TraderMike does his usual good job painting the technical picture for Google. It ain't pretty. I have said plenty about Google over the past two years or so, but I must say that "something" truly different happened post-earnings on Google this time around. The stock did not gap up or down with a monster move. In after-hours the stock first jumped and then shot downward to a low around $486, right at the 50DMA. In pre-market trading the day after earnings, a few analysts provided upgrades and suddenly the stock shot back upward and right past $500. There was just enough momentum to give GOOG the smallest of gaps upward. And it was all downhill from there. In other words, it was a whole lot of chop that sent the stock on one swift roundtrip. Note that all this churn and chop was simply a micro-version of what Google has been doing during this current 3+ month trading range. Now, GOOG sits right back on top of its former all-time high set at the beginning of 2006.

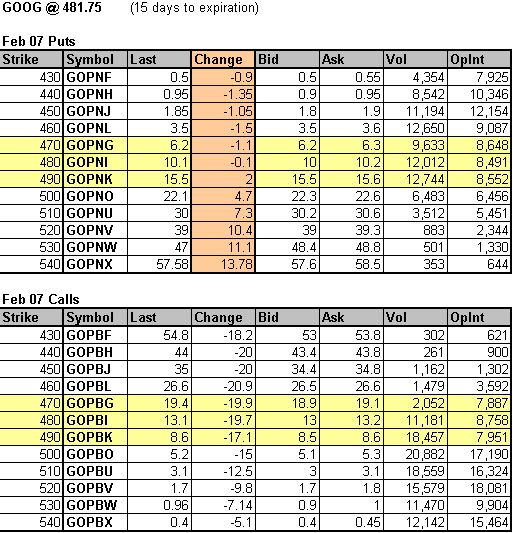

The overall one-day decline in Google's stock was "only" 4%, but the gyrations probably left even the hardiest of traders nauseated. And I am sure options buyers left the day wanting a vacation for the rest of the year. Almost everyone who tried to play Google's earnings by purchasing options in advance of the announcement lost money. I am referring specifically to February options as earnings-players typically will use the front-month options. I post the day-ending option quotes for February below.

Notice all the minus signs? If you purchased calls, you were of course out of luck for any strike price. But the puts did not even start making money until the 490s. I believe any hedged strategy was a big loser as well. The only people who made any real money on puts, purchased deep in-the-money puts. (Google closed the previous day at $501.50). The leverage on all the profitable trades was horrible given the risks involved. So, it was the sellers who made the real money - mainly the brokers that grease the skids. The sellers made a double-bonus. Not only did they cash in on the high implied volatility premium that comes with earnings time, but they also got a stock that barely budged after the smoke cleared. Essentially, the market got good at anticipating Google's earnings and performance this time around. The more Google chops and churns, the less attractive it is to buy options - unless you are a perfect timer. Instead, the real money will likely be made selling Google options. Selling options has its own risks of course, and it requires high levels of liquidity (margin) and often times knowledge of complex strategies to lower risks. So I cannot specifically recommend any strategy, just the theme. Moreover, one day, Google will disappoint the street bigtime, and the stock will flop for 15 or 20% or more...as all tech stocks seem to do at some stage. That one event could wipe out all profits from selling options (puts in this case) up to that point for the careless. Otherwise, it is hard to see the "casual" investor making much on purchasing GOOG options anymore.

Be careful out there!