The Consumer Lives On - Retail Sales Still Strong

By Dr. Duru written for One-Twenty

August 13, 2006

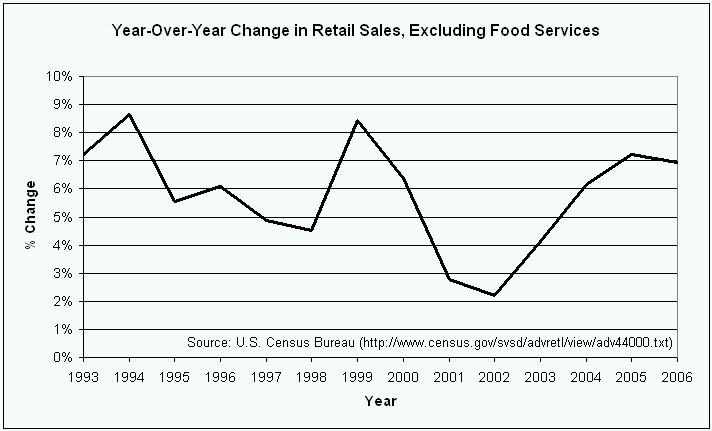

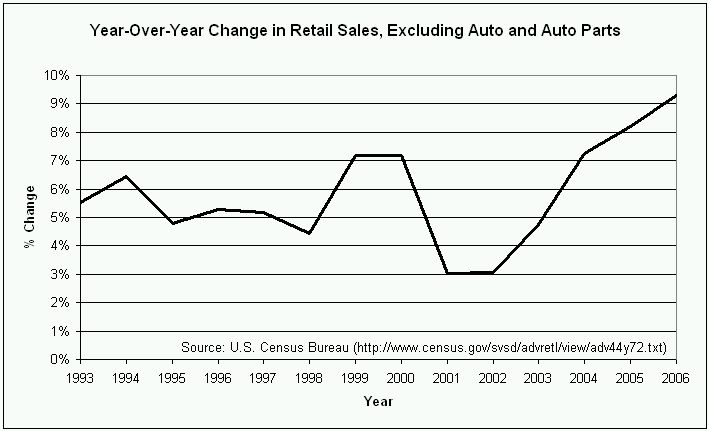

The ink was barely dry on the Fed's latest pronouncements and claim that slowing economic growth should tame inflation, when the Commerce Department reported the next day strong retail sales for July. I read various opinions as to whether this strength represented a blip on our way to recession or proof that the economic expansion remains intact. I decided to take a look at the data myself, especially since I had written earlier this year that Best Buy's earnings report demonstrated that the consumer was not yet dead. I looked at retail sales data from the U.S. Census Bureau from 1992 to 2006, first exlcuding food services and then excluding auto sales. For 2006, I annualized the sales figures using the ratio from 2005 (the ratio for all years in this sample was about 0.58). Finally, the Census Bureau reports that this data are seasonally adjusted, but not adjusted for price changes.

I have posted the charts below in terms of year-over-year changes. What you see is that when we include autos (and exclude food services), we see a trend of a very slow deceleration in retail sales growth. But, take autos out, and we find that in the past two years, the consumer has been stronger than in the past 13 years...at least! So, it is clear that the double stimulus of tax cuts and low interest rates gave retail spending a major boost after a huge deceleration following the bursting of the technology bubble. The auto industry has its own unique problems, so that sector of consumer spending should be considered on its own. Note well that the recession of 2001 and 2002 must have been quite mild because consumer spending continued to grow and did not contract. These data also demonstrate that two years of interest rate hikes have yet to slow the consumer (or the economy) down on an annual basis. In fact, retail spending has essentially grown stronger. It sure appears to me that the Fed's hopes that slowing economic growth will tame inflation will be quickly dashed. I am convinced yet again that the Fed will have to raise interest rates this year, probably at the next meeting - that is, if it want to continue to portray itself as a serious inflation fighter.

Now, of course all this spending is easy to do when you can pile on more and more debt and save less and less. We all know that at some point the gambit must end. This week, the sell-off accelerated in stocks of companies related to consumer credit . Companies like Accredited Home Lenders (LEND) confirmed once again that the mortgage business is shrinking, and investors quickly extrapolated. AmeriCredit (ACF), which provides auto loans to people with poor credit, sold off another 6% despite reporting strong numbers earlier in the week. Capital One Financial (COF) lost 3.4% and ended the week down 9.2%. COF is now scraping 52-week lows. So, while the retail numbers are singing a good tune, the financial markets are anticipating a swan song - the bright light before the bulb burns out.

One related side note. Even as consumers continue to pile on the debt in the face of rising interest rates, COF reported an interesting tidbit in their latest earnings release which is bad for them, but great news for the health of the American consumer. COF informed investors that "...the [U.S. Card segment] business experienced compression in net interest margin due to a decline in past due fees which accompanied strong credit performance." In other words, consumers are still accumulating debt, but many more of them are paying their bills on time. Let's call this one small step for the debt-dependent society. Now let's see whether folks can start saving more...

Be careful out there, and keep your credit cards to yourself!