Click here to suggest a topic using Skribit. Search past articles here.

The "bull advantage" that I wrote about in early May lasted all of two weeks. By May 26th, I was compelled to note a series of charts that warned me that lower prices on the major indices were likely to come soon. Here we are almost a month later and former resistance that served briefly as support has become resistance again. The one-day sell-off on June 6th was a major turning point. That was the same day that oil had its largest one-day price gain percentage since 1996. Although oil has since held steady in price, the S&P 500 has continued to sag since then. So, while it is tempting to hope that a correction in oil prices will bring new life to the stock market, we should be wary of such a quick conclusion. Inflation is engulfing the global economy, and folks in the U.S. seem to finally be taking it seriously. These inflation expectations will weigh heavily on U.S. markets and will intensify as the Federal Reserve's return to easy money policies over the past many months finally starts showing up in the U.S. economy. If oil craters, it will probably be a reflection of a continued slowing in economic activity and not because the world's alarmed inflation fighters are winning the battle.

The charts below show the many points of technical weakness that have me believing that the S&P 500 is Struggling & Peaking (S & P). (Volume not included).

The weekly chart of the S&P 500 shows two peaking formations. The horizontal lines represent the climactic lows from March and August 2007.

I think a break to new 52-week lows will confirm the second peak as a (short-term) top and further extend the time before we ever rechallenge the 2007 and all-time highs. Note that when we take this step back, we also see that the S&P 500 has essentially gone nowhere for the past two years. Friday's price marks the high in May, 2006 right before we got a deep correction on early recession fears. All this chop, fluctuation, and gyration have given both bulls and bears plenty to celebrate and agonize over and over and over, but in the end, this stuff is simply tiring... Add in a 2007 peak that failed around the highs from 2000, and we get a whole lot of nowhere. Adjust for inflation, and we get holes in our pockets.

The daily chart allows us to zoom in on the important technical levels established by last year's climactic lows in March and August (again, see the horizontal lines).

I know the non-technicians out there are going blind right about now, so let me restate the case here. The climactic lows from 2007 need to succeed as support for any rally to be sustained. Instead of support, we have been slapped with four false breakouts above these levels. The April-May false break is the most damaging as it sucked in a lot of buyers and a lot of hopes for a second half recovery. Eventually, the buyers and eager bottom-spotters will "get the point" and not wait for the sellers to fade every rally. We will get a failure of resistance that sticks and marks a sustained top. The down day on June 17th may have provided us that failure. The 200-day moving average (DMA) has sloped downard all year. The S&P 500 peaked in May right at this resistance with an ominous evening star formation. The failed test of the 200DMA confirms that a longer-term downtrend remains in place. Our final confirmation of struggling and peaking is Friday's massive sell-off. The volume surge was no doubt distorted by options and futures expirations, but it should be taken seriously. Friday's price action cracked below the April low. This means that almost all of the monster rallies of 2008 have been returned to the sellers. I count three monster rallies in March left to go before we get a retest of the 52-week lows.

All these negative indicators greatly increase the likelihood of a retest of the 52-week lows. We should expect the last buyers hanging around for the summer to try to defend those levels. I strongly suspect such efforts will eventually fail and my target low for the S&P 500 of 1200 will come back into play.

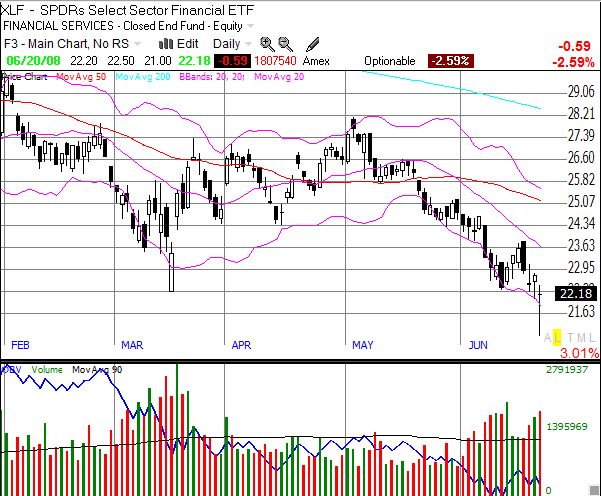

Finally, the XLF provides an example of what we might expect out of a failed attempt to defend important 52-week lows. On Thursday, there was some excitement because the March lows were cracked and gave way to a rally that got the XLF to close above those lows. However, the volume was not even close to the climactic lows from March and sellers went right back to work on Friday. A gap down, more selling, and a close near the open puts the XLF in the new 52-week low list.

The Philadelphia bank index (BKX) made new 52-week lows at the beginning of June and was our first clear warning for June. It is now down another 15% or so from there. So, we should not be surprised to see the XLF continue to slide from here. And with weak financials, the S&P 500 will continue to struggle...

One quick side note...The Dow Jones Industrials closed Friday at 11,842.69 (I care more about the Dow as a psychological gauge than a real indicator of value in the stock market). It is now just another 1.8% drop away from cracking its 52-week low. The Dow took six years to break its former all-time high around 11,750 set in January, 2000. It is no "accident" that the Dow bounced from that magic number back in March, 2008. Something tells me the buyers will once again attempt to defend these levels, but a major, two-year false breakout seems imminent given all the negative catalysts I have referenced before. This is what happens when a small minority of stocks are powering an index - much like the energy and commodity-related stocks are helping to prop up the S&P 500...

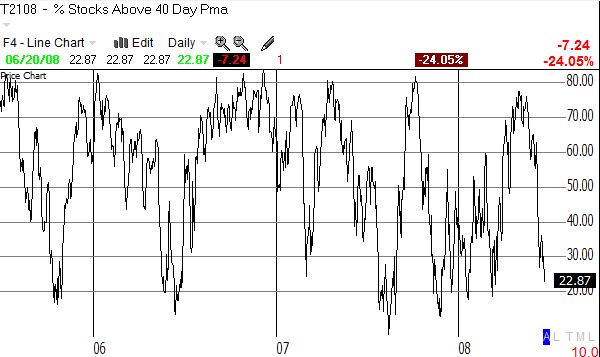

Finally, do not forget that we get another Federal Reserve meeting on Wednesday. This meeting could force a strong swing in the pendulum of short-term trading. Look for the Federal Reserve to do its best to talk up the prospects of the economy while at the same time talking down the specter of inflation. The Fed will say it remains vigilant on both fronts and will pretend it can both boost the economy and fight inflation at the same time. T2108, the percentage of stocks above their 40 day-moving average, supports the case that the market is getting ready for a reflex rally. T2108 has rapidly cratered to 22.87. Below 30 is typically considered oversold territory, and below 20 presents very poor risk/reward conditions for new short positions. The chart from the last two and a half years shows how sharp bounces can be at these levels. Our two climactic lows this year, January and March, did not produce rubberband-like bounces until this indicator dropped below 20.

Be careful out there...!

Full disclosure: Long the S&P 500 in an index mutual fund. No position in the XLF or the DIA. (See additional disclaimers here).