This economy is truly President Obama's mess now. The market greeted Obama with its worst showing ever for an inauguration day (I also heard that inauguration days tend to be down days anyway). While Main Street partied like the 1990s, Wall Street sulked like the 1930s. Volume on the S&P 500 was the highest of the year - apparently everyone on Wall Street was too busy selling to be bothered to pay attention to the inauguration. Tuesday's selling has now brought the S&P 500 within one trading day of retesting the 52-week lows. In other words, at 805, the S&P 500 is trading where it opened on the day it made a new closing low (Nov 20, 2008) and right above where it traded the day after it cracked a fresh low (Nov 21, 2008). Between dead-cat bounces and false rallies, of course it could take much longer than one day to retest (and break) the 52-week lows.

This misery is a sharp contrast to the hope and optimism that opened the year with the S&P 500's 3rd best start to a year since 1950. For now, pundits cannot utter catchy phrases like "all the bad news is priced in" or "unemployment is a lagging indicator" or "the market is a forward-looking indicator" (this last one seems to only apply when the market is rallying in the face of bad news...or rallying period).

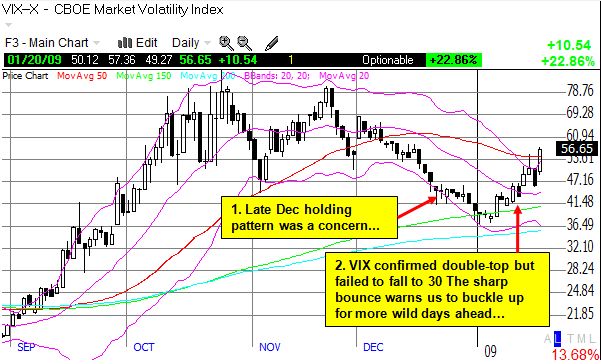

In response to the year's open, I stated: "I will even go so far to guess that January 2nd delivered the bulk of the gains we will see for the month." At the time, I thought this was a very conservative guess given the balance of good and bad signs, but it has become over-optimistic anyway. One bright side is that the over-bought reading on T2108 served as a good warning to move back to capital preservation mode. There is now a very high likelihood we will retest (and eventually break) the 52-week lows as everything I stated had to hold to sustain a rally has failed: the December "final wash sale" support on the S&P 500 at 816 finally failed, the VIX's double-top did not follow-through down to 30, and the Obama bounce story lost its cache as bad news is now being sold instead of bought. I realize there is a lot of bad news swirling around as it seems every bank in the Western world is spiraling downward to zero (and nationalization), but I continue to take my cue from the unemployment numbers. Every new turn for the worse tells me to expect worse from the economy and the stock market. I have yet to see any evidence that the worsening job situation is a sign that the recession has begun to run out of steam and/or marks a clarion call for a lasting market bottom.

The charts below summarize my current view on the S&P 500 and the VIX. The increase in volume on Tuesday's selling is a bad sign, especially on a day that traders should prefer to stay away from the market.

Be careful out there!

Full disclosure: long S&P 500 in an index mutual fund. For other disclaimers click here.