2006 produced some great gains for the U.S. stock market. The Dow, S&P 500, and the Nasdaq all clocked double-digit gains. The grinches have "hrumphed" at these gains and pointed out that these gains are the worst amongst developed economies across the globe, except Japan. When you factor in the hot developing economies in Brazil, China, and India, you can indeed see that the U.S. is a mouse amongst men. Part of the problem is that the U.S economy is slowing down while other economies have remained hot. Another problem is that the U.S. dollar continues to crumble as a lack of fiscal discipline in Washington and accumulating debt loads amongst consumers have produced a flood of dollars on the world currency markets. And no doubt the on-going fiasco in Iraq continues to erode the world's confidence in the U.S.'s ability to remain a dominant force in the world economy.

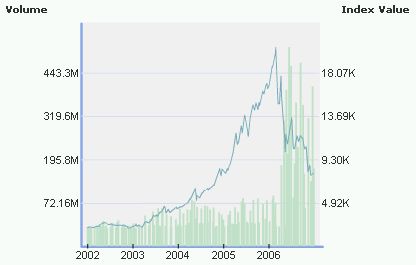

Many of you have heard all of this over and over. But there is one news story that I am surprised has received scant attention in the American financial media. Back in March, the bubble in the Saudi Arabia stock market popped. Never mind that this happened within less than a month of the time I even noticed that stock markets across the Middle East were hotter than hot. Instead, note that the stock markets in the Middle East continue to sink like stones. The Saudi market in particular has been pounded back to 2004 levels. The TASI ended 2005 at 16,712, peaked around 20,634 and ended the year at 7933. A gut-wrenching loss no doubt. Larges losses were also recorded in places like Jordan and Egypt. The chart below shows the drama.

Note how the volume has soared in the past 6-7 months as investors and traders ahve come to the sickening realization that their market is not coming back anytime soon. Oil prices peaked over the summer, and I am sure that added to the "market has topped" sentiment. I do not know enough about the market to make an educated guess as to whether the disaster will deepen, but the five-year chart below demonstrates that selling can easily continue. You can clearly see that the volume has skyrocketed on a historical basis. This means that folks are stil bailing on the market. If you believe that all parabolic moves must revert to more normal behavior, then I would say the market will not bottom until it reaches levels last seen in the beginning of 2004. In other words, more gut-wrenching losses ahead before things get noticeably better. And if oil prices continue to sink, we will see this correction accelerate. (Click here for a November, 2006 AP article on the Saudi stock market crash.)

As money comes out of the stock markets in the Middle East, I can only assume that this money will find new homes in other hot markets around the world. Whether this latest bubble deflation serves as a precursor to rapid deflations in other hot parts of the world in 2007 remains to be seen. Certainly, we financial animals never learn our lessons about the inevitable disaster that rampant speculation produces.

Happy New Year, and be careful out there!