What Do Speculators Know from High Options Volume?

By Dr. Duru written for One-Twenty

March 12, 2009

I have often seen and read claims that relatively high trading volumes in options are good predictors of future stock prices. Over the years, I have grown increasingly curious about these claims because I rarely see reports on where and how these analyses go wrong, only when these claims work. Moreover, most large stock moves do not seem to be preceded by a surge in options volume at all. So what do Speculators know from high options volume? (For this piece, we will not explore whether or not the SEC should pursue more cases or get more insider-trading convictions where surges in trading volumes for options and/or stocks precede major stock-specific news).

I recently ran a small test to determine whether I could find any predictive value in options trading volume. Consider this a sample analysis on the effectiveness of systematizing trades triggered by high options volume.

My analysis of options expiring February 20, 2009 produced two main observations:

- The overall (downward) trend in the market dominates stocks' price performance regardless of the options trading. For example, stocks perform nearly the same (mostly negative) between the date of the high options volume and options expiration whether the high options trading volume is only in calls or only in puts. Also, the maximum price gain in a stock improves slightly if just puts are traded in high-volume instead of just calls.

- When both puts and calls are traded in high-volume on the same underlying stock, the stock's price performance is at least equal to the cases where only calls or only puts are traded in high-volume.

In other words, in this analysis, the overall (downward) trend in the market served as a sufficient trading signal for bearish trades. Over a wide selection of stocks, options trading volume provided little additional information for triggering trades. There is little unique information in the options volume itself that informs the trader whether to place a bullish or a bearish bet beyond the market's prevailing trend. I was quite surprised by the consistency of these results. They imply that any advantage gained from watching options volume comes from augmenting the trading rules with other sources of information. Similarly, the success of the trade is not dependent on the market expressing a bullish or bearish bias in the options trading until expiration.

Before I present the quantitative results, here is a summary of the context and assumptions:

- Trading data in options expiring February 20, 2009 started from December 30, 2008 - I am assuming that speculators who believe they have a unique informational edge look to profit from near-term moves and will use near-term options. Presumably, going into the last seven weeks of trading for a given options month, sufficient open interest has accumulated to make speculative trading volume more significant and noticeable.

- This time period includes the January/February earnings season, but the first week of earnings season started immediately after the January options expiration. This means this analysis likely includes a lot of earnings-based speculation. Implied volatility in a stock's options tend to increase prior to earnings and then implodes afterwards. This analysis does not capture the significant impact such volatility shifts can have on option profitability.

- I used the options filtering tools from OptionsXpress which forced a specific definition of "high" options trading volume. For example, I could define "high" as 50% of open interest. Instead, I had to work within ranges of open interest and trading volumes. The following three configurations defined "high" options volume on a daily basis: (A) Volume above 2,500 contracts with open interest between 100 and 1,000 contracts, (B) volume above 10,000 contracts with open interest between 1,000 and 5,000 contracts, (C) volume above 20,000 contracts with open interest between 5,000 and 20,000 contracts. These criteria create very high hurdles, especially for options whose open interest is already quite high. Yet, this filter still produced 856 individual options trades for analysis.

- The data sample is very small. I am only reviewing one of many possible contexts. The seven weeks prior to February expiration were dominated by a downtrend in an overall bear market. As noted above, it also includes the entire winter earnings season. These are specific scenarios that limit the ability to extrapolate and generalize my findings to other contexts and seasons.

- This analysis does not account for the quantity of money traded, just the volume of the contracts. The more money involved in the trading, the more significant that trading should be.

