I added a table comparing the size of the price change from the post Labor Day trade to the other time periods.

I have posted the results below to allow you to form your own conclusions. My conclusions this year are similar to last year since last year's post-Labor Day trade was consistent with recent historical patterns:

- It has been much more common for the post Labor Day trade to move in the direction of the trade over any of the time frames of interest in the past 10 years than over larger samples of history.

- The Post Labor Day trade has been more important in the past 5 years than in any other time frame measured in this sample of history.

- The performance of the S&P 500 for the year up to Labor Day is very highly correlated with the year-over-year performance of the index. In other words, if the S&P 500 is positive for the year up to Labor Day, then we are almost guaranteed to have an up year overall. This correlation is far more important than the daily trade the day following Labor Day.

- The relationship of the one-day post-Labor Day gains to other time periods of the year has been remarkably consistent throughout 44-year sample.

- The market tends to perform better over time than the single day trade on the day following Labor Day. Of course, the longer the time frame, the more likely performance will exceed that of any given day.

- Finally, if previous history's tendencies hold true, then we will end this year on an up note given the strong performance of the S&P on the day after Labor Day. Note that based on the S&P's performance up to the day before Labor Day, we would have done well to bet on an up day following Labor Day.

.468w60h.jpg)