It Is Time to Sell First Solar Alongside the Insiders Who Are Dumping the Stock

By Dr. Duru written for One-Twenty

May 11, 2009

First Solar (FSLR) insiders are selling again. Insiders made a killing selling FSLR stock from $200-300 last year, but this activity came to a screeching halt after August, 2008. With FSLR once again pushing $200 within a much more forgiving stock market, selling season has begun anew with John Walton's estate starting the festivities with a $36M sale on April 30, 2009. In just one week of selling, insiders have cashed in an incredible $2.8 BILLION dollars worth of stock! John Walton's estate has sold 60% of that total. All told, this is an impressive sum for a company with a market cap of $16B.

As always, I sympathize with the sellers. It makes sense to sell into strength, when the demand is robust enough to absorb the large supply, when caution gives way to enthusiasm. The Wall Street Journal recently reported that "Follow-On Stock Deals Hit Two-Year High," so we know that the market is much more willing these days to provide for the various funding needs of publicly traded companies and their insiders. I am guessing that the traders and investors who have boosted FSLR since the 25% post-earnings pop on April 30, 2009 care very little about why these insiders are dumping so much stock, so rapidly. For example, I recall all the debate last year when top FSLR executives eagerly sold large quantities of stock. It was a typical bull vs. bear debate: the bulls focused on the long-term potential of solar, dismissing the indicators warning of short-term troubles for solar; the bears considered the looming problems sufficient to write-off the entire sector. I attempted to finesse both sides with short-term trading in the sector while clinging to some long-term positions. Meanwhile, insiders consistently dumped stock for months before the bottom fell out of the sector.

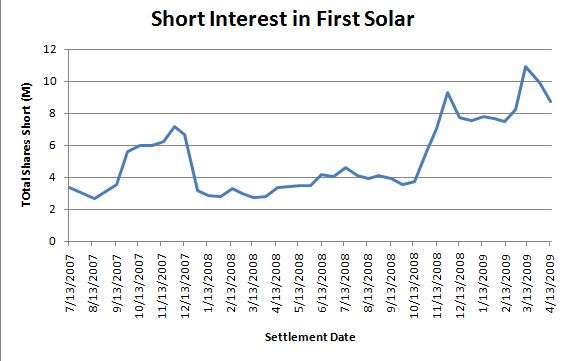

So is this latest round of massive insider-selling as good a warning signal as last year's? I am biased to say "yes." FSLR has now doubled since its November lows, it is trading around last September's levels, and its valuation once again appears extreme given the inherent risks of a recessionary/slow-growth environment. This combination should eventually create more motivated sellers than just a small number of FSLR insiders. Based on FSLR's historical volatility, April's large up-gap is highly likely to be filled sooner than later. This is what motivated me to get short FSLR at this point. I am fully aware that a large population of shorts already exists. As of April 9, 11% of FSLR's float was sold short. While the total number of shares short reached a peak right after the March lows, a high number still got caught in the recent post-earnings spike. This spike took FSLR above its multi-month trading range of about $100-175. The chart below shows the implication of this move. The number of shorts accelerated sharply starting in mid-October. All of these positions are now "underwater" - meaning that the smallest positive catalysts may be enough to drive more shorts to cover into a squeeze (for example, President Obama has been pushing his energy bill through Congress). I am managing my very small position to survive long enough to find out what event is motivating insiders to start selling again.

Ironically enough, I last wrote about solar stocks on Nov 23, 2008 ("The Week Solar Was Left for Dead") when negativity in the sector had reached a fever pitch. The volumes upon volumes of negative analyst commentary during that time were classic signs of a (short-term?) bottom in the making. FSLR made a 9-point landing on my earlier downside target of $85, yet, I sadly passed on the opportunity to buy.

Since it has been so long since I last wrote anything solar, I thought it would be appropriate to restate my current positions. Overall, I am a believer in solar energy for the long-term. However, I think there are few good long-term investments amongst the publicly-traded solar companies, and I mainly think of this wild and volatile sector in terms of short-term trading positions. I think of the heavy dependence on major government subsidies to be the major weakness of this entire sector in terms of investing in its stocks. Throughout the latest swoon, I have stuck by all my long-term positions (in the past, I have erroneously reported that Intel (INTC) and gold (GLD) are my only long-term positions). My biggest disappointment has been TAN, one of the solar ETFs - silly of me to think that it could offer a diversified way of reducing the risks involved in investing in solar. My biggest "relief" has been Solarworld which has offered me the more "sane" investing opportunity I prefer (my overall position is now slightly positive). I think of First Solar as a top company but typically far too expensive for my tastes. My favorite company besides Solarworld remains Sunpower (SPWRa). I currently do not hold a position in it, but I will likely start nibbling again by this Fall. My favorite solar stock for short-term trading (besides FSLR) is Suntech Power (STP). I hope soon I can jot down a summary of my impressions of solar earnings these past two quarters. I started one for last quarter, but I could never seem to finish it given how fast the landscape was changing in the first four months of this year.

Be careful out there!

Full disclosure: short FSLR; long TAN, Solarworld, 5N Plus, Arise Technologies. For other disclaimers click here.