Tradermike posted an article from Businessweek lamenting that the bottom in the housing market remains elusive: "The Housing Mirage." It seems like folks, including myself, have been trying to predict and time bottoms in this struggling sector almost as soon as the bubble began sliding from its top in the summer of 2005. This year, I have mainly taken the tack of playing the housing sector one technical bounce at a time. Two weeks ago, I said it was time to step aside and let the bears go to work on the homebuilder stocks - and boy did they ever! I am writing now because I noticed significant upside volume in the homebuilder ETF, XHB, that was more than twice the 3-month average. It formed a bullish engulfing pattern that can signify the end of a recent downtrend. This volume was particularly notable on a day where a surge in buying in the major indices produced technical bounces that did not produce signifcant increases in volume.

Of particular note: Hovnanian (HOV) had a 5% pop with a bullish engulfing pattern, and Centex (CTX) had a tremendous volume surge three times the average!

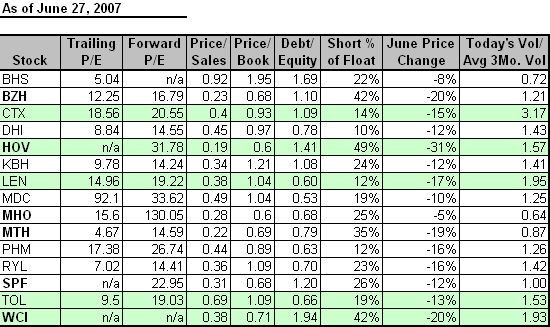

So, how much damage have the bears produced in the homebuilders? Well, the month of June has produced double-digit losses, and then some, across the entire spectrum of homebuilder stocks that I follow. The chart below shows the June declines in individual stocks, today's volume compared to the 3-month average, short interest as of May 10, and some fundamental metrics. Stocks in the green rows had particularly high surges in volume, and stocks in bold have book values less than 0.7 - a level that is supposed to represent particularly attractive value for homebuilders.

Source: Yahoo!Finance

Suffice it to say that the bears have leaned heavy on these stocks. I suspect that today's huge volume in the XHB is partially from shorts buying up to hedge individual shorts. It seems that the bad news is again reaching fever pitch levels. The latest news comes from Beazer Homes (BZH) after-hours. BZh fired its chief accounting officer for trying to destroy company documents. Let's just say that the chances just went up for finding a smoking gun somewhere in the on-going investigations of potential mortgage fraud and federal regulations. Reuters reported that Toll Brothers' CEO claims the housing market will not bottom before April 2008 (that would make for the THIRD anticipated Spring rebound in a row!). Finally, we got a sour earnings conference call from Lennar (LEN) which put the icing on the capitulation cake from the homebuilders by further confirming we should expect cotninued housing deflation. The following is a summary from briefing.com yesterday, June 26 (emphasis theirs):

The overriding sentiment in reviews by co was market is becoming more competitive as inventories are managed; great deal of downward pricing pressure through the use of incentives, price reductions and brokerage fees. Most of the competitive sales are of standing inventory homes which resulted from either cancelations or prior purchasers putting their homes the market... growing backlog of existing homes that are not selling at yesterday's prices, and they will soon be repriced in order to sell. Overall, the supply of homes to sell continues to climb in many markets; will not be able to get a good reading on how quickly this inventory will be absorbed.... On the demand side, the investors/purchaser part of the demand is now long gone; Primary purchasers are either on the side lines or demanding better pricing before purchasing... Because of the continued deterioration of the subprime lending market, an additional component of demand has been s idelined because of the inability of customer to say qualify for a mortgage or because the purchaser of a customer's home needed foreclosing cannot qualify... would expect to see FHA loans to continue a trend that has already begun, and that is to absorb a big portion of this demand... leading indicators and timing of a recovery have proven thus far to be elusive; suspect that we will not know that a recovery is coming until it is already upon us... co says have seen some markets continue to deteriorate; says many of their markets are not at the low end as competition continues to heat up; says need to stabilize the inventory that is out there first and foremost... notes cancelation rates have been staying around the 30% level... Co believes balance sheet will strengthen as they get towards the end of the year...On the gross margin side focus on construction costs has been heightened for well over a year. I think that we made meaningful progress; think tha t the force of price increases or decreases is stronger than the force or costs increases or decreases... backlog conversion ratio is right around 100%; selling and delivering and aggressively making sure that inventory is being delivered to customers.

The news has gotten about as bad as it can get again for the short-term. Many homebuilder stocks have made fresh 3 and 4-year lows until today where we finally saw some serious buying action. Finally, the 10-year yield has come tumbling down as fears of a liquidity crunch in the debt markets have sent folks scurrying for the "safety" of treasuries. So, I believe the time to buy for the next bounce in the homebuilder stocks has arrived. A violation of today's low on XHB would be a good sign to get out if a bounce to some key resistance like the 50DMA does not get you out with a profit first. See disclaimer here.) But please do not call this "the bottom" - not yet anyway.

Be careful out there!