Several solar stocks have had very strong upward moves since the middle of May. Most of these moves are continuations of the strong upward trends from the March lows. Over the past three days, these same stocks have sold off on decreasing volume toward important levels of support.

The three-day correction has come just as Evergreen Solar (ESLR) finally joined the solar rally party. When the worst stock (company) in a speculative sector joins a rally late, the move is often a sign that the sector's rally is coming to some kind of conclusion. The traders and investors who arrive late to the party often look for the laggards under the assumption that these stocks will soon follow the leaders. The fortunate buyers thus pay a "discount" admission into the theme park. But these discounts typically come just near closing time; the last buyers have finally arrived.

Struggling ESLR announced a much needed common stock offering on May 20th that sent the stock plummeting 19% the next day. For almost three weeks it churned in a tight range before surging 29% on June 10 and another 11% the following day. Even with the selling the past two days in ESLR, it remains 32% above the $1.80 price of the stock offering. My guess is that it will return to $1.80 in short order: nothing has happened in the past week to suggest that ESLR is worth more than the valuation the company gave itself through the stock offering.

Now that I have provided an ESLR "tale of caution," here are the solar charts that are of most interest to me from the long side in the near-term: Ja Solar Holdings (JASO), LDK Solar (LDK), Suntech Power (STP), and Yingli Green Energy Holdings (YGE). (Note well that given the strong runs to date, caution is required no matter what ESLR is doing!)

JASO had a strong breakout above the 200DMA on very high volume. Strong up volume also occurred at two earlier critical junctures in JASO's rally, providing confirmation of the momentum. The pullback over the last three days has occurred on decreasing volume, ending with a small hammer pattern conveniently hovering right above the 200DMA. Look for a confirmation move above the hammer pattern which could send JASO well past the June highs. The 200DMA provides the stop level.

Recently, LDK has gone nearly parabolic on extremely strong volume (and no company-related news that I could find). The last 3 days have wiped out the last leg of the 3-day upward burst. With 200DMA resistance looming overhead, LDK is probably a hot potato you do not want to hold too much longer, at least not without some company-specific catalyst. There is a "reasonable" chance LDK experienced a "blow-off" top. However, a bounce from Monday's high could provide one more decent trading opportunity. Stop below Monday's low.

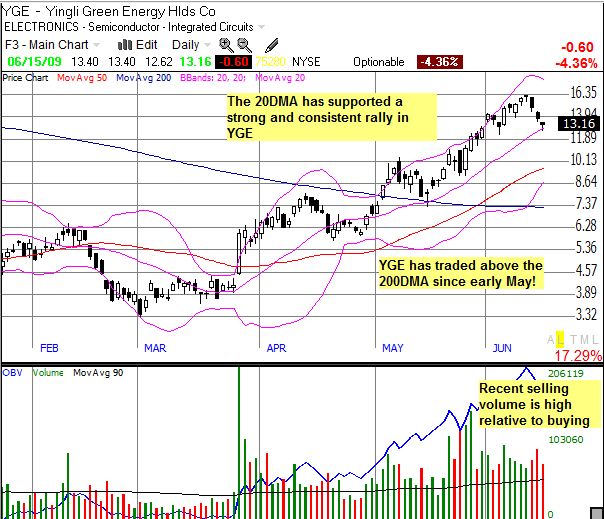

YGE has had one of the most consistent rallies of amongst all the solar stocks. The 20DMA has provided stiff support almost the entire way up these past three months. Look for this support to hold one more time as YGE formed a hammer pattern right at those levels on Monday. Note well that unlike the other trading candidates here, the volume on YGE's pullback is equivalent to the buying volume that preceeded it. So, I suspect that if support fails here, YGE could fall very quickly to its 50DMA at around $10/share.

Finally, STP remains my favorite short-term trading solar stock. This latest leg of its rally has been more subtle than its other more speculative cousins. With the high volume jump over the 200DMA, STP became buyable on a correction like the current pullback. The 50DMA and 200DMA are converging to form likely support. A stop below those levels makes sense here.

Be careful out there!

Full disclosure: Long TAN. For other disclaimers click here.