I have a lot on my mind but so little time. So, I will point your attention to three charts and provide quick commentary. I also have a few links that could be of interest.

By now, it should be clear to you that all the news of Wall Streeters canceling August vacations was a sign that trading desks need folks to figure out how best to liquidate assets and raise cash levels. The bumrush out of financials has been particularly dramatic and many big and regional banks are sporting fat yields of around 5% now, including Bank of America (BAC), Comerica (CMA), Integra Bank (IBNK), and National City Corporation (NCC) is up to 6%. Note carefully that NCC is highly exposed to the troubled mortgage sector. As the dividend drama in Thornburg Mortgage Inc. (TMA) shows, sometimes even the company itself has no idea how much its dividend should be when pricing in the debt markets is so uncertain and volatile. The trouble in financial stocks has caused the S&P 500 to hurt more than the NASDAQ. Something new happened to the S&P 500 on Tuesday even as the NASDAQ managed to hold the line with a close right at its 200DMA.

Note here how the S&P 500 has mightily churned in the past two weeks with a small net move. On Tuesday, for the first time in this churn, the S&P BOTH opened and closed convincingly below the 200DMA. The onus is definitely on the bulls now to straighten out the S&P's posture. The only saving grace was the below average volume on the decline. Perhaps the bulls can drum up the rally cry to ride the "wall of worry" again. Oh boy. This move is pretty bearish, but before you too hit the sell button, let's not forget the false breaks of the 200DMA that we had in 2006's sell-off scare. Between June and July, the S&P 500 dipped below and above this critical technical line several times before shooting nearly straight up until February, 2007.

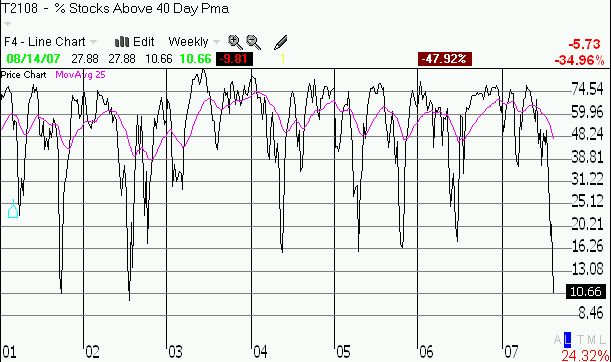

Even more notable are the T2107 and T2108 indicators. I have mentioned both of these before...it just so happened they provided great warnings of the 2006 summer swoon. Now, the indicators are at lows we have not seen in a VERY long time!

This indicator tells us how many NYSE stocks are above their 40-day moving average. At this point, essentially NONE! And this has not happened since the painful lows of the summer of 2002. This indicator alone tells us a big bounce is right around the corner for the markets.

T2107 tells us how many NYSE stocks are above their 200DMA. This indicator is now just as eye-popping as T2108. We haven't been this low since the early formations of the current multi-year bull run back in March, 2003. Sure we can go even lower, but I suspect it won't happen until we get a bounce that takes the T2108 higher first.

So, what to do? Well, do not initiate any big shorts here. Watch for the inevitable rally/bounce. Perhaps sell into it alongside the big boys. And see whether the next low in T2107 does the trick. In the meantime, the credit crunch will continue to play out and leverage will unwind - often with devastating effect to individual firms. Tuesday's poor retail results from Wal-Mart (WMT) and Home Depot (HD) just added more pressure to the markets. If the consumer FINALLY makes moves to raise cash levels (similar to what a lot of the "smart money" is doing now) and actually SAVE, look out below! I sure chose a GREAT time to declare I had become a bull because of the "price action", right? Oh boy... For now, I am sticking to a bullish outlook, but that will likely switch if we take out the lows of the year, and it will definitely switch if we fall out of the channel that this bull market has created over the past 3 years or so. (Note that financial stocks are already trading at new 52-week lows and many are at multi-year lows! Like the homebuilders...)

Here is a video from a Wachovia analyst talking about the stresses in the credit markets that I found particularly interesting: "Wachovia strategist highlights 2 stressed markets"

And what the heck, I will include a link to Jim Cramer's plea with the Fed to do something to help the rich bankers. (In case it somehow disappears from You Tube, you may also find it on CNBC here).

Be careful out there!