Click here to suggest a topic using Skribit. Search past articles here.

I regret that I do not own more. Gold gapped upwards almost 4% the day after the Federal Reserve demonstrated on Wednesday that it is not yet ready to get serious about fighting inflation (and it cannot without crushing the fragile American economy). And I am glad that I am still holding onto my gold. My second regret is that I did not turbo boost the gold impact with my favorite gold mining play, Goldcorp (GG). On Friday, GG made a new all-time high - up 13% for the week.

Gold corrected steep and fast into the climactic March lows for the stock market, and numerous gold skeptics were quick to write off the yellow metal. I re-established a position anyway. Every bounce in the dollar since the March lows has had folks cheering the comeback of the greenback (nevermind that a weak dollar is the only thing propping up corporate profits and the U.S. economy, such as it is). Every dollar bounce seemed to confirm that gold was "done." As inflation engulfs the globe, gold appears to be on the verge of a break-out similar to the last one that sent it hurtling to $1000. The Federal Reserve continues to tell us that "...the Committee expects inflation to moderate later this year and next year." And still, "recent information indicates that overall economic activity continues to expand, partly reflecting some firming in household spending." And finally, admittedly, "the upside risks to inflation and inflation expectations have increased." It is all very confusing, this rebound in growth with lower inflation. I think I will choose "normal" over "hopeful" economics and hold gold in anticipation of even higher inflation with increases in demand for oil, food, and other commodities. Who knows. If the economy fails to rebound as expected - and the 2nd-half recovery is looking like so much fantasy now - we might see further pressure on the dollar and more support for gold.

Anyway, back in January, I was quick to point out the break-out in gold. It made me regret selling my entire position in late 2007, but I never got the pullback I wanted for re-establishing my position. Perhaps this created my over-eagerness when gold corrected back in March. I also thought that the former break-out point of $800 would be re-tested and provide my second potential entry point. I never quite got it.

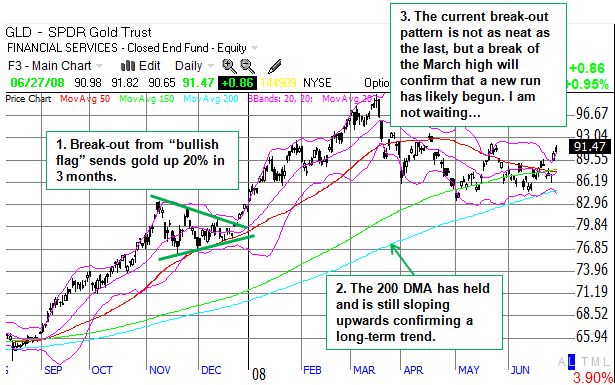

The following chart provides a price-based technical summary of where gold stands. Until the Federal Reserve actually begins a new rate cycle of increasing rates, I will hold onto my gold.

Be careful out there!

Full disclosure: Long GLD. For other disclaimers click here.