I thought it would be 2007 or 2008 before I saw any positive headlines out of the homebuilders again. So, it came as a pleasant surprise that Brookfield Homes (BHS) reported Thursday night that new orders actually increased 6% year-over-year in the third quarter. What made this one bright light even more surprising is that BHS has a very high concentration of its business in overheated housing markets: San Francisco Bay Area, Southern California - divided into Los Angeles and San Diego, and the Washington, DC area. BHS's report shows that Southern California more than made up for continued declines in their other markets. Specifically, the Los Angeles area was the only one of the four to also show an increase in new orders when comparing the last nine months, year-over-year. The other three markets have suffered brutal declines. Finally, it looks like the increases in new orders have been supported by an increase in "active selling communities" in Southern California. There are of course no guarantees that this blip canbe sustained, but it is something different in what has been a dim year for homebuilder headlines.

What also interests me about BHS is that it has the second highest short-interest of the homebuilder stocks that I check on from time-to-time. I have updated my list that I last posted on August 4th. Back then I noted an unusual surge in buying and the stock prices in many homebuilder stocks, and I thought the high short interest in these stocks might explain the large moves as shorts got squeezed. The format for the list is as follows: [stock name]: September's short ratio, July's short ratio, and May's short ratio if I recorded it back then.

- BHS: 30.3%, 20.3%, n/a

- BZH: 16.6%, 17.0%, 20.30%

- CTX: 10.7%, 8.6%, 7.80%

- DHI: 5.1%, 3.6%, n/a

- HOV: 33.5%, 31.9%, 14.80%

- KBH: 12.3%, 11.1%, 9.50%

- LEN: 9.8%, 7.3%, 7.70%

- MDC: 19.2%, 14.8%, n/a

- MHO: 18.0%, 17.6%, n/a

- MTH: 20.7%, 18.1%, 13.90%

- PHM: 10.1%, 9.3%, 7.60%

- RYL: 19.8%, 13.7%, n/a

- TOL: 15.3%, 12.1%, 11.10%

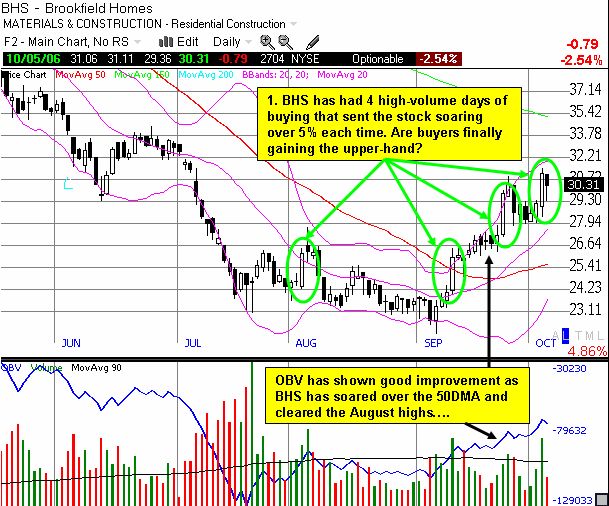

If the stock market has a message here, I think it is telling us that folks are more interested in buying BHS than selling it. The chart below shows a dramatic improvement in on-balance volume (OBV) and, even better, BHS is one of the few stocks in this universe to have significantly cleared the price of the first surge on August 4. In general, homebuilder stocks have moved sideways in a wide range as this apparent bottom attracts believers (you can see this best in the homebuilder ETF, XHB).

In related news, Fed Chairman Ben Bernanke and Vice Chairman Donald Kohn spoke separately on Thursday on the outlook for housing, inflation, interest rates, and the economy in general. Not much new from either man, but it I am intrigued by the Fed's continued insistence that inflation risks remain even as the market has entirely bet against such a possibility. As long as the Fed decides not to raise rates, their vocalized concerns are really just so much lip service. The market is more tuned into the prospects for slower growth and a potential rate cut next year. And we can tell that the market is betting on slower growth, but not too much of a slowdown, because the housing stocks have stopped going down for now. Higher unemployment and wage losses would cause the current bust in the housing boom to accelerate into an outright crash. Housing stocks would get even cheaper than they seem to be now. In fact, I think this is the one risk that the market has completely under-estimated, and it is what keeps me from joining the increasing calls for a bottom in housing stocks. Interestingly, while the major indices reacted very positively to Thursday's Fed-speak, the 10-year yield went up slightly and most housing stocks stayed flat or went down: BHS closed down 2.5% on the day. Regardless, I will be watching for the market's reaction to BHS's sliver of good news. Folks have been particularly vigorous in buying after bad news, so it stands to reason that good news should really get things hot and bothered. Stay tuned on that one. (Note that I am neither recommending a buy or sell on BHS, although I am giving serious consideration to getting on the bandwagon. See my disclaimer here).

Be careful out there!