I Prefer to Observe XLI Trading Action Here, Not Follow It

By Dr. Duru written for One-Twenty

March 30, 2009

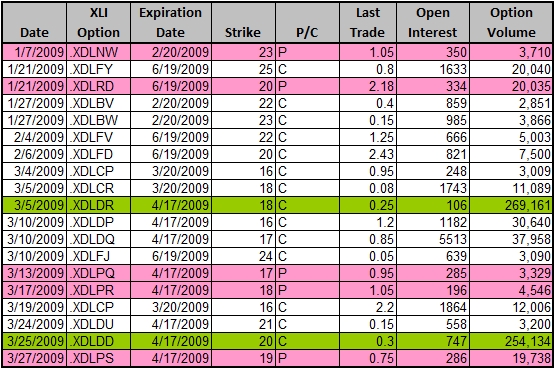

The industrial sector ETF, XLI, has garnered a lot of interest this month as trading in calls has twice reached impressive extremes. On March 5th, near the recent bottom of the market, 269K April 18 calls traded against a mere 106 open interest. Apparently, these calls were closed out for a large profit on March 25th after the durable goods data came in much better than expected (see Fast Money, March 25, 2009, 6:10 in the video). A small portion of the profits were promptly re-invested in XLI April 20 calls contributing to volume of 254K versus open interest of 747. This big money speculator (or speculators?) is now riding on the house's money with a sizeable profit already secured. The temptation is to assume that even larger gains are to come in XLI. However, the large speculator is now in a no-risk position and likely feels free to roll the dice big. With no "skin in the game" automatically following the second phase of speculation carries much more risk than the first.

Since I am already collecting options trading data, I decided to look a little closer at the trading in XLI. I have collected this options trading data for the past several months as part of an effort to determine any tradable correlations between options volume and a stock's future price direction. I have supplemented this data with a review of the put/call ratio and short interest.

The table below shows all trading days of high trading volume in XLI options where volume well-exceeded existing open interest at the time (see earlier piece defining "high options trading volume"). Puts are marked in pink. Note that there has been a strong bias toward calls when action has really heated up.

While the high-volume trading has been dominated by calls, I am surprised to find any high-volume trading days in puts after March 5th. Then again, all the call-buying before this date resulted in an almost complete loss at the February expiration when the XLI closed at $18.67. According to my earlier analyses, the trend of the overall market seems to dominate the performance of speculating in high-volume options; that is, no matter whether calls or puts are traded in high-volume, traders do best to stick with the overall market's movements for directional trading. Since the XLI so closely follows the S&P 500, a trade in XLI should abide by a forecast for the near-term trading trend in the broader index.

The chart below shows just how closely the XLI follows the S&P 500. The green line represents the price action of the S&P 500.

The put/call ratio can provide additional color on the ability of options speculators to generate accurate stock price signals. I did not use this indicator in the previous analyses. I use Schaeffer's put/call ratio which measures open interest of all options expiring in less than three months. XLI experiences a large spike in mid-January from a put/call ratio of 0.50 to over 1.50 in a matter of days that flashed an accurate sell signal (click here to construct the chart). But by mid-February, speculators turned optimistic almost as suddenly as they had turned negative a month earlier. This shift turned out to be premature as the XLI continued to sell-off into early March. The large purchase of calls on March 5th sent the put/call ratio down to an amazingly low 0.10, the lowest for at least the past 12-months. Anyone looking at just the put/call ratio at that time would be tempted to conclude that such a brazen show of complacency in the midst of general investor pessimism and persistent selling was a sure sign that the XLI was going to go even lower! In other words, bottom-fishers typically look for contrarian signals like a spike HIGHER, to new highs even, in the put/call ratio and NOT the other way around. Overall, the put/call ratio for XLI provides mixed results as a harbinger of future prices in the ETF.

So, why bother trading in the XLI when it is so closely correlated to the S&P 500, and where one's high-volume trading will be noticed by just about every trader in the known universe? The first thing that comes to mind is that perhaps the goal IS to get noticed and to generate a snowball of followers that carry the trade ever higher. Easier to do this in a sector-specific index than in a broad-based one. But as we noted above, the XLI is tightly tied to the fate of the S&P 500. Moreover, the XLI includes many heavily-traded, very liquid equities. It is not likely that one trader alone could move these stocks.

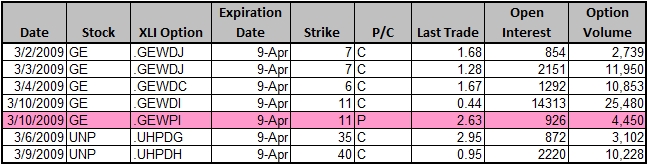

The next possibility is that the speculator "knows" something about at least one of the larger components of the XLI. The top 10 holdings comprise 48% of XLI's assets: 3M COMPANY (MMM), BOEING CO (BA), EMERSON ELEC CO (EMR), GEN DYNAMICS CP (GD), GEN ELECTRIC CO (GE), HONEYWELL INTL INC (HON), LOCKHEED MARTIN CP (LMT), UNION PACIFIC (UNP), UNITED PARCEL SVC (UPS), UNITED TECH (UTX). Of these, only GE and UNP also show up as having high options trading volume this year (see chart below). GE of course has been dogged by a lot of news risk surrounding its financial unit. Very interesting to note that call activity really picked up as GE sold off heavily for three days into its 52-week, and multi-year, lows. Again, not what we typically would expect at a climactic low. Could it be that all this call-buying is from the hands of perfect market-timers? Maybe even the legendary Plunge Protection Team (PPT)? Or perhaps shorts looked at the selling climax and decided to more heavily hedge positions in case of a bounce? We may never know...

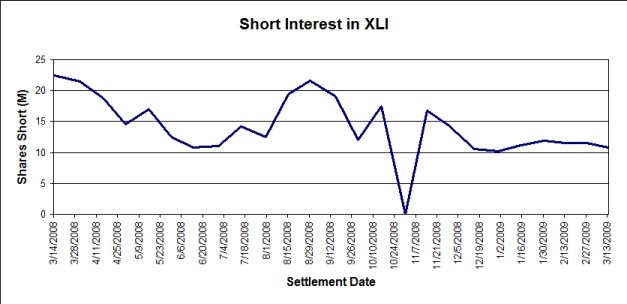

The timing of the shorts in XLI appears to be at least as good as the timing of the call buyers. The chart below shows the total short interest over the past year. Shorts reduced their bets after the lows of March, 2008 to the near-highs in July, 2008. They then accelerated their bets going into Labor Day and profited all the way down to the next set of lows (I assume the drop to zero in October is a bad data point). After which, once again, shorts smartly reduced bets. After another peak in the market to start 2009, shorts increased bets again, but this time, not nearly as much as one would expect given the carnage that followed. At this point, it is very tempting to declare that these gyrations are the hallmark of a bear market that periodically produces the sharp relief (dead cat) rallies generated by short-covering. But shorts have been much more tentative this year, making it harder to interpret recent action (not to mention all the call buying!). The March, 2009 lows were not marked by a spike in short interest, and the current rally has not caused them to rapidly retreat. Assuming short interest remains a useful signal, it will be useful to watch whether shorts begin increasing positions soon.

So, overall, I am very reluctant to hop on the coattails of the XLI speculator's "free ride." But I do believe there are important lessons remaining to learn by continuing to observe trading behavior in XLI going forward.

Be careful out there!

Full disclosure: long GE stock and puts. For other disclaimers click here.