Share Click here to suggest a topic using Skribit. Search past articles here.

A week of full of earnings reports from various solar companies has highlighted the bruises, cuts, and scrapes in the solar sector. Across the damaged list of publicly traded companies, we find many stocks trading in the single digits - and that includes the solar ETFs TAN and KWT. We received reports from the likes of ReneSola (SOL), LDK Solar (LDK), Trina Solar (TSL), Suntech Power (STP), and Canadian Solar (CSIQ). The good news was far and few between. What stuck out most to me was the (all too familiar) vigorous selling that followed LDK's earnings report that featured increases in revenue guidance (Q4 revenues of $555.0-565.0 mln vs. $512.99 mln consensus. FY09 revenues of $2.9-3.1B vs. $2.57B bln consensus). Lazard cut their price target on LDK from $16 to $12 and explained its skepticism based on the margin outlook: "LDK will suffer further gross margin erosion, resulting from the increased D&A charges as its polysilicon plants come online, which will likely not be offset by increases in revenue." Amid the doom and gloom, the market has all but left solar stocks for dead. Let's review some of the events and flurry of analyst commentary over the past few weeks since I last lamented about the state of solar stocks. That was just as the last bear market rally in these names was peaking.

The peak of the last bear market rally in solar was punctuated by a flurry of call buying on November 4th. After stocks like First Solar (FSLR) had rallied over 70% in just over a week, options traders in solar stocks decided to load up on calls. This "buying panic" likely occurred in anticipation of a continuation of the run after the resolution of a Presidential election featuring two pro-solar candidates. FSLR, LDK, Evergreen Solar (ESLR), CSIQ, and Solarfun (SOLF) saw some of the most aggressive call-buying. All of these stocks had made new 52-week lows by the time these calls expired on Friday.

On November 12th, Digitimes reported more confirmation of weakening demand and downward pressure on the pricing of solar wafers. As reported from briefing.com:

"...spot prices for polysilicon have dropped sharply, as demand from solar cell makers has weakened due to the onslaught of the global financial crisis and Spain's cut in feed-in tariffs for renewable energy, according to industry sources. Whether sold directly by the suppliers of through brokers, polysilicon from major suppliers, including Hemlock, Wacker, REC, MEMC, Tokuyoma, Sumitomo, and Mitsubishi Material is now priced at $250-300 per kilogram, down from $400 in October, the sources noted. Solar cell makers are no longer as keen as they were to stockpile materials, the sources said, adding that many solar cell makers are currently waiting for prices to go down further. Some traders who have stockpiles of polysilicon are now under pressure to offload the material. Additionally, semiconductor players are also trying to sell their excess polysilicon to the solar market, the sources remarked." Also: "...the price level of a 6-inch solar-grade silicon wafer in the spot market stands at $9 currently, dropping by 10-14.3% from $10-10.5 quoted in October 2008, according to industry sources in Taiwan. The price drop is mainly because the global demand for solar cells has turned slack for the time being since Spain's incentive program expired at the end of September 2008, the sources pointed out. Before the end of September 2008, spot market quotes for such wafers had once climbed to $11-12.5, the sources indicated. Several small makers of 6-inch solar-grade silicon wafers in China have offered prices of lower than US$9 in the spot market, but the product quality may be an issue, the sources noted. As $9 is still higher than but close to existing contract prices of 6-inch solar-grade silicon wafers, Taiwan-based makers of crystalline silicon solar cells may ask for re-negotiation of such contract prices if spot market prices further slip, the sources pointed out."

The barrage of analyst downgrades and negativity continued in November - some of it in response to or in anticipation of last week's solar earnings. The few positive words were reserved for First Solar (FSLR) and Energy Conversion Devices (ENER). Here is a sampling:

Nov 10: Deutsche Bank issues a comprehensive downgrade of CSIQ, FSLR, ENER, and SPWRA after getting burned by the fake-out on the post-election trade: “While there were arguably better spots to step out of solar PV company stocks earlier in the fall, several factors…have helped spur appreciation in some names off of recent lows. We were lax to step out of solar PV stocks anticipating an Obama win in early November, and while timing may not be perfect, we believe appropriate positioning for [the first half of 2009] would be reduced exposure to the group.” The basket of reasons for the downgrade are all familiar: rising cost of capital, reduced access to capital, declining fossil fuel prices, worsening 2009 macro environment, and significant module price declines.

Nov 17: Memc Electronic Material (WFR) warned (again) on revenues and margins for the current quarter. Most important was what WFR had to say about industry conditions: "The weak macroeconomic environment has continued to deteriorate, and has had an increasingly negative effect on the semiconductor and solar markets over the past few weeks. These effects are quickly cascading backward through global supply chains, and we cannot expect to be immune to the impact on our customers in all the markets we serve. This recent sequence of events has increased pricing pressure in the short term solar market and exacerbated the demand weakness in the semiconductor market."

Nov 17: Business Week quoted the positive commentary on ENER of several asset managers and analysts. They cited superior products and excellent execution. Unfortunately, this did not stop the stock from falling another 20% on the week.

Nov 18: J.P. Morgan joined the downgrade festivities: "We believe very high subsidy levels in Europe are unsustainable and are likely to be reduced significantly over time. As a result we believe 2008 reflects a peak in solar energy subsidization with risk of cuts going forward. U.S. and Chinese companies also face pressure from strengthening currencies." However, FSLR was given a special exemption as a "safe haven" company.

Nov 18: Hapoalim Securities maintained its sell rating on FSLR and dropped its price target to $80 from $90 after attending the European Photovoltaic Industry Association's thin-film conference. Hapoalim claims that the Street does not fully understand the risks to sales, revenues, and earnings.