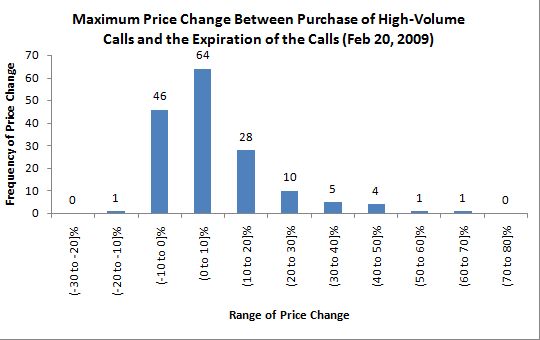

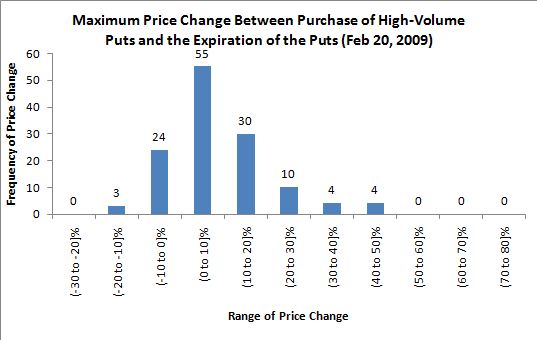

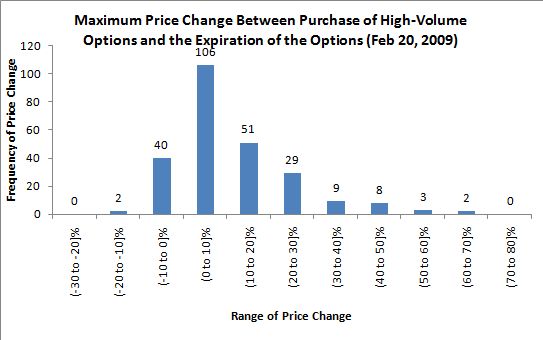

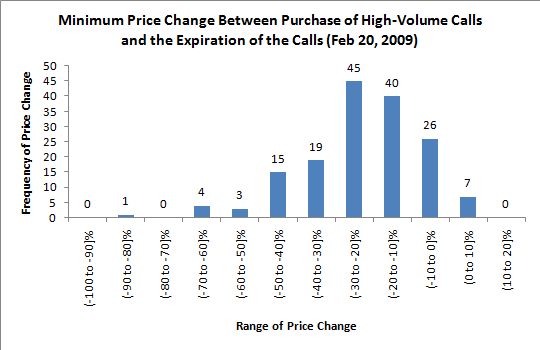

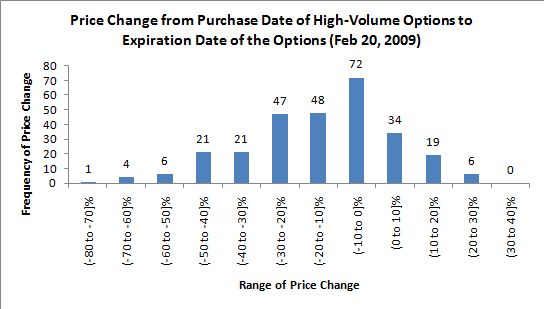

I describe the results of this analysis using a series of histograms. Each histogram is structurally the same. The x-axis represents the range of price change in the underlying stock from the time of the high options volume to either (A) the point of the lowest stock price on or before options expiration on February 20, 2009, (B) the point of the highest stock price on or before options expiration, or (C) the day of expiration. The title of each chart explains which of these scenarios is relevant. The price range is inclusive of the top of the range and exclusive of the bottom of the range. The y-axis represents the number of times (frequency) that an underlying stock achieved the price change on the corresponding x-axis. I do not attempt to distinguish whether the maximum return precedes the minimum return or vice versa.

Each high-volume options event is recorded with an "action date", the underlying stock, and various price points for the stock: close on the day of the high options volume, expiration day, the maximum up to expiration, and the minimum up to expiration. I also record the high trading volume of a different option strike or same option on a different day on the same underlying stock as a separate options trading event. This eliminates the need to determine why a particular option is traded. It also means that a stock that experiences broad-based options activity across multiple strikes and multiple days will count multiple times in this analysis. Fortunately, after eliminating options on the major indices, no single stock or sector-specific ETF dominated this analysis.

Finally, I separated the underlying stocks into three categories based on the kinds of options trading on them: (1) stocks on which calls represented all the high-volume options trading, (2) stocks on which puts represented all the high-volume activity, and (3) stocks on which high-volume option trading consisted of both calls and puts (note carefully that the action date was recorded from the time of the FIRST high-volume call or put activity). These distinctions allowed me to determine whether the type of options being traded had any significant predictive value on the resulting price change in the stock. Simplistically, we would want call buying to clearly signify a buying opportunity in the stock and put buying to clearly signify a shorting opportunity. It also means that each category contains a mutually exclusive set of stocks.

For all three price change scenarios - the maximum change, the minimum change, and the change to expiration - the distribution of price changes is nearly the same. (You can confirm this by converting the histograms' y-axis to percentage of observations). Note also that these data suggest it is typically not desirable to hold the options to expiration. When the underlying stock moves "significantly" in favor of the trade, it is best to take the profits.

At last, here are the results in graphical form...

