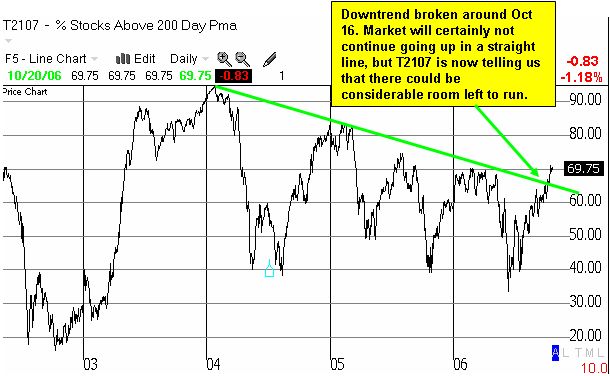

It is looking more and more like the bears will have to put off their doomsday scenarios for yet another year. I am a little late in posting note of T2107, but it has finally broken through the downtrend that has persisted for over 2 1/2 years. (Please see previous posts for more explanation of this indicator). I consider this a bullish development and a confirmation of the current, strong rally. See the chart below. This also means that I am again fully endorsing the "buy on the dips" bias that I first endorsed back in January. A buyable dip may finally be in the works as last week was full of ominous earnings news for important cyclical and semiconductor companies. T2108 is also near over-bought levels at a reading of 76.4 (see earlier post for more explanation). However, I suspect the overall market cares much less about actual earnings this month than the outcome of November's elections. The election results, or even the anticipation of results, could generate a major firming or shift in sentiment that will overwhelm all else, at least until other economic news reassures or refutes the market's assumptions.

I find it quite ironic that the bears were calling for a big correction in the general market, and, instead, the huge correction came in oil and other commodity-related stocks. It was the kind of decline I suspect the bears expected for the general market. I also wondered whether the correction was a sign that the underlying economy was indeed weakening as demand softened up. Oil is still in a tailspin but other commodities, especially copper and steel, have been on a sharp rebound. Even natural gas is trying to find some kind of bottom these days. I earlier claimed that commodities "had" to bounce along with the market's general bet that the economy is still healthy. And, here we are. Steel stocks like CHAP and OS are at 52-week highs, and copper company Phelps Dodge (PD) has surged about 20% from its October lows to challenge its 52-week high set earlier this year. The market got a one-day inflation scare last week and then moved on, but the resurgence in commodities should put inflation back on the radar of the Fed. So, I still maintain that it is not "done being done" just yet. Increased consumer spending could support inflationary pressures, but I would caution anyone from equating cheaper gas prices with increased consumer spending on other goods. As we have seen for much of this year, consumers never stopped spending even as gas prices were soaring. The key there will remain expansion of easy credit and employment growth.

Be careful out there!