{Correction to this missive posted on June 24, 2007}

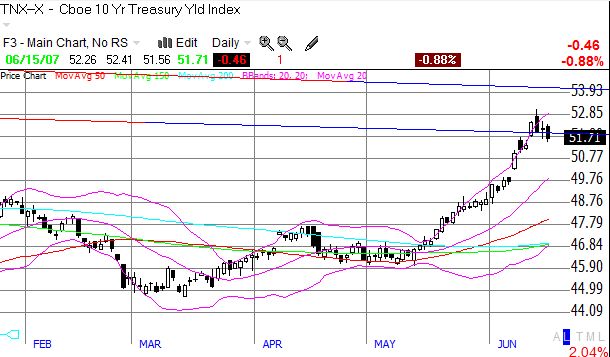

Saved by the economic bell. On Wednesday, we got word that retail sales came in surprisingly strong: up 1.4% versus expectations of a 0.6% gain. That's extremely good considering oil prices were reaching for last year's highs and gas prices had already passed it. In general, consumers continue to ante up for gas and do what is needed, aka debt, to keep consuming. The bond market responded in kind by sending rates up again in line with the strong trend nearly straight up since mid-May. But by the end of the trading day, rates were down from the previous day. Two tame inflation reports later and a tepid industrial production report to boot, and we find ourselves inching back down into Tuesday's dramatic gap upward. A whole lotta drama.

The bond market has been served up two big reality checks: the Fed is not lowering rates anytime soon (if they had only listened to me way back when), and the struggling housing market is still not sending the economy into the toilet. But with inflation still being reported as under control (nevermind the prices of stuff we really care about like childcare, healthcare, food, and energy!), the bond market also cannot get overly concerned. The economic data is saying we are hot but not too hot and this was enough to keep rates trapped at the long-term downtrend. Yep, rates are actually still going down.

Let's do an update on where we stand relative to the historic long-term erosion of interest rates. This time, I have drawn two downtrends: the top line is drawn from the peak in rates in 1981, the second line starts from the spike in rates that helped cause the big crash of 1987 and manages to connect with highs in rates in 1994/95 and 2000 (yep - right before the dot-com bust).

A close-up on rates shows we are now jumping along the lower down-trendline and have not quite smashed through the upper line.

Clearly, we are sitting at one of those important junctures. While things look precarious for the bulls, I will remind the bears that the major indices have fought back to multi-year highs despite rates. And assuming the long-term downtrend in rates remains intact, there are many basis points of downside in rates to give bulls plenty more reasons to keep on buying. Trader Mike makes the great point that rates are "due" for some kind of retracement after such a powerful move upwards.

Be careful out there!