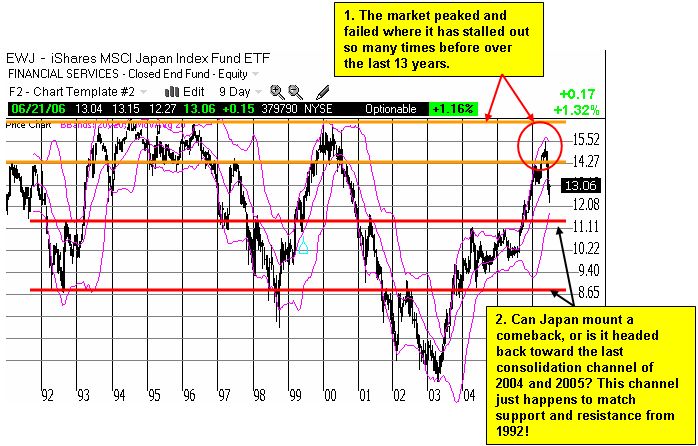

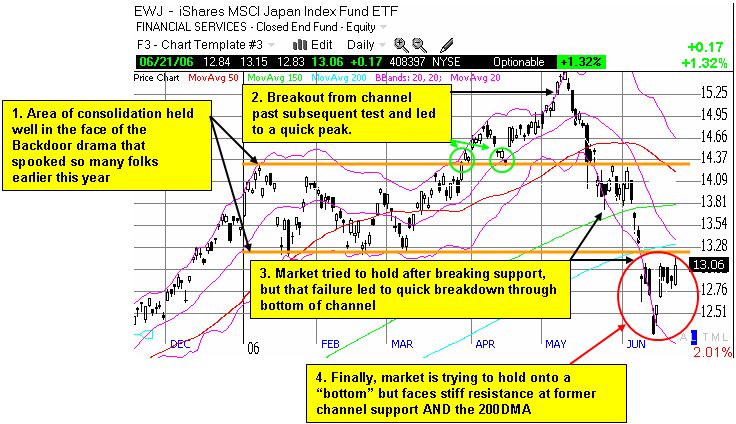

In light of the amazingly good economic news coming out of Japan yesterday, I took another look at the technicals of the Japanese market. I like to use the ETF for Japan, EWJ, as my proxy. I have been a fan for Japan for a while. My bullishness worked well earlier this year as the Nikkei fought off despair over the Live Door scandal and made an impressive run to multi-year highs. Now, the tables have completely turned. What was once support is now resistance, and the EWJ has gone from six-year highs to lows on the year. I should have excersied more caution as EWJ raced right into the channel that has provided tough resistance for the last 13 years. As the market corrects, it threatens to re-test the sloppy consolidation area from 2004 and 2005 - which also coincides to the churn from 1992. A lot depends on the health of the global economy. With the latest economic numbers showing exports and imports soaring, there is hope. But these same signals may give the central banks of the world one more reason to try to squeeze more liquidity out of the global money supply.

I have posted an intermediate-term and a long-term chart below to tell the story in pictures. I remain cautiously bullish on Japan (see disclaimer here), but another failure of the lows for the year will quickly turn me bearish. Such an event could trigger additional waves of selling that could take EWJ back to 2004 and 2005 levels.

So, be careful out there!

Remember that a break of the 200DMA is consider a very bearish event - a time for investors to sell and await a better day. Given that the economy of Japan still looks sound, I am inclined to wait to see whether the market makes new lows before converting to the "dark side."