Intel (INTC) started off the year with a revenue warning due to "...further weakness in end demand and inventory reductions by its customers in the global PC supply chain." The stock dropped 6% on that day (Jan 7). Including last week's surge, INTC has now re-challenged those post-warning levels twice. This aimless churn is not surprising given that Intel punted on further revenue guidance during its January earnings call. Friday's close also just happens to be the exact price where I purchased Intel's stock during last October's swoon. It has been a wild ride while I get paid to wait for a recovery (dividend yield of 4%).

INTC remains the only stock outside of the commodities space that I am holding for the "long-term." My logic at the time of purchase was pretty simplistic: cheap valuation, lots of cash, low debt levels, and, most importantly, an assumption that Intel will still be around with products customers want on the other side of this recession. Given my worst (dreadful) case scenario of another 50% haircut down to book value, I only invested half of what I want to buy. I have not yet decided on the next buy criteria if (hopefully) the worst case scenario does not unfold (I am think the "likely" additional downside risk is about 20%).

While I wait things out on INTC, I decided to review my previous pieces on INTC. In July, 2004, I considered support levels all the way down to 1995-1996 prices after INTC announced a particularly devastating earnings warning. Hey, I was particularly bearish in those days (egged on by such perma-bears as Abe Abelson and Bill Fleckenstein): "Just as Intel's bull market occurred over a long span of time, I am suggesting that this subsequent bear market is also unfolding on a similar scale." While I eventually accepted the market's stubborn resilience for the next several years, INTC did peak at the end of its strong 2003 run. But INTC resisted retesting the 2002 lows until the rest of the market did. I followed up on INTC in Feb, 2006 when the stock took another hard tumble in sympathy with a dire earnings warning from Dell. At that time I noted the semiconductor index (the SOX) was approaching important resistance at two-year highs. It never saw those levels again. It took INTC another 18 months to recover from that Dell warning...and soon after that, the entire market peaked. The weekly chart below shows the multi-year action in INTC.

In 2004, I argued that INTC was expensive based on historical valuation - net profit margins had come down from the heyday of the 90s, but the P/Es had gone UP. Profit margins recovered over the next two years, but in the last three they have slipped ever lower again. The following annual chart shows total revenue peaking in 2005 along with margins (financial charts courtesy of Gridstone Research).

Curiously, revenue per share has increased while earnings per share have dropped.

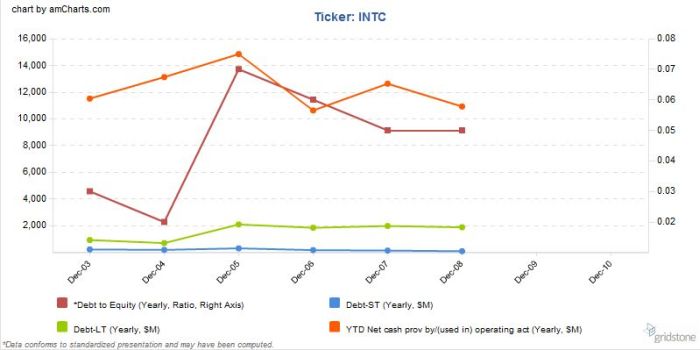

You would think that the moribund stock performance and slowing financial performance would swear me off INTC. But these times are different. In a sea of debt-laden companies with broken business models and lowering dividend yields, INTC stands out to me. INTC is no longer a growth company, but it should survive the recession in relatively good financial health. The market should reward INTC on the other side of this recession...at least as well as it did in 2003 when the stock doubled from the lows. The chart below shows just how strong INTC remains financially: debt to equity has been dropping and operations are still throwing off cash well in excess of debt levels that have remained low and steady.

So, for now, I am figuring that the world will continue to need Intel's products in the next several years and that seasoned management will figure out how to maintain the company's financial health on the way to recovery.

Be careful out there!

Full disclosure: long INTC. For other disclaimers click here.