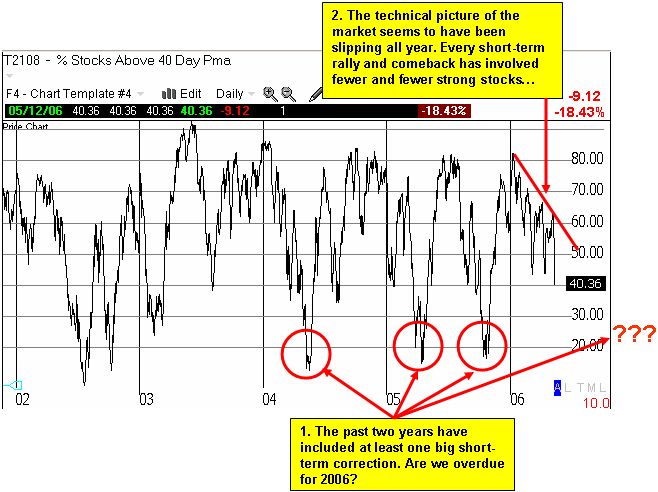

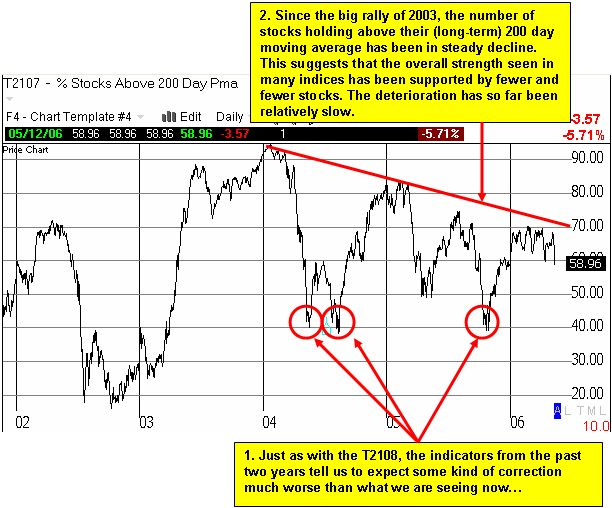

TraderMike did another one of his excellent technical reviews of the market. There are warning signs all over the place of a market that may be trying to put in some kind of a top. This is not Mike's conclusion, just me reading between the lines. Back in late February, I pointed at some "earnings fades" to suggest that the market seemed to be getting tired. The stocks I listed there have provided mixed results as about half are below and half are higher than the earnings fades I flagged. This time, we are seeing widespread technical damage that is much more convincing of trouble ahead. When I see this kind of thing, I like to pull up T2108 and T2107: these are two special charts provided in TC2000 that indicate what (approximate) percentage of stocks are above their 40 day moving average and their 200 day moving average respectively. These indicators are a great way of determining how broad-based the pain or the euphoria is in the market. What we see today is potentially a slow but steady decline in the overall technical health of the stock market:

T2108 has bounced all over the place, even during the big rally of 2003. We should expect this kind of volatility in a short-term indicator. Stocks can maintain long-term up-trends while whipping up and down through their short-term trading averages. So, you should focus on 1) the current trend - which is decidedly down, and 2) the likely range we should expect to see in a year - which tells us that we are long overdue for a big correction. Put #1 and #2 together, and you cannot help but worry even as many indices are hitting new multi-year highs. Each short-term rally has carried fewer and fewer stocks with it.

T2107 is a long-term indicator. RIght now, it tells us that the market has been struggling to "hang in there" since the big rally of 2003. The decline in the longer-term technicals has been slow and steady. We would not even know it based on the numerous indices hitting multi-year highs and the strong rallies taking many sizable stocks to 100% gains and more. However, as TraderMike shows with the Dow Jones Industrials, it seems that a few stocks are doing a lot of the big muscle work to keep the party going. Also witness how many of the large-cap tech stocks have been in serious declines for much or all of this year - to multi-year lows even. The trend tells us that fewer and fewer stocks are standing in with Atlas.

The biggest bull markets are in commodities (including oil, mining, and minerals) and materials and the industrial companies that help extract these commodities and materials, and even many of the companies that consume them. The economy has been surprisingly strong (albeit bought at an apparently heavy price of massive debts) so each correction has been greeted by happy bargain hunters. I suspect that the current correction will eventually be bought abruptly, sharply, and vigorously. We may even soon get back to new multi-year highs. But with the Fed leaving the market in a cloud of uncertainty over the timing and frequency of rate hikes, we will see more volatility. more instant emotional outbursts, and more knee-jerk reactions to the latest headlines that appear to provide clues to the picture on inflation. Cash rates are around 5% and potentially going higher. These are not ideal conditions for investing and maintaining money in equities. And with many economic indicators about as good as they can get, like the high rates of GDP growth, historically high earnings growth in individual companies, and the particularly low unemployment rates, you know it is time to give the contrarian side serious consideration. That is, things are so good now, it is hard to see how they could improve. But things are good enough for the Fed to keep fighting against us rather than for us. You cannot sell 'em all, but the buyable bulls will likely continue to thin...

As always, be careful out there!

Independent Thoughts

=========================================================

There are a number of categories of credit cards, issued by different companies and banks in order to introduce different packages. If you are a holder of citi cards, you may use them anywhere in the world for shopping for different goods of daily life. The credit card debt is offered to cater to customers' financial needs instantly. There are a lot of manufacturers of credit card processing machines which are fitted in banks to check the number and password of the credit card. The credit card types are introduced to fulfill the specific requirements of the users. The travel credit card holder may get such privileges for using these valuable cards in order to meet financial needs while traveling.