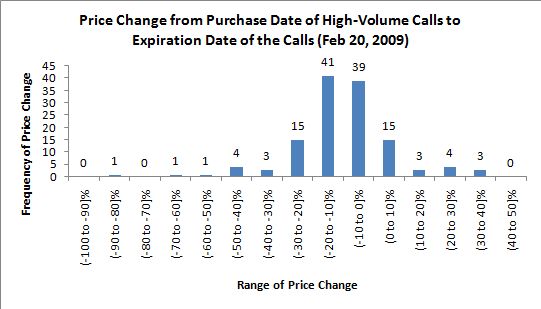

Price change from the day of high-volume options activity to the day of maximum stock price before option expiration

31% of the time (49 out of 160 observations), buying stock after observing high-volume trading in calls generated a maximum return over 10% before options expiration (these are the first three bars on hte histogram below)...

However, 37% of the time (48 out of 130 observations), buying stock after observing high-volume trading in PUTS generated a maximum return over 10% before options expiration! The distribution of price changes is nearly identical to the call buying above.

Moreover, 41% of the time (103 out of 251 observations), buying stock after observing high-volume trading in puts AND calls generated a maximum return over 10% before options expiration. Again, the distribution is nearly identical the two histograms above.

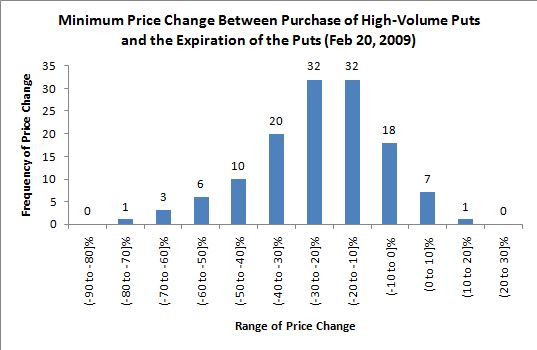

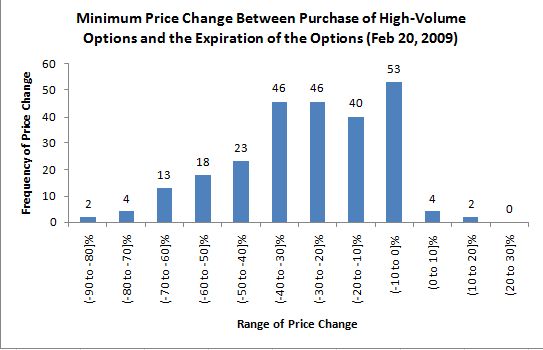

Price change from day of high-volume options activity to minimum stock price before option expiration

79% of the time, buying stock after observing high-volume trading in CALLS generated a minimum return (maximum loss) of at least -10%.

80% of the time, shorting stock after observing high-volume trading in puts generated a maximum gain (listed below as minimum return) of at least 10%. Since this percentage is the same as the call-buying scenario, we conclude that the general downtrend in the market dominates these results.

Similarly, 76% of the time, buying stock after observing high-volume trading in calls and puts generated a minimum return (maximum loss) of at least 10%. Once again, all three histograms for this scenario are very similar.

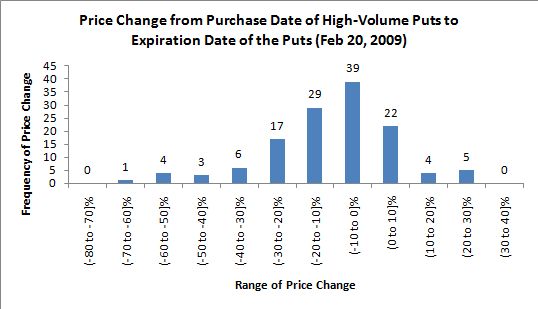

Price change from day of high-volume options activity to option expiration

50% of the time, buying stock after observing high-volume trading in calls generated a minimum return (maximum loss) of at least -10% by options expiration.

46% of the time, shorting stock after observing high-volume trading in puts generated a maximum gain (listed below as minimum return) of at least 10% by options expiration. Again, we conclude that the general downtrend in the market dominates results.

53% of the time, buying stock after observing high-volume trading in calls generated a minimum return (maximum loss) of at least 10% by options expiration.

I am still collecting options trading data. I hope to provide updates on this analysis in the future and determine whether the results change under different contexts in the market. Note well that these analyses are a bit tedious, so I cannot give any guarantees!

Be careful out there!

Full disclosure: No positions. For other disclaimers click here.