Solar Shorts Continue to Rise Even As Oil Surprises

By Dr. Duru written for One-Twenty

July 13, 2008

Click here to suggest a topic using Skribit. Search past articles here.

When a particular investing theme gets hot, I like to check in on what the shorts think about it. Folks are fond of scapegoating shorts for bringing down stocks and even whole markets, but in general, they tend to conduct much more rigorous analyses than most promoters of stock. Shorts have much more to lose than longs, and they do not have the luxury of falling back on long-term thinking to cover up for short-term mistakes. I tend to learn a lot from them that otherwise would not see the light of day. For example, when I noticed in early June that shorts in the stocks of homebuilders were still holding firmly onto their positions, I finally retreated from my insistence that the risk/reward was poor for these short positions. I took on the analysis because Centex (CTX) was threatening to become the first homebuilder stock to re-establish new 52-week lows. I then predicted that the rest of the sector would soon follow, and boy did it ever crumble.

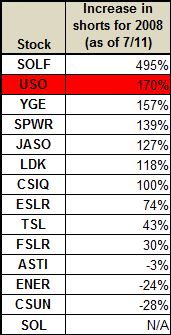

However, like the rest of us, shorts are not always correct. In particular, poor timing can have disastrous results. I have posted a few missives on solar stocks, and in one I pointed out how wrong the shorts have been in First Solar (FSLR). Betting against a trend is always a dangerous thing to do, and FSLR's uptrend did not break decisively until the shorts had largely given up. Given that FSLR recovered this year and even made new all-time highs, it is clear that the market is still not yet ready to accept the bear thesis. But what about the rest of the solar sector? Well, it appears shorts have increased their bearish bets against the sector this year. This surprised me given that solar energy will have to become a more important part of our energy mix. But then it occurred to me that perhaps these short positions reflect a certain amount of skepticism in the sustainability of high oil prices. Sure enough, the number of shares short in the United States Oil Fund ETF (USO) have soared right along with the solar shorts. See the chart below (source: www.nasdaq.com):

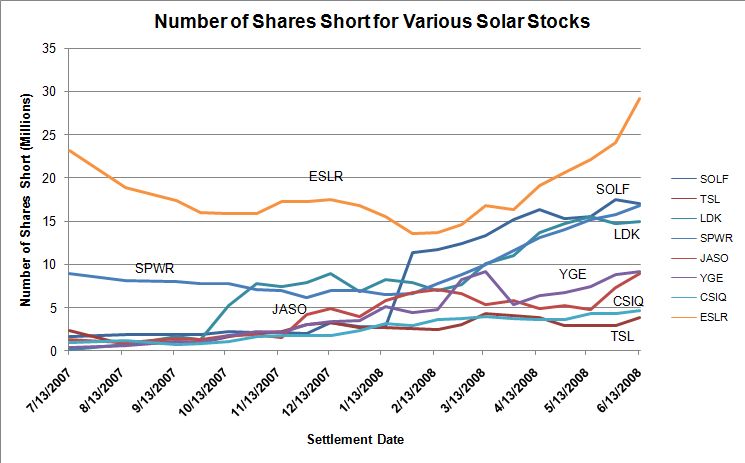

The next chart shows those solar stocks whose short positions have seen the most rapid acceleration in 2008 relative to 2007.

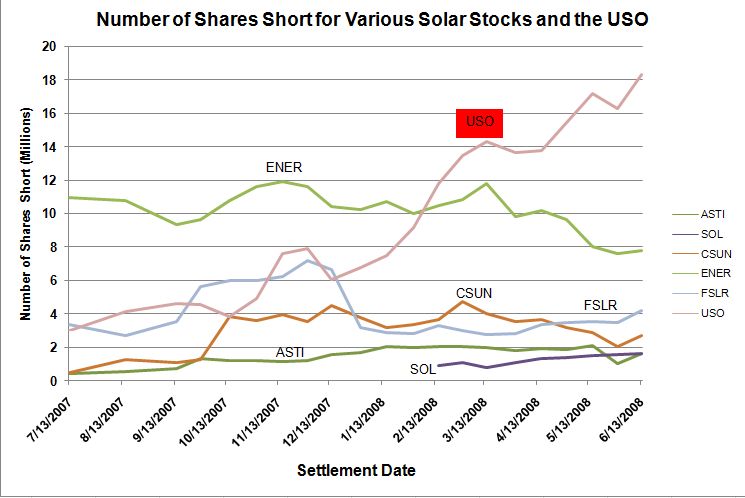

This last chart shows the rest of the solar shorts and overlays the short positions in the USO for stark contrast.

So, skepticism in the high price of oil permeates into a sector that should look more attractive the higher oil goes. (Since oil seems to be at the center of the latest recession fears, one wonders why more buying power is not also being applied to stocks in general). I could add my two cents into the lively debate about whether oil is in a bubble, whether speculators are driving the market, whether Middle East turmoil will drive prices ever higher, etc, but I figure you have read enough on that stuff already. What I will point out is that no bubble in human history has ever been sustained (by definition, I suppose!), and there is no current bubble we can identify that has lived longer than, what, say 3 years? All bubbles eventually burst, and it does not matter what drives the bubble. In time, the market always works its magic, and the downdraft is typically more vicious and swift than the updraft. I do think the bubble debate is a distraction from the longer-term choices we need to make for a sustainable energy policy. To the extent that we believe that oil will somehow get "cheap" again and stay that way, we will find more excuses for inertia and inaction. When (not if) oil corrects, we need to use those savings to invest and not simply to consume more. I suspect that this correction will produce more selling pressure on solar stocks (see "Solar Warnings" for a more complete explanation of my earlier short-term bearishness on solar), but I will be looking to buy more solar at that point (most likely in the TAN ETF - see "Solar Plunges with the Market" for more of my thoughts on this). Now, if this correction ends up being from $200 to $150, then the strategy may change!

The shorts will eventually be right on oil, but timing is everything here, and I suspect they are not trying to make long-term bets. The data above also tells me that shorts are now trying to target some of the worst plays in the solar industry. Surely, they will get some bets wrong given how widespread these bets are. I will continue to track the relative positioning of the shorts for any insights they might bring. Note that while oil remains in a clear uptrend, there are few solar stocks that remain in uptrends (relative to the 200-day moving average in price).

While all this volatility plays itself out, I am encouraged to observe that many small steps are being taken to change our relationship with energy consumption. For example, four-day work weeks are sprouting up across the nation in an effort to decrease gas consumption and reduce commutes. So far, it seems government agencies are the primary promoters of this campaign: Oakland County, Michigan, Augusta, Georgia, Charlottesville, VA, and the state of Utah are just a few examples. I think we will also find more efficient workplaces and services.

I recall several pundits over the past year or so who claimed to know something about oil and the economy, poohed-poohed increasing oil prices because America is a service economy. Service economies only consume small amounts of oil relative to economic amount after all. More excuses for doing little to change oil consumption patterns. At $145 per barrell and more, we are learning the hard lessons of a price-taker who has real, meaning finite, budget limits. We must change.

Even oil man Boone Pickens has gotten the religion as he promotes natural gas, wind, and solar power (click on video below or go directly to his website at www.pickensplan.org).

July 14, 2008 addendum: I neglected to include that STP's short interest has increased 215% in 2008 through 6/13/08. WFR's short interest increased 47%. Also note that numbers for June 30, 2008 settlement have now been released.

Full disclosure: Long ESLR and TAN. Hedged long FSLR. For other disclaimers click here.