As Housing Market Struggles to Turn, Homebuilders Focus on Survival

By Dr. Duru written for One-Twenty

February 17, 2009

It has been six months since I reviewed homebuilders in any detail. The news has just been so consistently bad and trending ever downward that it seemed there was nothing new to say. Back in August, 2008, I was motivated by Jim Cramer's excitement about a pending housing bottom - an excitement that blossoms (and wilts) on a periodic basis. I reviewed Toll Brother's (TOL) conference call at the time after it had popped 12% over two days, I found almost nothing exciting and certainly nothing investable. I passed. However, homebuilder stocks kept creeping haltingly upward from there all the way into September. Even as the market began its Fall meltdown after Labor Day weekend, homebuilder stocks held their own, mainly finishing flat for September. The next swoon in homebuilder stocks began in October, and the overall downtrend remains intact. See the chart below.

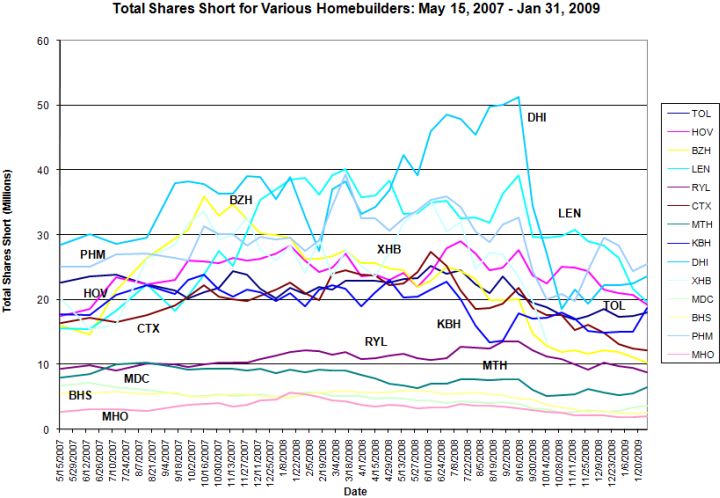

September was also a transition period for shorts in homebuilder stocks. After stubbornly maintaining positions for many months, shorts finally started covering in September. Perhaps this activity partially explains how the homebuilders held up so well (note that the SEC also announced its ban on short sales on financial stocks in that month). KB Home (KBH) is the only homebuilder in my list that did not experience a big drop in short interest in September. Note that KBH shorts did significantly reduce positions in July, 2008. Pulte Homes (PHM) is the only homebuilder who has experienced an increase in short interest that has returned shorts to September levels. Finally, I am quite surprised to see millions of shares are still short in Beazer Homes (BZH) and Hovnanian Enterprises (HOV) even as they head for "penny stock" status. The graph below shows total shares short (data from nasdaq.com). I do not have access to historical data on shorts as a percentage of float, but I find trends in total shorts more informative.

So, I got interested in the homebuilder data after a friend of mine insisted that the latest National Association of Realtors (NAR) inventory data demonstrated that a turn was finally in the works for housing. The following is his commentary:

****************

The increase in existing homes sales that the NAR released on Monday (Jan 26) had me looking more closely at national real estate data than I have in years. I thought I was going to be able to poke holes in the monthly data and find that the housing market is still in tatters. What I actually found was much more positive in housing than I expected. The highlights are:

- Existing homes sales inventories are decreasing! After years of double-digit percentage increases in inventories, inventories increased at a single-digit percentage rate for the first half of 2008 and actually started decreasing in the second half of 2008. December 2008 inventories are down 20% from their July highs (some of this is seasonal) and they are down 7.5% relative to December 2007. It's incredible to think after all the layoffs, foreclosures, and minimal buying interest that inventories are smaller now than they were a year ago.

- Builders have stopped building! It's an even steeper drop-off than I expected. Inventories of new homes are already at 2003 levels. And they are headed down even more sharply. Moreover, building permits in December 2008 were about 50% below December 2007, while November new home sales were only 33% below during the same time period. From August to November of 2008, new home sales are down 10%, while building permits are down 34%. A staggeringly low 24,000 permits were issued in December of 2008 for single-family homes in the entire country. This can be contrasted with the 1.6 million permits issued in 2004 and 2005.

- Foreclosures are close to peaking. Unfortunately, the data on this topic are sparse. RealtyTrac (a proven exaggerator of foreclosures) estimates that the number of foreclosures in 2008 was 860,000 up 100% from 2007. Moody's.com estimates that foreclosures will increase 18% in 2009, increase more in 2010 and then taper off in 2011. I think that it is unlikely that foreclosures go down in 2009, but I am also confident that they won't double again. This is the wild card, because annual foreclosures are 25% the size of current inventories, so they can have a significant impact depending on where they end up. A related wild card is how much the moratorium on foreclosures by Freddie and Fannie at the end of last year has artificially deflated existing home sales inventory.

