I have not written much about oil and gasoline since the beginning of this year. I really dropped the ball not taking more advantage of the sharp drop in oil prices that we got back in January. I feel even worse for not staying on top of my perennial favorite oil and gas play, Valero (VLO) and now its amazing cousin Tesoro (TSO). We find ourselves with the media and our politicians all hot and bothered that gasoline prices are back at the $3 level. I think this is the third time we have reached these levels in the last two years. So, given the fevered pitch of gasoline news, it seems natural to ask whether the hype has become over-extended yet again. Or will this time be different?

Let's start with a bit of oil politics. Forbes had an excellent article last week called "Pumping Politics" which essentially lambasted Congress for its feeble history of attempts at price controls for gasoline. I wrote a short piece criticizing Hawaii's attempt to cap wholesale gasoline prices back in 2005. Like taxes, gasoline prices are an easy hot-button issue. Most of us have to pay up, and we all like it when taxes and gas prices are lower, not higher. So, most politicians cannot resist having an opinion that tends to pander to our desire to have more money in our pockets, not less. The basic problem with our current energy situation is that we have a heavy dependence on foreign imports of oil, have limited gas refining capacity, and a national ethos that has yet to embrace energy conservation in any significant way. We have problems on both sides of the oil supply and demand divide.

It is energy conservation that has the most promising, near-term solution to achieve lower energy prices (and a cleaner environment to boot). So, when I hear all the belly-aching about high gasoline prices and no accompanying serious attempt to reduce gasoline (or energy) demand, I cannot help but see gas prices go even higher. This behavior should also concern those of us who think that inflation is more of a problem than the financial markets want to acknowledge. The last two times we hit the $3 mark, supply came to our rescue. When supply finally fails to save us, and we decide to accept $3 levels for gasoline, it means we have achieved one more notch higher on our inflation expectations. These higher prices will force consumers to add more debt and/or cut back on purchases of certain discretionary expenditures (consumers have long shown a preference to add to debt). And supply will certainly fail us at given rates of worlwide oil and gas consumption. I keep reading that incremental oil production is falling behind incremental increases in consumption (for example, read "Global Oil Production Peaking: What Happens Now"?, and I still haven't seen a new refinery get built in the U.S.!

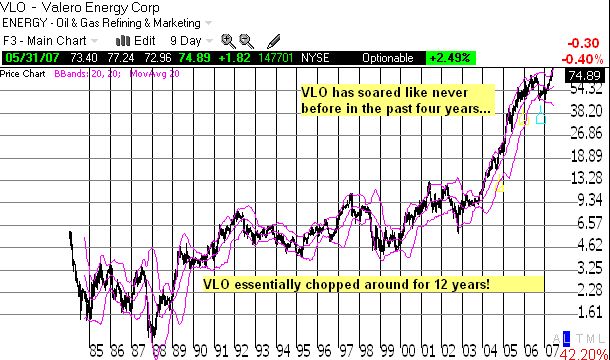

Despite this gloomy picture, the contrarian in me still could not help but think that all this talk about gasoline prices has reached the kind of feverish pitch that often marks some kind of top. Add to this the seasonal factors: Memorial Day weekend marks the beginning of the summer driving season and the market should be now anticipating lower gasoline demand sometime soon in the future. So, I turned to the charts of the refiners to find some clues of a top...and I simply could not find much of a chink in the armor. Refiners like Tesoro (TSO) and Valero (VLO) have been on sharp, nearly unbroken, up-trend since the vicious lows in January. Refiners like Holly Corp (HOC) barely budged in January on the way to ever higher stock prices. Even a laggard like Alon USA (ALJ) finally showed some life, mainly in March. The long-term charts of most of these refiners are even more impressive. Since the incursion into Iraq began in March of 2003 - an event that was supposed to bring much lower oil prices and not the much higher ones that we have now - refining stocks have been on a historic tear. For example, the 733% gain in VLO (from $9 to $75) since then is unmatched since 1989. And the gains in 1989 simpy represented the sharp recovery VLO made from a particularly devastating collapse in price in 1988. Otherwise, VLO spent the 12 years preceding the Iraq invasion just chopping around a wide trading range.

TSO essentially went nowhere for 17 years (1985 to 2002) {But what a remarkable collapse it experienced in 2002!). Yes, folks, welcome to "permanently" higher gas prices. Continue to laugh at the analysts who look for oil and/or gasoline to return to the "good old days"!

So, if you really must push this hype issue, I found ONE potential chink in the armor from the technical review of the charts of the refiners. TSO has chopped around in May as on-balance volume has experienced its first one-month decline (see chart below) this year. I was waiting for this to translate into a top, but I think this is wishful thinking given the bigger picture! (See disclaimer here).

Be careful out there!