Click here to suggest a topic using Skribit. Search past articles here.

I have never been so long-term bullish and short-term bearish on a sector as I have been on solar stocks. Solar energy is full of promise as an increasingly important part of our energy solution over the coming decades, but the prices of too many solar stocks are discounting and presuming too many successes with flawless execution too far into the future. Some folks are no doubt surprised that solar stocks are not performing better given this year's large spikes in the prices of oil, coal, and natural gas. This alone should serve as a warning that the short-term thesis on solar stocks is faltering. For example, imagine what might happen if commodity prices correct. Another disturbing pattern I have observed during the last two earnings cycles is the tendency for solar stocks to fade hard after earnings, even after reporting what appear to be stellar headline earnings and future guidance.

I will tell my own tale of warning by picking on two solar stocks in particular: First Solar (FSLR) and Evergreen Solar (ESLR). (Note that I am or recently have been long and/or short each of these stocks. I am also long Solarworld (executive insider buying first got me interested) and Arise Technologies (for some speculative juice). See my disclaimer here).

First Solar has been the darling of the solar industry, mainly because of tremendous earnings and revenue growth, a rabid fan base, and a presumed competitive moat created by its industry-leading thin film technology (Cadmium Telluride or CdTe). Of the pure play solars, FSLR is one of the few to actually make new all-time highs in 2008 after the solar craze reached its pinnacle at the end of 2007. JA Solar (JASO) is the only other stock to achieve such heights, but its new closing high lasted just one day (April 18). (Correction on June 17, 2008: Canadian Solar (CSIQ) achieved new all-time highs in May and has held on! Thus, at the time of writing, I believe CSIQ was the only pure play that traded in 2007 to achieve and hold new highs.) Ever since FSLR's last major run took it up over 50% into its April 30th earnings call, a lot more negative chatter has been printed and reprinted. Renewed doubts about the stock and the business have weighed FSLR down 23% from it's all-time high. The negative chatter has often been sharp and sometimes cynical, and the defense of FSLR has often been passionate. We should expect no less from a stock that is priced at such a premium. For now, the bears on FSLR have the upper hand and the chart technicals are on their side. I will start with there...

The weekly chart shows that 2008 has been a wild and choppy ride for FSLR, suggesting a damaging break in the momentum.

The daily chart makes the short-term bearish outlook clearer. A dangerous downtrend has been in place ever since the all-time highs were established in mid-May.

It seems that the top is in for now in FSLR. Until proven otherwise, the short-term trend is down. If FSLR retests the 50DMA (around $273.50) a classic shorting opportunity may arise. A fauilure there will all but confirm FSLR's top for some time. The one positive about FSLR's chart is that on-balance volume (OBV) has remained strong, even during corrections.

So, what are the more fundamental reasons that have caused FSLR to falter? Well, the news outlets and analysts have actually covered most of them very well. One June 8, 2008, the Toledo Blade provided an excellent account of the good and the bad sides of this drama: "Analysts cool on First Solar: New competitors, high stock price spur ratings dip". I will add to this my own list of what I think is important to consider, some of which the article covers. There are other issues I have seen raised that I will not cover here and are not covered in the article (such as the risk of lower ASPs and margins). Do not take these negatives to mean that FSLR's business is finished. Far from it. Match these issues with the high valuation of FSLR's stock and ask why should we pay such a price alongside such high risks?

- A lot of ink has been spilled over CEO Michael Ahearn's dumping of half his stock. When this news broke, it caused the technical damage shown in the second chart with the abandoned baby top. While Ahearn remains tight-lipped, we should not criticize his sales. As Jim Cramer always says, you only need to get rich once. Ahearn would have to be pretty greedy to continue holding $1 billion plus in paper value without taking some profits off the table. Now, he can just focus on maintaining his wealth and not worry about the fact that his company needs to execute nearly flawlessly to maintain its current valuation.

- Speaking of Jim Cramer, he has been one of the most passionate cheerleaders for FSLR around (ok, he is ALWAYS passionate!). When the stock was $300+, he cautioned his viewers to wait to buy on a pullback. But his most recent pronouncement (June 10, 2008) indicates that he has begun looking for greener pastures: "'I've been recommending First Solar It's a good speculative play.' But Cramer says wind stocks and natural gas are his preferred energy plays." A whole herd of passionate buyers have effectively been taken out of play now.

- And speaking of passionate cheerleaders, even Andrew Ling (as seen on Seeking Alpha) finally cooled on FSLR just a tad on May 7, 2008: "Q1's earnings were below my expectations and reduce my 2010 and beyond outlook for the company although this is somewhat counteracted by an increased 2008 outlook due to a huge throughput gain. I'm slightly less bullish on the stock now, although the long term outlook is still bullish." I have followed Ling's FSLR commentary with great interest because he has often used high leverage to load up his portfolio with FSLR. I count this piece as at least a short-term negative.

- Ling has recently hedged his bets by adding Applied Materials (AMAT) to his portfolio. There are some skeptics about AMAT's chances with thin film technology, but I take this competition seriously. AMAT's sunFab thin film line should become a serious threat to FSLR's thin film business by spreading top-notch thin film technology across many aspiring manufacturers. AMAT's $2 billion dollar deal in Abu Dhabi confirms AMAT is going to throw some big muscle in this game. (Also click here for an article that claims FSLR's cost advantage over poly-silicon will start to erode over the coming year).