****************

These arguments seem compelling enough, but I remain skeptical. I decided to check out the latest earnings conference calls from some of the major homebuilders: Meritage Homes Corp (MTH) - Jan 29, Pulte Homes Inc. (PHM) - Feb 5, Centex Corp (CTX) - Feb 4, and D.R. Horton Inc. (DHI) - Feb 3. (All transcripts from Seeking Alpha). The recurring themes running throughout all these calls were holding and building cash levels, sacrificing margins for sales, cutting costs aggressively, reducing inventories, and positioning to take advantage of cheap land held by banks. It seems that the majors will be able to survive 2009 with healthy balance sheets, but I prefer to keep watching and waiting and sticking to short-term trades in the interim. The list below represents a few quotes that stood out to me:

CASH

- MTH: "As anticipated, we generated a significant amount of additional cash, increasing our cash position by $87 million, more than 70% increase in the last three months of 2008. We ended the year with $206 million in cash and no borrowings outstanding under our credit facility."

- PHM: "We increased our cash position by almost $500 million during the fourth quarter and ended the period with close to $1.7 billion of cash on hand...While it will be more difficult for the industry to achieve cash flow gains in 2009 versus 2008 given smaller backlogs and overall weaker market conditions, Pulte does expect to grow its cash position during 2009 notwithstanding our expected tax refund."

- CTX: "Our cash balance increased during the quarter by $200 million to nearly 1.5 billion...and we're expecting our cash balance to increase by the end of our fiscal year."

- DHI: "We have generated positive cash flow in each of the past 10 consecutive quarters for a total of $4.9 billion. We plan to continue to generate positive operating cash flow for the remainder of fiscal 2009 in addition to any income tax refunds...we currently do not anticipate a need to borrow from our revolver during fiscal 2009."

- MTH: "As we discussed last quarter, the increase in foreclosures has put pressure on both sales and margins due to their heavily discounted prices."

- PHM: "When you see the unbelievable movement in the market like we saw through October, as an example, buyers are in a position to want to cancel and frankly, rather than resell the homes, we would just as soon renegotiate them, generate the cash. Clearly our focus, as you've seen from what we delivered was on cash, and margins, candidly, took a hit as a result of that...We're doing a lot of negotiating at the closing table just to keep that sold backlog in backlog and get them through the closing process, and that deteriorated on us in the fourth quarter...if we thought the market was going to get better in the next 30 days, then we'd probably stand our ground...You've got markets like Las Vegas, for instance, where 60% to 70% of the resales are now either short sales or foreclosures."

- CTX: "Our headcount has been reduced by 30%, since September 30th, and we continue to be aggressive about further reductions...Our headcount will likely finish the year down 70%, from the beginning of the fiscal year, as we continue to consolidate regions and divisions, and make adjustments to our corporate operations."

- MTH: "We introduced 53 new plans based on extensive market research of what those buyers (first-time and first-time move-up) want in a home. All these plans are priced to fit within the FHA mortgage caps, where we believe most mortgage financing will come from in the next few years."

- PHM: "We have chosen to maintain our presence and support key strategic housing markets, unlike many of our competitors. And as we speak, we are increasing market share because of this long-term view."

- PHM: "We've got too much inventory; we've got more land in this kind of environment than we need...I think we could probably stand to improve returns for awhile before we put a lot of additional inventory out there."

- CTX: "As the cycle progresses, we'll start to see the banks work through the land and lots they've acquired. We've been in continuous contact with the banks so we can move quickly when the time is right. They're ramping up their processes now and we're prepared to take advantage of a new lower cost land opportunities that we believe will appear in the near future. Our home building operations were cash flow positive for the sixth straight quarter"

- DHI: An analyst asked: "I wanted to ask about land purchases and I know that you are in the move to conserve cash right now, but are there any areas of the country where you would consider adding to your land position if the terms were right?" The simple answer was "No."

It has been interesting to watch the transformation in these conference calls over the years. The executives have travelled a long road during the housing bust. Around the peak of the bubble, the housing execs were fond of complaining about the market's unwillingness to assign higher valuations to their stocks. As the market slid from the peak, the executives pointed to low employment and strong GDP numbers as reasons to believe that the housing market was fine. As the housing slowdown became too ugly to hide, some execs claimed that the market would recover fine once it worked through the inventory unloaded by speculators. Now that every prop to the housing market has been damaged, the homebuilders are focused on survival.

Be careful out there!

Full disclosure: short PHM, short TOL. For other disclaimers click here.