Click here to suggest a topic using Skribit. Search past articles here.

For most of June, many solar stocks held up well even as the major market indices sold off every week. June 26th was a major breaking point. The S&P 500 broke down by -2.9% and the NASDAQ dropped by -3.3%, and the deepening bearish mood took down the solar stocks en masse. TAN, the Claymore/MAC Global Solar Energy Index, plunged -5.7%, and KWT, the Market Vectors Solar Energy ETF, plunged -4.8%. Everything has been downhill ever since even though oil has continued to break records and natural gas continues straight up (the coal fever finally broke in spectacular fashion last week, but expectations are for the run to resume). The solar indices TAN and KWT are now more than 10% below their respective first-day prices - not good for the ETF promotion materials. In a bear market, the cheap get cheaper, and the expensive become a source of profit-taking.

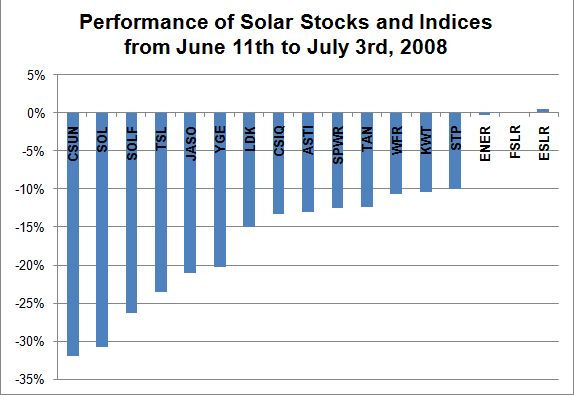

When I wrote "Solar Warnings" on June 11th, I gave a sour short-term outlook on solar stocks. That was only four weeks ago, but we have already been on a wild ride. Solar stocks in general had a strong 3-day run two days after I wrote that piece. They held steady for another week and a half before taking the current plunge. I have no idea how much further these stocks will plunge, but the selling serves as a partial validation of my original thesis. The solar industry is full of execution risk, and there is little reason why we should pay premium valuations for solar stocks. However, the market only cares when it cares; the realization of systemic risk has a nasty habit of making folks suddenly care a lot about risk/reward. Let's take a specific look at the performance of several solar-related stocks since June 11th:

Even though my start date of June 11th is a bit arbitrary, I still think the above chart is very telling. I defer to the market first before I take note of analyst chatter, company pronouncements, and other various forms of stock promotion. Currently, the market is telling me that there are roughly 3 tiers of solar stocks. Reading from right to left, ESLR, FSLR, and ENER rest comfortably above the rest. STP, WFR, SPWR, ASTI, CSIQ, and LDK occupy a middle tier. The rest fill up the garbage bin. Of course, if you are a value investor who makes a living arguing with the market and betting against it, your interest in this chart starts from left to right. I can sympathize because the recent selling sure smells like panic, and the solar stocks in the garbage bin now sport a mix of forward P/Es below 15 and price-to-sales and price-to-book ratios below 2. If you are a short-seller who makes a living betting against vestiges of the market's folly, perhaps your interest in this chart starts from the right side. Regardless, I am personally a lot more interested in placing bullish bets on these stocks than I was a month ago. I am positioning in individual stocks in the expectations of a (sharp) short-term bounce, and nibbling on TAN for building out a long-term holding.

Let's take a closer look at the two "top performers" over the past four weeks, ESLR and FSLR. I just so happened to write about each stock as a follow-up to the June 11th piece because each one seemed to defy my short-term bearish call on the sector.

Evergreen Solar (ESLR)

The excitement over another blockbuster contract announcement has waned and faded again for ESLR. In "Second Try for Evergreen Solar" I switched to fully bullish based on the stock's ability to hold the big pop in the stock upon announcing another $600M in contracts. I also made the case for waiting on a pullback, and I went ahead and nibbled on a few calls on the next day's pullback. ESLR has disappointed ever since and is now struggling to hold onto the June low that marked the bottom of the selling from May's big contract announcement. ESLR perfectly timed the last announcement in conjunction with an analyst day, and the company promptly took advantage of the higher prices to do some fundraising. I am willing to give ESLR another shot here, but a break of Thursday's low will convince me once and for all that ESLR remains a "show me" company and stock. In other words, at that breaking point, I would no longer trust this $1.7B backlog in orders. Also note that earnings are on July 17th. We must ask ourselves what kind of news can they report at this event to top almost $2B in contracts?

First Solar (FSLR)

First Solar remains a company and stock rife with speculative chatter and analyst commentary, but no new news coming directly from the horse's mouth. On June 24th ("First Solar Earnings Run"), I dove into the bandwagon and made a case for playing a run into earnings at the end of July. It only took 3 more trading days for FSLR to break the 8% stop I marked for those who wanted closer to the typical 1:3 risk/reward trade. On Thursday, in a stroke of blind luck on a holiday-shortened trading day, FSLR missed the 20% stop by a few pennies before soaring twenty points back up (almost 9%). Through all of the churn, FSLR's daily trading volume remains well below the 90-day average, leaving me less willing to attach much meaning to these moves. In the meantime, I buffered my position with puts, but I have now sold all but one. If Thursday's low breaks, the next potential support is at the 200DMA, now sitting at $220. (Stock chart not shown).

We have to believe that the news risk (bad or good) is increasing on FSLR beyond the typical din that buffets solar stocks as a group. For example, so many solar companies have now announced secondaries and dilutive fundraising events in the past 2 or so months that I have to believe that FSLR is considering such a move as well. Granted, FSLR's current cash position is an enviable $680M but that is only 3.4% of the market cap. For a big-cap comparison, Cisco (CSCO) has a cash position 18% of market cap. Intel (INTC) has a cash position of 13% of market cap. FSLR insiders have been cashing in hand-over-fist. While CEO Michael Ahearn made a lot of news by dumping half of his stock through numerous sales in May, Kenneth Shultz, Executive Vice President of Advanced Development, has sold $9.5M in stock in June on top of all his other sales earlier this year. The company should be cashing in soon as well. Given the stock is now 20% off its all-time highs, FSLR might wait until it can rebuild some confidence in the stock. The next earnings report would present such an opportunity. I am purely speculating here (like everyone else has been doing on FSLR since the last earnings call), but I want to make sure I am thinking through potential catalysts for short-term price moves. Overall, the massive selling by insiders this year continues to represent a major overhang.

So, here we sit with a deeply oversold market looking for a reason to bounce. When that reason appears, I expect the solar stocks to bounce just as fast, if not faster, than they plunged with the market in the past two weeks. I will look to that bounce to reveal further which solar plays the market thinks are the survivors. Beyond the short-term, the solar industry has to work through a lot more execution risk in order to survive the on-going stock market and economic malaise. Note that while we might think that a global recession will dampen willingness to invest in solar energy, we could see the opposite. A global recession will prompt governments to scramble for pro-growth spending initiatives and investments in solar energy, and other alternatives to oil, will make for tempting targets for increasing government largesse. The companies which prove they have reduced execution risks will be prime beneficiaries.

Be careful out there!

Full disclosure: Long ESLR and TAN. Hedged long FSLR and SPWR. For other disclaimers click here.