- Everyone knows about the subsidy mess because it is currently the lifeblood of the entire solar industry. We all will be relieved when solar reaches "grid parity." Until then, the solar industry will remain vulnerable to the vicissitudes of energy politics. Germany almost passed massive reductions in subsidies. The American Congress cannot agree on whether or how to extend America's small subsidy program. Briefing.com quotes Collins Stewart's June 10 commentary on the situation in Spain: " Collins Stewart has confirmed that the negotiating position of the Association of the Photovoltaic Industry (ASIF) and the Spanish Association of Renewable Energy Producers (APPA), who are jointly negotiating with Spanish regulators, will be asking for a capacity cap of 480MW for 2009 along with the 30% reduction in the feed-in tariff. In their view, this is a negative development for the solar industry, as it may potentially limit demand in what has been the industry's fastest growth and high-ASP market..." With solar companies reporting record profits and comfortable margins and even creating a billionaire or two, we should not be surprised to see governments questioning whether they need to continue buttering up corporate bottom-lines at the current pace. In Germany, electricity consumers are paying much higher electric bills only to see a lot of their solar money leaving the country to the likes of FSLR. Subsidy risk alone is a reason that solar stocks should not be bought at large premiums.

- On March 27, 2008, Southern California Edison created a lot of excitement when it announced America's largest solar cell installation project. At the time, there was plenty of speculation that First Solar could win significant business from this project given the company's goal to make bigger inroads into the American utility market - the economics of FSLR's thin film panels makes them most practical for large, utility-scale installations. FSLR's stock moved ever higher in response. Still no news on any contracts, but on June 3rd, So Cal Edison announced a large 245MW contract with eSolar, a solar thermal company. It turns out that solar thermal holds a lot of promise for utility-scale electricity and is likely to provide FSLR a lot of competition for such projects. Jon Markman writes an interesting piece on solar thermal's potential: "It's solar power's time to shine."

- And let us not forget the on-going credit crunch in the financial markets. We can only speculate how many big contracts will end up being cancelled due to financing issues. We cannot put our finger on any solid figures here, but it is something to keep in mind if the credit crunch continues through the remainder of this year (as seems likely now.)

In case you wanted something positive in this missive, here is an upgrade from hold to buy by ARGUS which attempts to allay some of the fears I expressed above. Price target of $292. Argus slapped a hold on FSLR at the beginning of April. Nevermind that FSLR was around the same price then as it is today.

OK. Now, on to Evergreen Solar (ESLR)...

ESLR is perhaps the one pure-play solar company with the longest record trading as a public company. The company gets major kudos just for surviving the public markets for almost seven years. Several semiconductor companies that now serve the solar industry have been public even longer, but they have multiple business lines, including Applied Materials (AMAT), Energy Conversion Devices (ENER), Memc Electronic Material (WFR), and Emcore Corporation (EMKR). ESLR went public in November, 2001 and within a year it was flat on its back trading around 50 cents/share. Ever since that nadir, the company has fought and struggled its way back, never making any money but always making promises. By 2006, ESLR had finally regained its opening day IPO price. Within a year, it received another 50% haircut. ESLR rode 2007's solar craze back to that same high price. ESLR has now made a long-term triple-top, and the time to perform is almost now or never. The chart below shows the wild, multi-year ride and potential triple top.

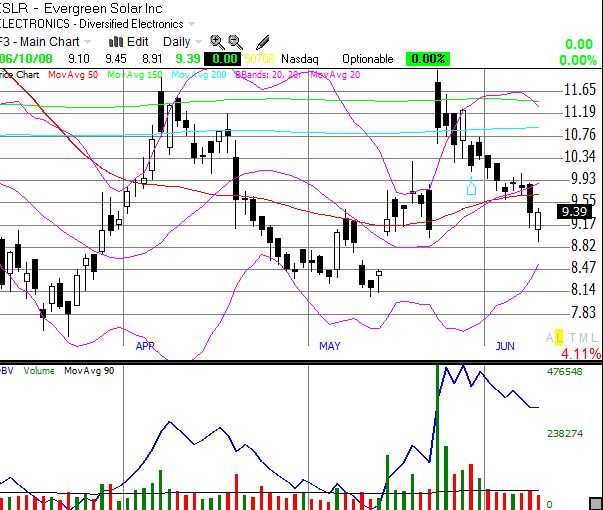

ESLR is indeed trying to perform by reporting last quarter what I believe was its first quarterly profit ever. A month later, ESLR followed up with the amazing announcement that it had signed new sales contracts valued at $1B. The stock responded by a pop of 20%, 33% at its peak. But as of June 10, ESLR has returned all that excitement back to the sellers. See the chart below:

If the fade on that first day did not convince you that "something" is wrong, this complete fade should. How could $1B in new contracts not create more sustainable excitement? Especially when ESLR's CEO Richard Felt got on Fast Money and claimed that demand for solar is "virtually infinite"? Well, before this announcement, ESLR had six customers with $850M in order backlog, and ESLR has just now recorded a profit. The new contracts exceed this amount, are from just two customers, and extend through 2013. We can only imagine that there is a lot of execution risk here. Perhaps once ESLR starts to deliver successfully on all this backlog, a skeptical market can begin to believe. The charts have provided your technical levels of proof. First, reconquer the $12 price mark. Next, establish and hold new all-time highs. You aggressive types can start your bidding now...

Be careful out there...!