Nov 19: Friedman Billings downgraded and lowered its target for First Solar...and dragged the rest of the industry through the mud as well: "Recent checks suggest that FSLR's new strategy in the U.S. market is already facing headwinds. Although projects such as Sampra are proceeding well and actually expected to be scaled up to 30 MW-plus, they believe that the distributed segment is where the levelized cost using FSLR's modules does not offer better economics when compared to crystalline modules. They view FSLR as the best in the business to maximize the return on assets (a key differentiating factor in a commodity-type industry such as solar manufacturing), but this does not imply that customers have no choice! They expect FSLR, along with the rest of the solar stocks, to remain under pressure, and they would encourage profit-taking on any rally." (as reported by briefing.com)

Nov 21: And what would a somber earnings week be without a full slate of fresh analyst downgrades? Barron's provides a list of five analysts that downgraded a comprehensive basket of solar stocks.

Whew! I have to believe that the analyst chatter cannot get any more negative at this point. I would call this a contrarian buy signal, but the overall, on-going liquidation in the stock market means that the constant beating from analysts reinforces the conviction of sellers and drains the confidence of potential buyers. One has to wonder what big money institutions are out there still eager to buy solar stocks? The market has left solar for dead. We should expect in the short-term that any rallies will lack holding power (it is a bear market after all). Even though there are some politicians who remain convinced that investments in alternative energy are national energy and security imperatives, the severe decline in energy prices (oil, coal, and natural gas) will take the edge off any collective urgency. The outlook for solar will not improve until the outlook on global economic growth improves.

I have now closed out all of my short positions in solar stocks and am back to 100% long, mostly in my long-term positions. The shorts did so well, it sure made me wonder why I was long any solar at all. But here we are with solar stocks finally priced more like the speculative investments that they are. First Solar is an interesting exception. Its valuation across trailing and forward P/E, P/B, and P/S is well above all its compatriots. This valuation reflects the confidence the market has that First Solar will be one of the stronger survivors of the shake-out that is likely to come soon to the solar industry. However, when FSLR hit my target of $85 on Thursday and Friday, I still felt no urge to buy. (It does not help when the long-term investments have been reduced to wasteland status.) The gap down on Thursday marked the failure of a triple bottom (click here for my explanation of why triple bottoms tend to fail) and only a high volume surge above this support-turned-resistance wouldfs turn the technical outlook around. In the meantime, important support at $75 is coming up. See chart below.

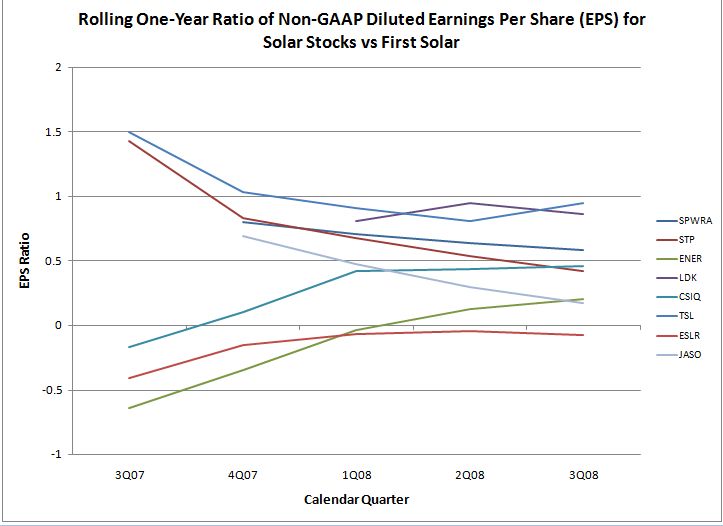

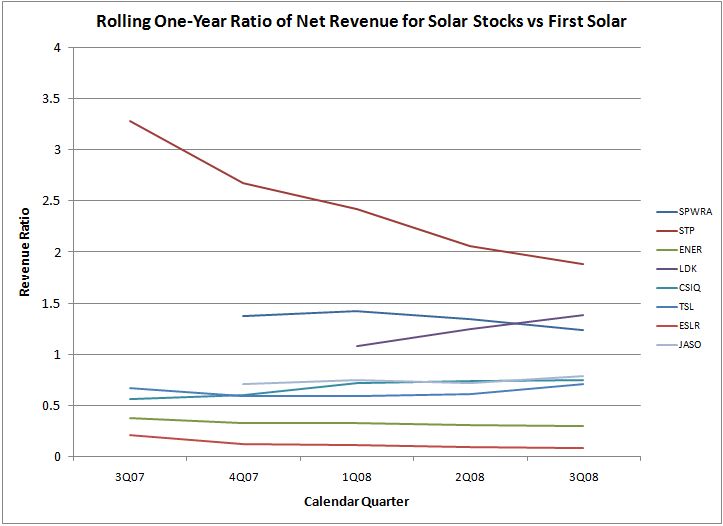

I also tried to compare FSLR's earnings and revenue trends to other solar stocks for evidence that FSLR deserves its valuation premium. In the charts below, I graphed out the ratio of FSLR earnings and revenue to other solar stocks. To capture trending and to account for seasonal variation, I calculated these ratios on a 4 quarter (one year) rolling basis. I included those companies for which I could get enough data (all data from briefing.com). I was surprised to see that FSLR is not pulling away from the entire set of solar-related stocks. On the earnings front, JASO, STP, and SPWRa lag FSLR. On the revenue front, STP is the clear laggard. Ironically enough, I still hold a long position in STP and last week purchased a small amount of SPWRa for the long-term basket. I probably have some rethinking and re-alignment to do soon, especially given the awful technical picture.

Be careful out there!

Full disclosure: long STP, SPWRa, TAN, Solarworld, 5N Plus, Arise Technologies. For other disclaimers click here.

Share