Throughout the recent bull market in the stock market, I have frequently heard that the investment brokers like Goldman Sachs have been "printing money." I have understood this to mean that business has been booming, and these financial powerhouses have been able to name their price for issuing IPOs, brokering mergers and acquisitions, selling bonds and other debt, and other financial wheelings and dealings.

Lately, I have understood this printing press in a different way as I continue to read more and more about the creative derivatives and leverage used to make mucho money in the home mortgage business. Paul Tustain at BullionVault has written the best article I have yet read describing how American ingenuity has generated an effective printing press out of debt: "Investment Landfill: How Professionals Dump Their Toxic Waste on You". It is written in plain English and easy to understand, albeit very long. I highly recommend it if you want to get a better look at how financial powerhouses are able to wield the power of debt, leverage, and derivatives to create money essentially out of thin air. All is well until some event forces reality back into the equation - like home prices coming down to reflect "real" asset values and not just imaginary values based on expectations of flipping the bag to the next buyer - or like enough folks realizing that they cannot pay a mortgage (or other debt burdens) on zero income.

Here is a key quote from the beginning of the article:

"It all starts with the mortgage. About six million people in the United States who have no money have borrowed about 100% of the value of a house, right at the top of a housing market which has since fallen sharply. These are the subprime borrowers. The lenders, however, did not have to worry very much about the risk of default, because they rolled these mortgages into bonds called Mortgage-Backed Securities, which they then sold. They got to be off-risk within a few weeks, because by then these re-packaged mortgages belonged to other financial organizations."

Folks like Tustain belong to an elite crew of bears who despise paper currency and believe in the holding power of real assets, mainly gold. They are typically written-off as looney perma-bears, folks who refuse to play the game and in the end lose out on all the riches. Since the stock market has mainly gone up for countless decades (or more specifically, in a several very powerful spurts), it is easy to discredit them. But over these decades, we have also had serious financial crises. It pays to at least stay on top of these kinds of critical assessments of the financial system so that you can prepare yourself, if you so choose, for the collapse of whatever boom happens ot be in vogue at the time. The crumbling housing market has yet to take out the American economy, but clearly the potential remains if the financial institutions who possess the "red button" do not figure out new schemes to keep the shells shifting.

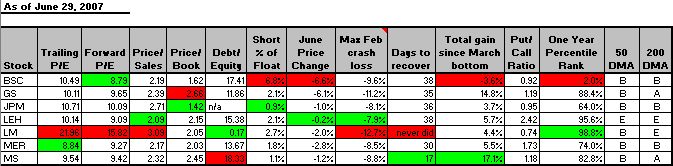

In the meantime, I have been thinking through how to use the brokers to hedge against some sort of stock market calamity related to the unwinding of financial leverage. I am figuring that if things resolve just fine, then the strongest financials will soar yet again, and if things do blow-up, then the weakest of the bunch will get crushed. I have posted a table below that I am using to formulate a framework. My first experiment was buying a call on Goldman Sachs (GS) and a put on Merrill Lynch (MER). Small potatoes but it worked even better than I expected. If I do not reload for later in July, I will definitely position myself by late August. Sorry I do not have more time to go into my developing thoughts based on this data, but I think you select folks that take your precious time to read my pieces can figure out something! =smiles= If you really want to "talk" further about it, feel free to email me.

Note that in the last two columns, "B" stands for "below", "A" stands for "above", and "E" stands for "even." Red color indicates the worst of a category and green stands for the best of a category.

Be careful out there!