Click here to suggest a topic using Skribit. Search past articles here.

On June 11, I tried to make the case that the stock price of First Solar (FSLR) does not properly reflect the risks to its business and premium valuation. I also laid out the technical case that seemed to confirm short-term weakness. Yesterday (June 23), FSLR all but nullified my technically-based complaints with a nice one-day 7.4% jump in response to analyst upgrades. AmTech's price target of $450 was perhaps the most significant piece of news. Briefing.com supplies the following quote:

"AmTech says that since becoming a public co, shares of FSLR are up on average 14% from the completion of any given quarter (the June 30, 2008 equivalent) through the report date. Excluding the reporting period for Q407 where shares were down 34% into the print due to general macro concerns and a difficult tech tape, shares of FSLR are up 24% on average into earnings reports. Outside of firm's longer-term positive thesis on FSLR, they believe that there is likely a near-term trading opportunity in shares prior to earnings. Firm believes the Q208 pre-earnings trade is setting up similarly to Q207 as the co is currently ramping capacity in Malaysia, similar to the German ramp in mid-07."

I calculated the percentage moves in stock price that FSLR has experienced from the close the day after an earnings announcement to the close right before the next earnings announcement - so this data excludes the one-day move from the last earnings announcement: 2/14/07 to 5/3/07 = 32.6%, 5/4/07 to 7/31/07 = 68.8%, 8/1/07 to 11/7/07 = 55.5%, 11/8/07 to 2/12/07 = -21.8%, 2/13/07 to 4/30/07 = 27.8%. Clearly, traders look forward to FSLR's earnings reports! Monday's price move has almost pulled FSLR even with its close the day after the last earnings on 4/30/07 ($303.98). If I had earlier noted these strong runs into earnings, I would have been forced to reduce my short-term bearishness on FSLR in the last piece! Anyway, if history is any indicator, then let's set a "conservative" target of a 20% lift between earnings for a $360 price target. A stop at the June low of $233.97 gives you a potential loss of 19%, so the risk/reward on this trade is little better than 1:1. A stop under the last small correction at $265.20 gives a potential loss of 8%. Much better, but also much higher chance of getting stopped out.

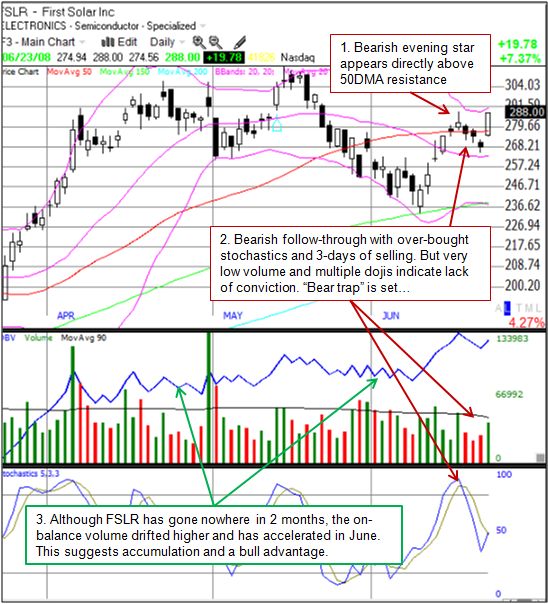

The chart below shows the current technical picture. When I last wrote on FSLR, I noted that the strong on-balance volume was one positive. It looks like it could now be the underpinning of a any pre-earnings rally. (The chart does not include notes on overhead resistance marked by the all-time high at $317 or the congestion area from April between $268 and $304 or so).

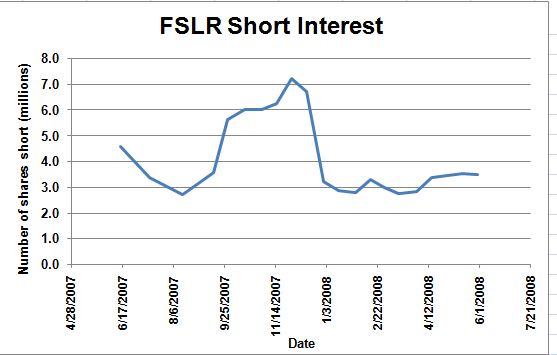

Note well that my use of the term "bear trap" is not to suggest that a short squeeze may be underway. In fact, the bears seem particularly "quiet" on FSLR. The put/call ratio is about 1.25, but that ratio is just around the middle of the range for FSLR over the past year. The shorts were hot and heavy on FSLR's case in the second half of 2007, especially after a big dip in August. But FSLR went on to almost triple in price by the end of the year. The shorts bailed almost perfectly at the top of that run. The chart below shows that the number of shorts in FSLR cratered after that top and has since remained near the 52-week lows. (Data from nasdaq.com)

I remain highly suspect of FSLR's premium valuation, but I must respect the market action and building momentum and switch to a (short-term) bullish stance. Note this a one-month (high risk) trading call only. I personally would not be long going into FSLR's next earnings report. As indicated above, a break of the June low before earnings will invalidate this view. A break below the last correction low puts this view at high risk of invalidation. Also note that with all the analyst chatter in the past month or more speculating about FSLR's business, FSLR has yet to make a single announcement regarding new contracts, new business, progress on its Malaysian manufacturing plants, earnings and/or revenue guidance, etc...

Be careful out there!

Full disclosure: No position in FSLR at the time of writing. For other disclaimers click here.